What's Affecting Markets Today

Asia-Pacific Markets Rise Despite U.S. Tariff Concerns

Asia-Pacific markets largely advanced on Friday, defying a sharp decline in U.S. equities following President Donald Trump’s tariff threats. Trump announced a potential 200% tariff on all alcoholic imports from the European Union in response to the bloc’s 50% duty on whiskey, reinforcing his commitment to a broader set of tariffs set for April 2.

Michael Strobaek, Global CIO at Lombard Odier, highlighted that uncertainty surrounding Trump’s policies adds market risk, noting the challenge of navigating “unknown unknowns.” He advised investors to focus on fundamentals and maintain diversification amid heightened volatility.

Australia’s S&P/ASX 200 gained 0.43%, reversing previous losses. Japan’s Nikkei 225 and Topix rose 0.35% and 0.40%, respectively. South Korea’s Kospi was flat, while the Kosdaq surged 1.74%. In China, Hong Kong’s Hang Seng opened 1.98% higher, and the mainland’s CSI 300 climbed 1.69%, rebounding from the prior session’s decline.

ASX Stocks

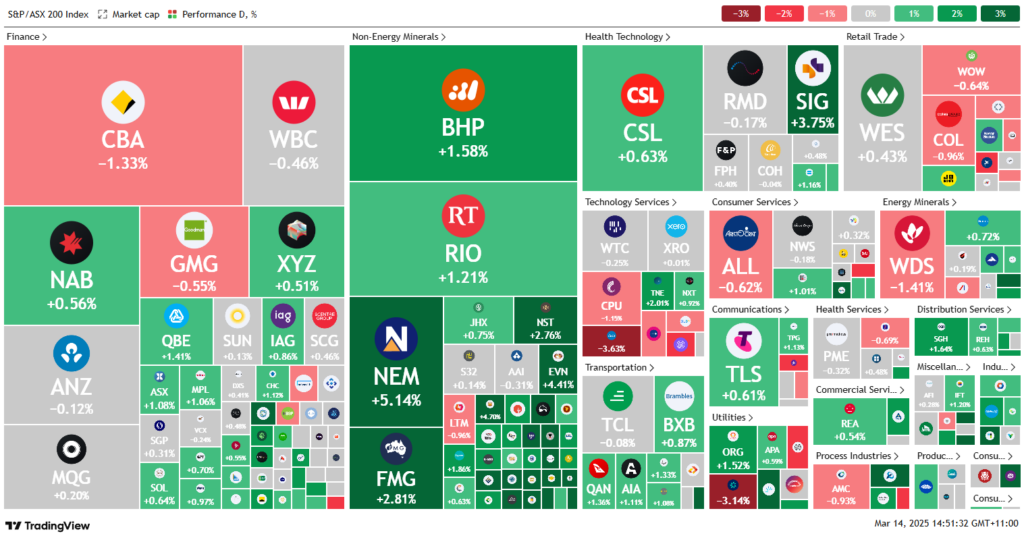

ASX 200 - 7,782.5 (+0.40%)

ASX Rises as Miners Lead Gains, BHP Up 1.6%, US Avoids Shutdown

The S&P/ASX 200 climbed 0.4% to 7,780.8 on Friday afternoon, breaking a three-day losing streak as major miners drove gains amid rising gold and iron ore prices. The All Ordinaries also rose 0.5%, with seven of 11 sectors finishing higher.

The rebound lifted the ASX out of correction territory, diverging from Wall Street, where the S&P 500 hit a five-month low after Donald Trump threatened 200% tariffs on EU wine in retaliation for the bloc’s 50% duty on American whiskey. However, US futures pointed higher after lawmakers averted a government shutdown.

Iron ore’s rise above $103 per tonne boosted BHP (+1.6%), Rio Tinto (+1.4%), and Fortescue (+2.8%). Gold miners surged as gold hit $2,990/oz, with Regis (+4.0%), Genesis (+4.7%), and Evolution (+4.3%) leading gains.

Liontown Resources (+7.7%) jumped on narrowed losses, Catalyst Metals (+4.8%) rallied after on-budget production, and Myer (+2.7%) rose after an executive overhaul. Seek (-0.4%) slipped despite a Bell Potter ‘buy’ rating.

Leaders

DRO – Droneshield Ltd (+14.43%)

PNR – Pantoro Ltd (+8.33%)

VGL – Vista Group International Ltd (+6.65%)

LTR – Liontown Resources Ltd (+6.50%)

SGM – Sims Ltd (+6.01%)

Laggards

VUL – Vulcan Energy Resources Ltd (-5.70%)

CAR – CAR Group Ltd (-3.17%)

CMW – Cromwell Property Group (-2.60%)

RDX – REDOX Ltd (-2.47%)

MEZ – Meridian Energy Ltd (-2.36%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!