Overnight – Stocks slump ahead of Fed Meeting and Nvidia Conference

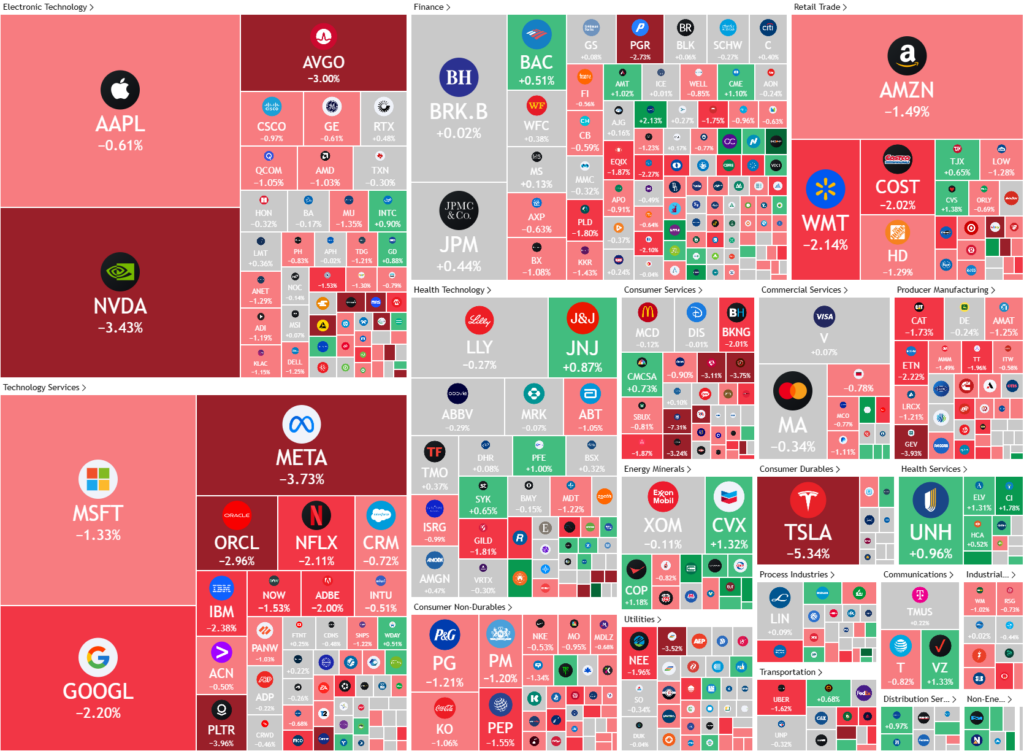

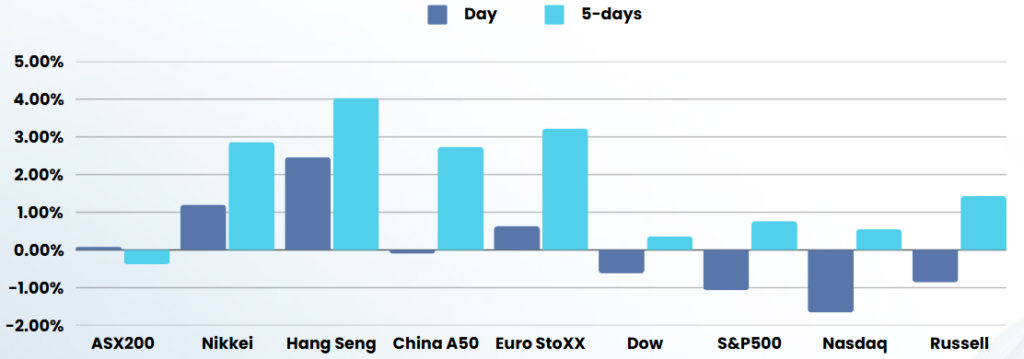

Stocks slumped again overnight ahead of the Federal Reserve’s two-day meeting, and Nvidia’s annual conference.

