Overnight – Stocks up on tariff optimism, Copper hits record highs

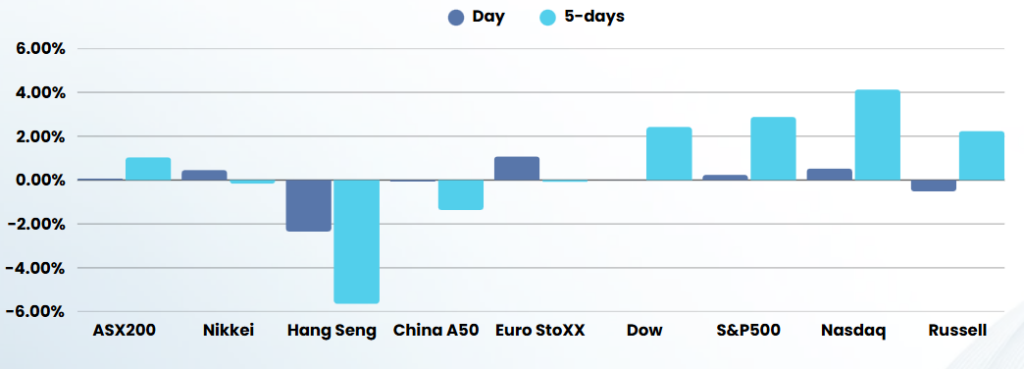

Stocks consolidated gains overnight as Investor optimism continues to be fuelled by hopes that U.S. President Donald Trump will be more flexible with tariffs, ignoring softening economic data.

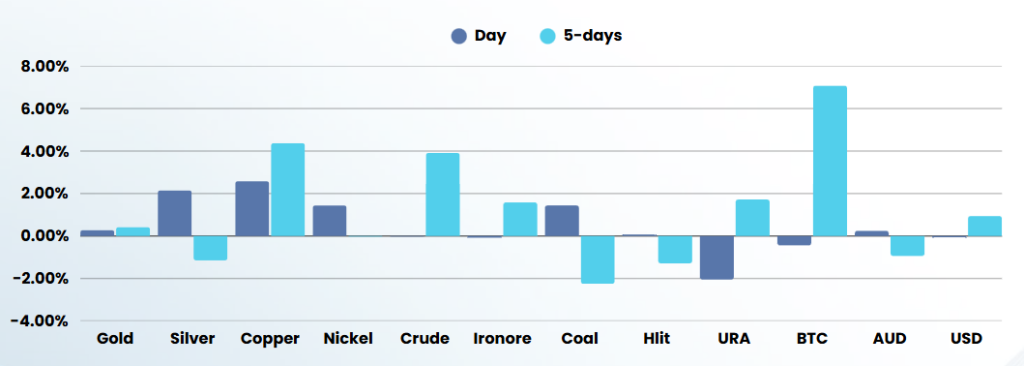

Copper hit record highs overnight, breaking through the $5.20lb mark in the US, London Copper futures also broke through $10,000

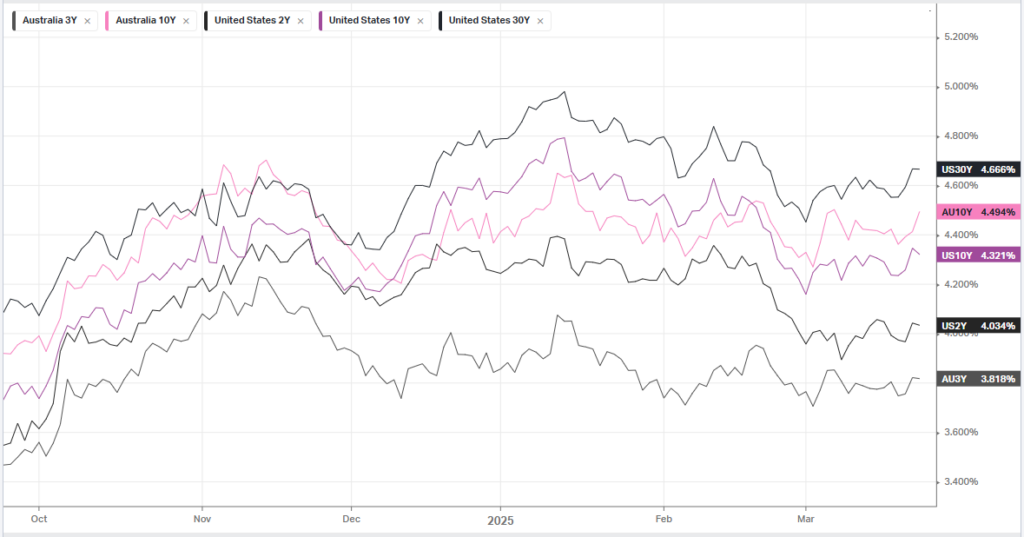

The Conference Board’s consumer confidence index fell to a reading of 92.9 down from an upward revised 100.1 in the prior month amid ongoing concerns about a tariff-induced slowdown. Signs of a cooling economy come just days ahead of a key inflation reading later this week. PCE price index data- which is the Federal Reserve’s preferred inflation gauge- is due on Friday. The print, particularly core PCE data, is widely expected to have remained above the Fed’s 2% target in February. Before that, a revised reading on fourth-quarter gross domestic product is due on Thursday, while home prices and sales data are due on Wednesday.

