Overnight – Stocks bounce! Then Trump held a press conference

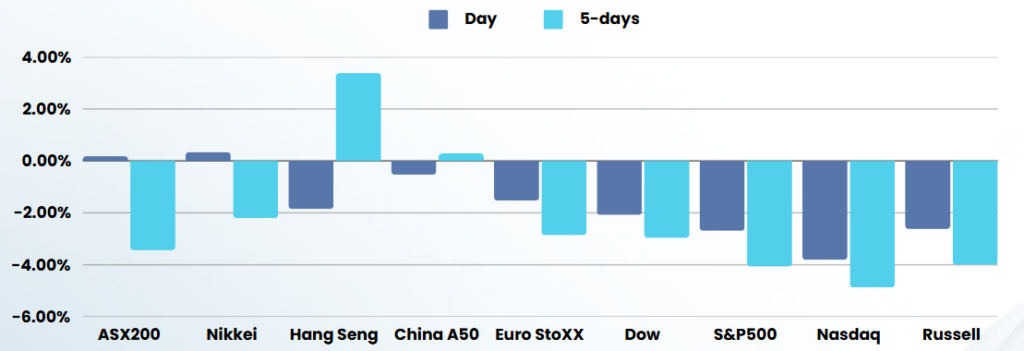

Stocks bounced as much as 1% overnight, calming investor nerves…. Then Trump held yet another press conference sending the market into negative territory as the juvenile tit-for-tat “trade war” continued

Stocks gained some traction early in the session after the US agreed to resume military aid and intelligence sharing with Ukraine immediately after talks in Saudi Arabia in which Kyiv voiced readiness to accept a U.S. proposal for a 30-day ceasefire in its conflict with Russia, the countries said in a joint statement.

Adding to the positive momentum, Ontario’s premier said he had agreed to suspend the Canadian province’s 25% surcharge on exports of electricity to Michigan, New York and Minnesota.

Meanwhile, a U.S. Labor Department report showed job openings increased in January.

