The 2025 Australian Federal Budget, set to be delivered by Treasurer Jim Chalmers, is expected to focus on several key areas, including cost-of-living relief, healthcare, infrastructure, and green energy initiatives.

The budget its unlikely to be significant for the index with 6 of the last 10 budgets seeing a weekly gain, 3 flat and only 1 negative. But given the current economic landscape and government’s re-election ambitions and Trump upsetting the apple cart on global trade, this budget could potentially be significant for some ASX listed companies

Key Budget Initiatives and Potential ASX Beneficiaries

The budget will include several initiatives that could benefit various sectors and ASX-listed companies:

Cost-of-Living Relief:

- The budget will extend energy rebates, providing a $150 discount on quarterly power bills for all households and a million small businesses. This is expected to reduce electricity bills by 7.5% and will cost the budget $1.8 billion.

- A two-year freeze on excise indexation increases for draught beer will also be implemented, costing taxpayers about $200 million in forgone revenue.

- Potential Beneficiaries:Energy retailers like Origin Energy and AGL Energy might see increased demand due to the energy rebates, although their profitability could be affected by the cost of providing these discounts. Discretionary spending could be supported by cost of living relief.

Healthcare:

- An $8.5 billion boost for Medicare to expand bulk billing has been announced, with $2.4 billion allocated over the next four years.

- A $689 million plan will reduce the maximum cost of PBS medicines from $31.60 to $25.

- Additional funding includes $644 million for opening 50 new Medicare urgent care clinics and a $573 million women’s health package.

- Potential Beneficiaries:Healthcare providers like Ramsay Health Care, Cohlear and Healthscope could see increased demand due to expanded bulk billing and healthcare services.

Infrastructure and Housing:

- Significant investments in infrastructure projects are planned, including $7.2 billion for upgrading the Bruce Highway in Queensland and billions for Victoria.

- The Help to Buy scheme will be expanded to include higher-income earners and more expensive homes, with an additional $850 million over four years.

- Tropical Cyclone Alfred repairs will cost at least $1.2 billion in additional natural disaster and infrastructure spending. Along with other disasters, the total cost of natural disasters will be $1.9 billion higher than forecast in the mid-year update.

- Potential Beneficiaries:Companies like Maas Group and Boral Limited could gain from increased infrastructure spending. The expansion of the Help to Buy scheme could also benefit real estate companies and Cyclone relief will likely help CAT repairers like John Lyng Group

Industry Support:

- The government has announced support for the local steel and aluminium industry, affected by US tariffs. This includes additional funding for the Buy Australian campaign.

- Potential Beneficiaries:Companies like BlueScope Steel might see support through the government’s Buy Australian campaign and potential industry assistance packages.

Green Energy:

- The budget will continue to emphasize green energy, building on previous commitments to the Clean Energy Finance Corporation (CEFC).

- Potential Beneficiaries:Companies involved in renewable energy, such as Infigen Energy and Meridian Energy Australia, may benefit from green energy initiatives.

Education:

IDP Education (IEL): While not directly mentioned, increased funding for education initiatives could indirectly benefit companies involved in education services.

WANT TO KNOW MORE?

ASK MARK A QUESTION ABOUT THE ARTICLE

Context

Economic Outlook

The budget will also provide key economic forecasts, including inflation projections. Treasury has previously forecast inflation to moderate below 3% per annum, supported by measures like the Energy Price Relief Plan. However, global factors, including the impact of US tariffs and economic trends in major trading partners like China, will play a significant role in shaping Australia’s economic outlook.

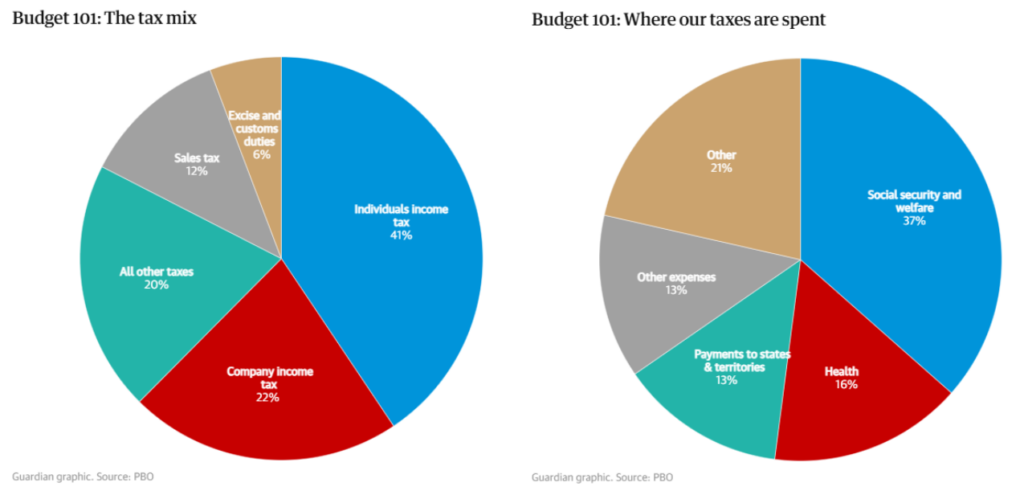

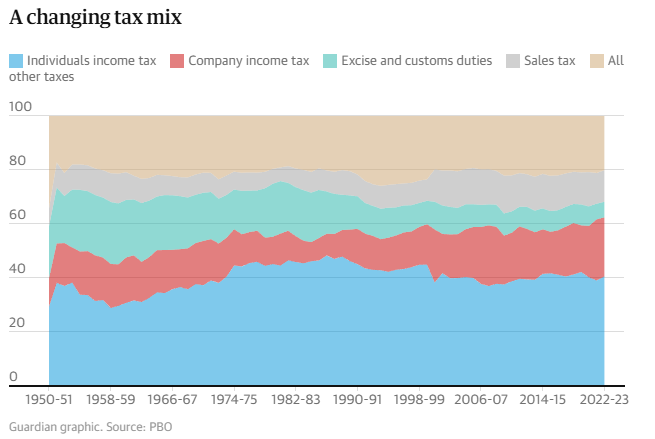

Revenue Sources

The revenue for these initiatives will primarily come from a combination of tax receipts, commodity prices, and borrowing. The government’s net debt is expected to remain stable as a percentage of GDP, between 20 and 22% over the forward estimates. Key revenue streams include tax incentives for critical minerals production and hydrogen production, as well as tax compliance measures targeting large businesses and high-wealth individuals.

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.