What's Affecting Markets Today

Asia-Pacific markets declined on Tuesday, mirroring losses on Wall Street amid concerns over tariff policy and a potential U.S. recession.

Japan’s Nikkei 225 fell 1.7%, trimming steeper losses earlier in the session, while the Topix dropped 1.95%. Among the worst performers, Konica Minolta slid 7.07%, and Furukawa Electric lost 6.51%. Japan’s revised Q4 GDP came in at 2.2% annualized growth, below the expected 2.8%.

South Korea’s Kospi declined 1.26%, while the Kosdaq shed 1.11%. Hong Kong’s Hang Seng Index fell 0.99%, and Mainland China’s CSI 300 slipped 0.54%.

Taiwan’s Taiex dropped 1.84%, paring an earlier decline of over 3%.

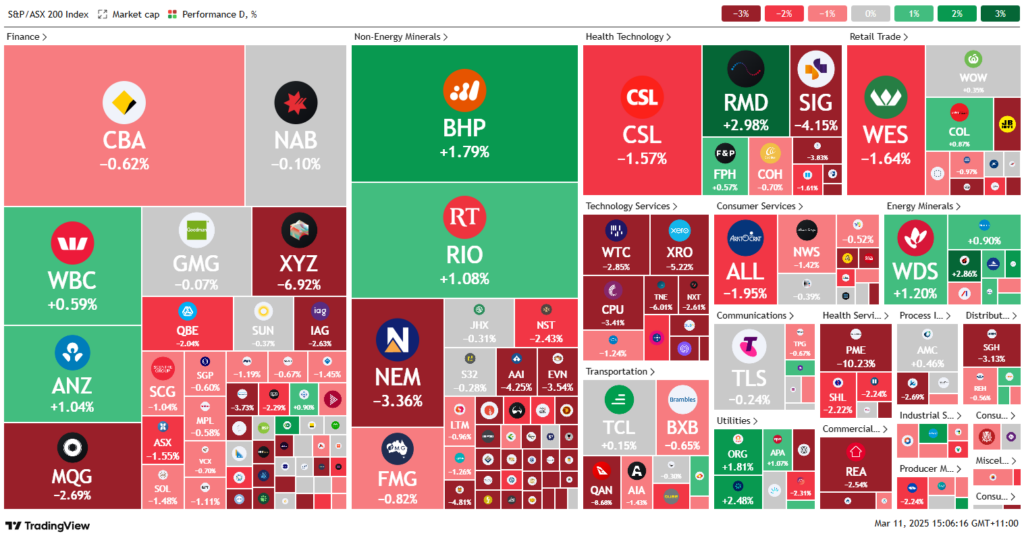

In Australia, the S&P/ASX 200 fell 0.79% in its final hour of trade, reversing gains from the previous session.

Meanwhile, India’s Nifty 50 opened 0.41% lower, and the BSE Sensex dipped 0.50%, as regional markets struggled under the weight of global economic concerns.

ASX Stocks

ASX 200 - 7,894.5 (-0.90%)

The Australian sharemarket pared some losses on Tuesday afternoon but remained down nearly 1% as a sell-off in WiseTech weighed on the broader index, following a sharp decline on Wall Street.

The S&P/ASX 200 was down 0.7% (58.3 points) at mid aftertoon, after earlier shedding as much as 1.8%. The All Ordinaries fell 0.9%, with technology stocks leading declines. The sell-off accelerated at midday before stabilizing as US equity futures and Asian markets softened.

Overnight, the Nasdaq Composite slumped 4%, while the S&P 500 dropped 2.7%, nearing a correction. Tesla plunged 15.4%, shedding over half its market cap since December, while Nvidia fell 5.1%.

Locally, the ASX technology sector fell over 4%, with Xero down 5.5%, WiseTech 3.1%, and TechnologyOne 6.2%. Major banks recovered, with ANZ, Westpac, and NAB moving into positive territory, while Macquarie fell 2.8%.

Energy stocks fluctuated as oil held below $69, with Woodside (+1.5%) and Santos (+1.2%) gaining.

In corporate moves, PolyNovo fell 8.6% following CEO Swami Raote’s immediate departure, while Guzman y Gomez slipped 3.9% after releasing 15.4 million escrowed shares.

Leaders

VUL – Vulcan Energy Resources Ltd (+5.14%)

VGL – Vista Group International Ltd (+4.20%)

ZIM – Zimplats Holdings Ltd (+3.85%)

RMD – ResMed Inc (+3.25%)

NHC – New Hope Corporation Ltd (+3.12%)

Laggards

NIC – Nickel Industries Ltd (-16.89%)

RMS – Ramelius Resources Ltd (-14.34%)

OBM – Ora Banda Mining Ltd (-11.96%)

DRO – Droneshield Ltd (-11.22%)

CSC – Capstone Copper Corp (-10.85%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!