What's Affecting Markets Today

Asia-Pacific markets traded mixed on Thursday following a softer U.S. inflation report, which helped Wall Street partially recover from two consecutive days of losses.

The U.S. consumer price index (CPI) rose 0.2% month-on-month in February, bringing annual inflation to 2.8%. Vishnu Varathan, Mizuho Bank’s head of macro research (ex-Japan), called the data a welcome relief but noted that tariff impacts have yet to be factored in, keeping the Federal Reserve cautious.

In Japan, the Nikkei 225 gained 0.98%, while the Topix advanced 0.82%. Seven & i Holdings rose 3.6% as Canadian retailer Alimentation Couche-Tard reiterated its $47 billion takeover bid, which would be Japan’s largest-ever foreign buyout if completed.

South Korea’s Kospi added 0.81%, while China’s CSI 300 edged up 0.23%. Hong Kong’s Hang Seng dipped 0.14%. Australia’s S&P/ASX 200 traded flat after early gains.

In India, inflation eased to 3.61% in February, with Nomura forecasting CPI to remain below 4% in Q1 2025, supporting GDP growth.

ASX Stocks

ASX 200 - 7,752.8 (-0.40%)

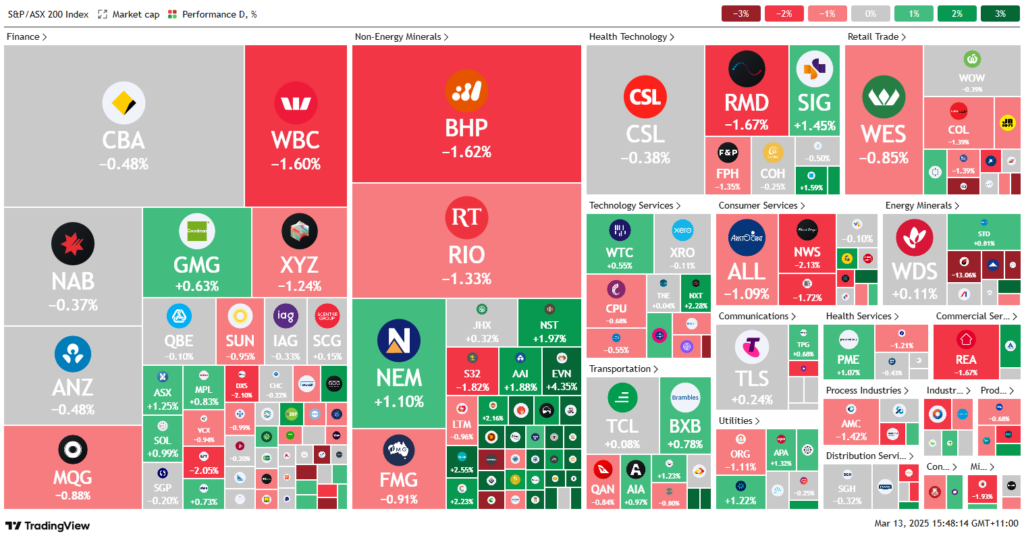

The Australian sharemarket reversed early gains on Thursday afternoon as investor sentiment weakened amid uncertainty over US President Donald Trump’s tariff policies and their impact on inflation and economic growth.

The S&P/ASX 200 Index declined 18.7 points to 7767.5, approaching Wednesday’s seven-month low of 7733.5. The index is now 9.8% below its recent peak, nearing correction territory.

Consumer stocks led declines, with City Chic Collective down 6.2%, while Wesfarmers and Flight Centre also retreated. Energy stocks slumped after Macquarie downgraded New Hope (-8%) and Whitehaven Coal (-5.4%) to “neutral”, citing weaker coal demand. Coronado dropped 4.6% after a downgrade to “underperform.” Yancoal plunged 13% ex-dividend. Major miners were weaker, with BHP down 1.3% and Rio Tinto falling 1%.

In contrast, real estate gained, led by Mirvac (+2.2%), while gold miners surged on safe-haven demand, pushing gold to $US2943/oz.

Corporate moves included Boss Energy (+0.9%), Silk Logistics (-21%) on regulatory concerns, and Westpac (-1.1%) following a Morgan Stanley downgrade. Nine Entertainment appointed Matt Stanton as CEO.

Leaders

OBM – Ora Banda Mining Ltd (+8.90%)

WGX – Westgold Resources Ltd (+6.76%)

DRO – Droneshield Ltd (+6.29%)

BGL – Bellevue Gold Ltd (+6.04%)

SPR – Spartan Resources Ltd (+5.63%)

Laggards

YAL – Yancoal Australia Ltd (-12.56%)

NHC – New Hope Corporation Ltd (-7.84%)

ING – Inghams Group Ltd (-7.30%)

MMS – McMillan Shakespeare Ltd (-6.94%)

WHC – Whitehaven Coal Ltd (-5.53%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!