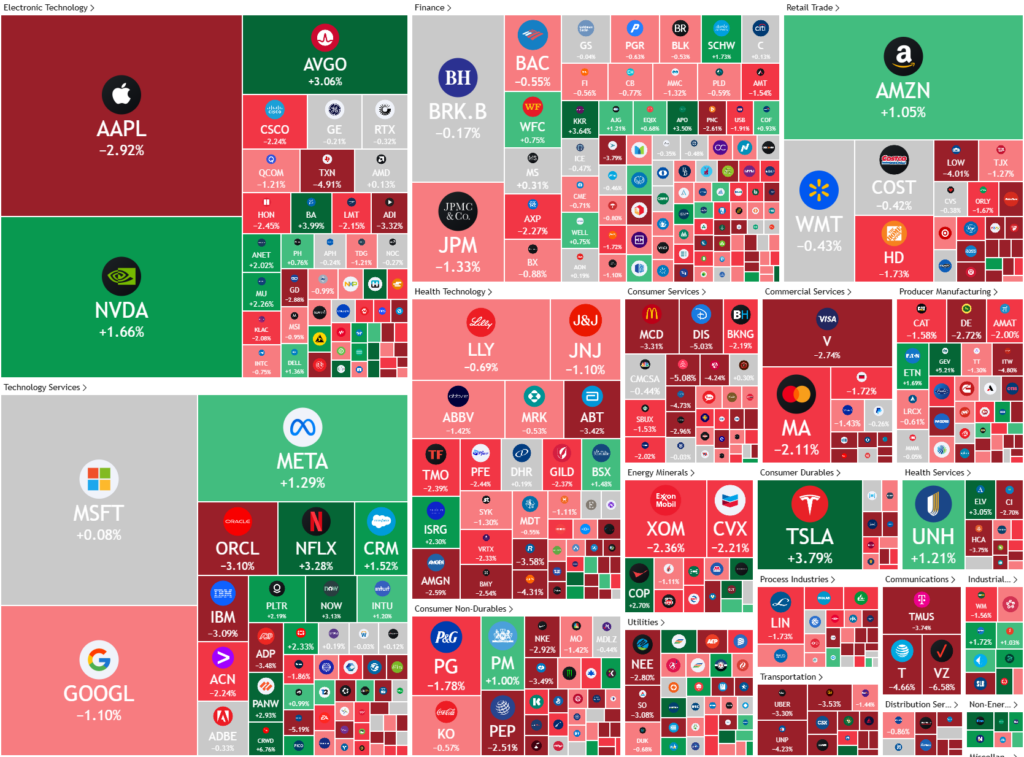

In recent trading, notable stock movements included Tesla rising over 3% despite broader market declines. Delta Air Lines fell 7.99% after revising its Q1 forecast, while American Airlines dropped 8.3% due to a forecasted larger-than-expected loss. Southwest Airlines bucked the trend, rising over 8% after announcing new fees and fare tiers. Kohl’s plummeted 24.1% after a weak sales forecast, and Oracle’s stock fell 3% despite strong bookings.

In an effort to bring the focus back to markets, due to the constant headline grabbing from President Trump, a new section of the pre-market pulse has been created, “the Trump Theatre” for those interested in the reality TV show they call the US Presidency

The Trump Theatre

- Canada on Tuesday agreed to suspend its 25% hike on electricity exports to the United States after agreeing to meet on Thursday to discuss a pathway to renew the North American trade agreement ahead of a Trump-imposed Apr. 2 reciprocal tariff deadline.

- Trump on Tuesday said he would double a planned tariff on all steel and aluminum imports into the U.S. from Canada, pushing the total levy up to 50%, following a move by the province of Ontario to slap a 25% duty on electricity exported into the U.S.

- White House senior counselor for trade and manufacturing Peter Navarro said, however, that Trump’s threat to double the tariffs he previously announced on Canadian steel and aluminium imports into the U.S. will no longer be going into effect tomorrow.

- The backing away from the brink of a trade war helped cool investor fears, helping markets briefly cut the bulk of losses, but resume their selloff a son-and-off tariffs continued to sow investor uncertainty.

- Trump offered to buy a single Telsa to “help out Elon”

ASX SPI 7809 (-0.95%)

The ASX are set to extend losses after US President Donald Trump raged anew at Canada, though futures pared their drop after Ukraine agreed to a proposal for a 30-day ceasefire in its war with Russia.

Company Specific

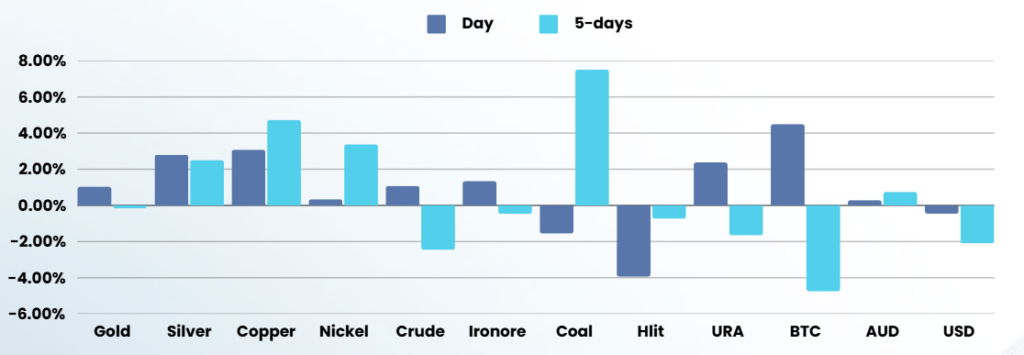

- Rio Tinto is looking to sell up to $US9 billion of bonds to help cover the cost of acquiring Arcadium Lithium.

- Nickel Industries, the biggest pure-play nickel producer listed on the ASX, lost nearly one quarter of its value on Tuesday after one of its major shareholders dumped half of its stock below the asking price.