Bloomberg and the Wall Street Journal reported over the weekend that only some of Trump’s sectoral tariffs will be imposed on his April 2 “liberation day,” and that his reciprocal tariffs will also be more concentrated than previously expected. Trump, however, still kept up his tariff threats, adding on Monday that he will impose tariffs on automobiles, pharmaceuticals, and aluminium in the “very near future,” and said duties on lumber and semiconductors will follow down the road.

The European Union trade commissioner is due to meet with U.S. officials in Washington later this session, according to media reports citing an EU spokesperson. Earlier this month, the bloc delayed planned retaliatory tariffs on U.S. steel and aluminium levies in a bid to buy more time for talks with the Trump administration. Markets are still waiting to see just how Trump’s tariff agenda will play out, and how it will impact the global economy.

Delegations from the U.S. and Ukraine are set to meet in Saudi Arabia following talks between the U.S. and Russia earlier this week. In a nightly video address, Ukrainian President Volodymyr Zelenskiy said that the discussions would take place on Tuesday. The Trump administration on Tuesday, meanwhile, agreed to help Russia boost exports of its grain and fertilizer to global markets, as part of a deal between Russia and Ukraine to halt the use of force in the Black Sea.

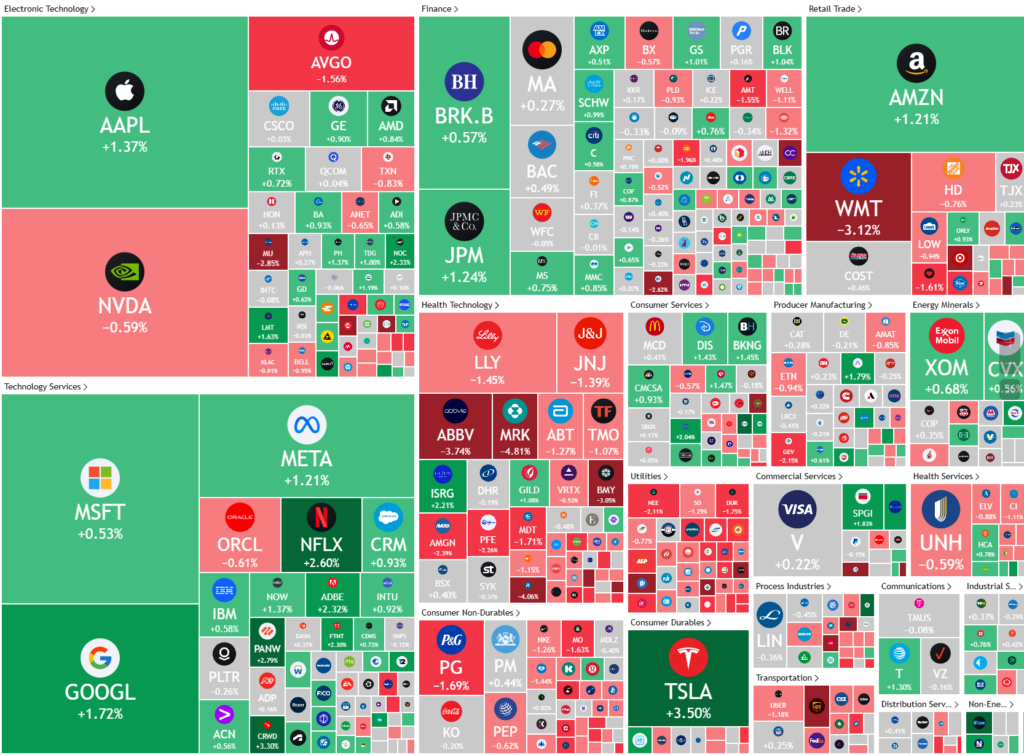

Company Specific

- Tesla – was more than 3% higher, even after data showed European sales slumped just over 40% in February as the electric car maker grappled with tough competition and growing ire towards the political activities of CEO Elon Musk. The company’s market share in the region also shrank to 1.8% from 2.8% a year earlier, data from the European Automobile Manufacturers’ Association showed on Tuesday.

- CrowdStrike jumped more than 3% after BTIG upgraded the stock to buy from neutral, citing optimism over improved visibility following IT outage eight months ago.

ASX SPI 8033 (+0.58%)

The ASX should have a positive day with all sectors having a reason to head higher. Copper miners should be in focus as the red metal hit new record highs.

For a more detailed summary of the budget, read our article Federal Budget 2025 Winners and Losers

Company Specific

- Paladin Energy has retracted its 2025 production guidance after unseasonably heavy rainfall significantly disrupted operations at its Namibia Langer Heinrich mine.

- Endeavour executive chairman Ari Mervis is undertaking a major review of the owner of Dan Murphy’s liquor stores and hundreds of pubs which could ultimately lead to the break-up of the hospitality company.

- IAG, Greensill Capital’s biggest insurer, is trying to delay a $7 billion trial over insurance claims, stating it needs more time to review more than one million documents as it opposes creditors’ calls to disclose reinsurance policies.