What's Affecting Markets Today

Asia-Pacific Markets Gain Despite Wall Street Volatility

Asia-Pacific equities mostly advanced on Wednesday, diverging from Wall Street, which saw heightened volatility amid uncertainty over U.S. tariff policies and recession concerns.

The White House confirmed that 25% tariffs on steel and aluminum exports from Canada and other nations took effect but clarified that President Trump no longer plans to increase levies on Canadian imports to 50%.

Japan’s Nikkei 225 gained 0.29%, while the Topix rose 0.94%. Nissan climbed 0.87% after CEO Makoto Uchida announced his resignation, with current Chief Planning Officer Ivan Espinosa set to succeed him. Honda fell 0.21% after confirming merger talks with Nissan had ended, though it remains open to future discussions.

South Korea’s Kospi surged 1.60%, while the Kosdaq added 1.64%. Hong Kong’s Hang Seng was flat, and China’s CSI 300 edged down 0.27%. Meanwhile, China’s 10-year bond yield approached the 2% level.

In India, February inflation data is expected to show a slowdown to 3.98%. NSE CEO Ashish Chauhan highlighted that India led global IPO fundraising in 2024 with $19.2 billion raised.

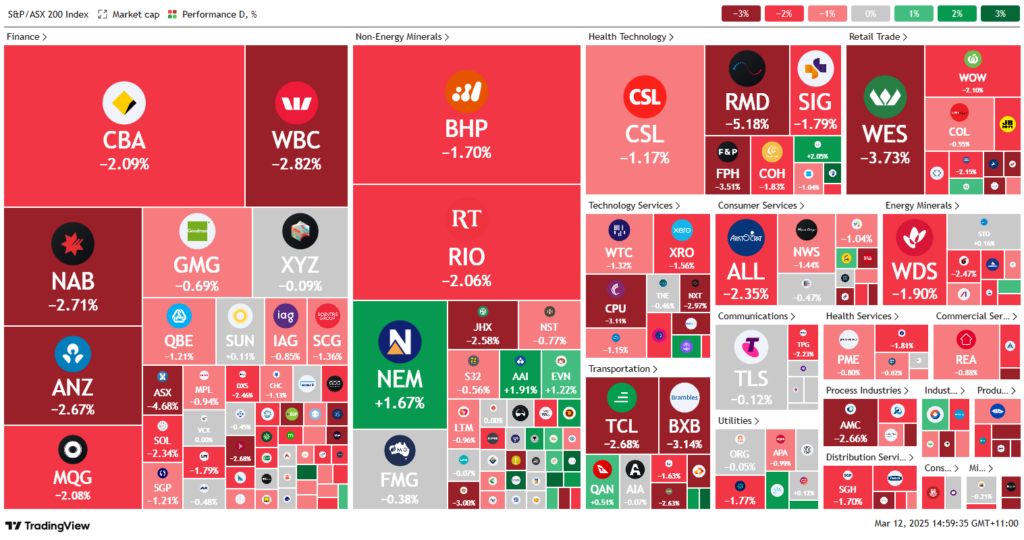

ASX Stocks

ASX 200 - 7,754.9 (-1.7%)

The Australian sharemarket pared some losses on Tuesday afternoon but remained down nearly 1% as a sell-off in WiseTech weighed on the broader index, following a sharp decline on Wall Street.

The S&P/ASX 200 was down 0.7% (58.3 points) at mid aftertoon, after earlier shedding as much as 1.8%. The All Ordinaries fell 0.9%, with technology stocks leading declines. The sell-off accelerated at midday before stabilizing as US equity futures and Asian markets softened.

Overnight, the Nasdaq Composite slumped 4%, while the S&P 500 dropped 2.7%, nearing a correction. Tesla plunged 15.4%, shedding over half its market cap since December, while Nvidia fell 5.1%.

Locally, the ASX technology sector fell over 4%, with Xero down 5.5%, WiseTech 3.1%, and TechnologyOne 6.2%. Major banks recovered, with ANZ, Westpac, and NAB moving into positive territory, while Macquarie fell 2.8%.

Energy stocks fluctuated as oil held below $69, with Woodside (+1.5%) and Santos (+1.2%) gaining.

In corporate moves, PolyNovo fell 8.6% following CEO Swami Raote’s immediate departure, while Guzman y Gomez slipped 3.9% after releasing 15.4 million escrowed shares.

Leaders

NIC Nickel Industries Ltd (+7.03%)

PDI Predictive Discovery Ltd (+6.45%)

CSC Capstone Copper Corp (+5.06%)

DGT Digico Infrastructure REIT (+4.81%)

CYL Catalyst Metals Ltd (+4.38%)

Laggards

ASB Austal Ltd (-19.11%)

IPH IPH Ltd (-8.72%)

OPT Opthea Ltd (-6.54%)

SIQ Smartgroup Corporation Ltd (-6.49%)

RMS Ramelius Resources Ltd (-5.63%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!