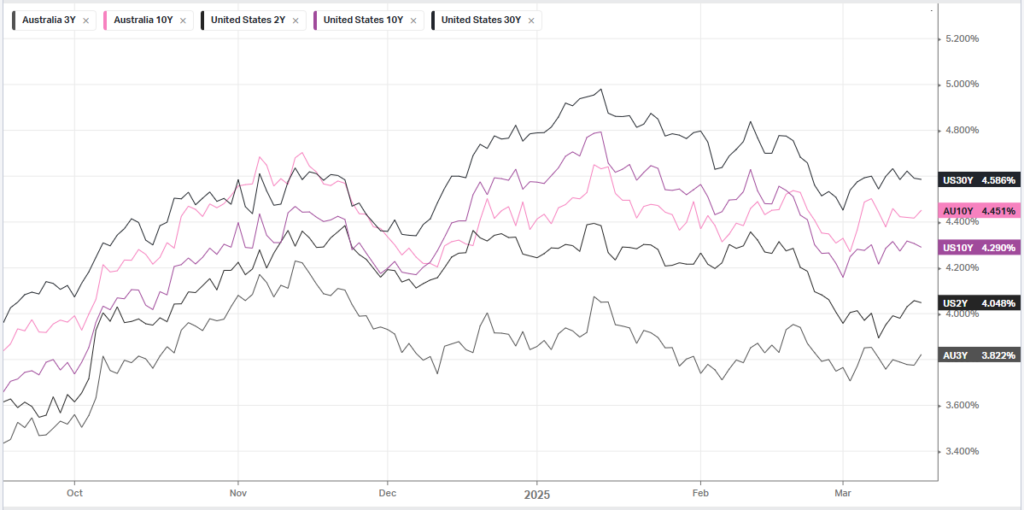

While the Fed isn’t expected to make a change in interest rates, investors are keenly watching for new economic projections that will provide insights into how the Fed views the impact of recent Trump policies on the economy.

On the economic front, housing market numbers showed some positive signs, with single-family homebuilding rebounding sharply in February, increasing by 11.4% to a seasonally adjusted annual rate of 1.108 million units. Despite this, rising construction costs due to tariffs and labour shortages pose a threat to sustained recovery.

Geopolitically, President Donald Trump and Russian President Vladimir Putin agreed to pursue a limited ceasefire on energy and infrastructure targets for 30 days. This agreement includes plans for technical negotiations on a maritime ceasefire in the Black Sea and aims to move towards full ceasefire and permanent peace.

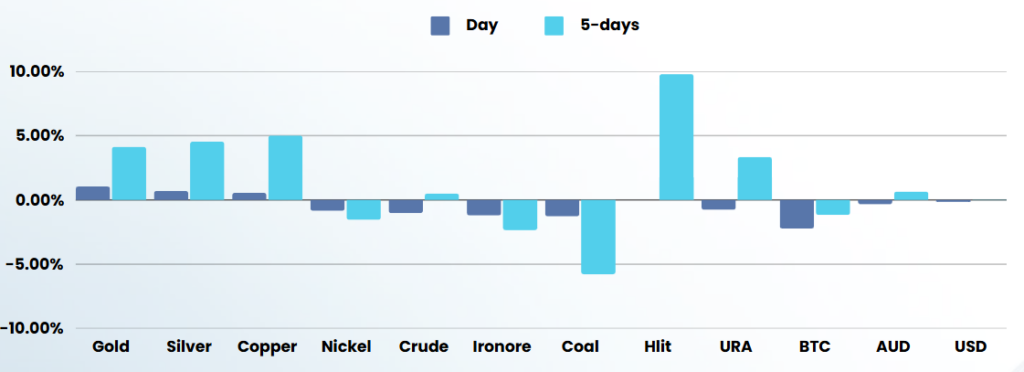

Gold prices climbed to fresh record highs, while Silver missed a 13-year high by a mere 8c, as safe haven demand remained underpinned by uncertainty over trade tariffs and a slowing economy. Haven demand was also boosted by increased geopolitical ructions in the Middle East, after the U.S. launched a wave of air strikes on Houthi rebels in Yemen in retaliation for their attacks on shipping lanes in the Red Sea.

Company Specific

- Nvidia’s CEO Jensen Huang highlighted strong demand for AI-related chips, emphasizing that the computational needs for agentic AI are significantly higher than previously anticipated

- Tesla’s stock continued to decline, falling over 5% due to rising competition and concerns about its self-driving software.

- Alphabet also made headlines by agreeing to acquire cybersecurity startup Wiz for approximately $32 billion.

ASX SPI 7808 (-0.66%)

The local market is in for a weak day following the US lead. Gold stocks will be the only shining light with gold prices hitting fresh records.

Company Specific

- Endeavourexecutive chairman Ari Mervis is facing a restive market – investors and brokers, at two private meetings in two weeks, raised governance issues and voiced concerns about a lack of a permanent chief executive.

- Mineral Resources has stopped haulage on its Onslow haul road after a sixth jumbo road train crashed on its network in the Pilbara region this week.

- WA gold player Ora Banda Mining’s largest shareholder, Hawke’s Point Holdings LP, trimmed its 31.4 per cent stake this week in a block trade handled by UBS