Market Outlook and Strategy

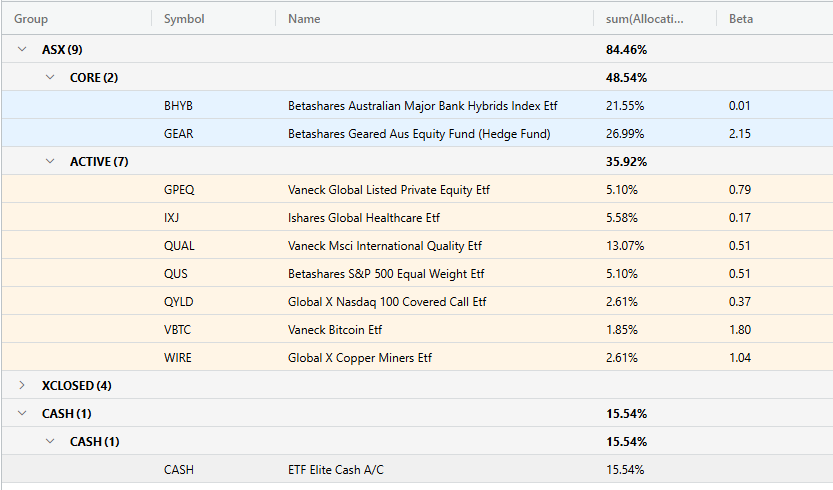

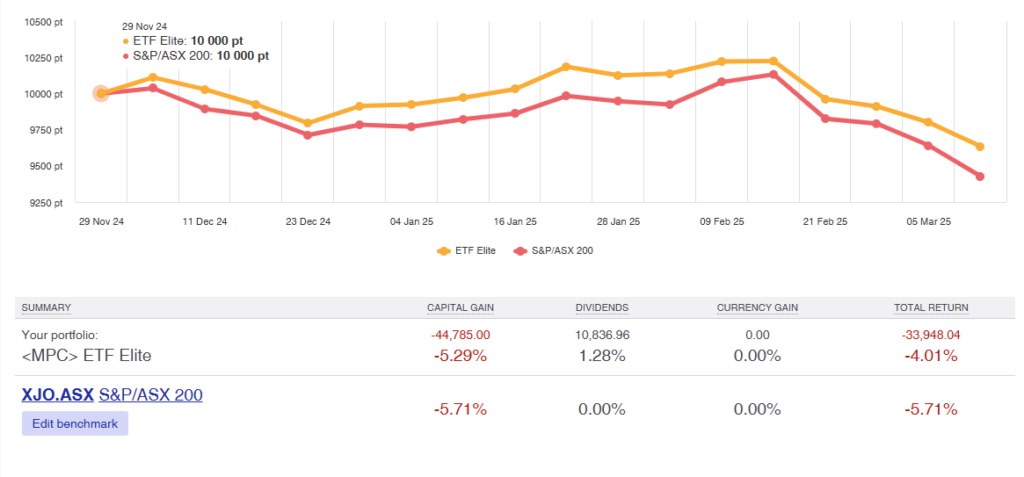

Cash Allocation: Currently, 15% of the portfolio is in cash, which has helped in avoiding losses during market downturns. This strategic move saved about 6% across the board on 15% of the portfolio.

The market remains volatile, with concerns about potential downturns, particularly in the NASDAQ. The strategy involves maintaining some cash on hand to capitalize on future opportunities.

The geopolitical situation, especially with Trump’s influence, suggests a need for defense stocks as a hedge. European defense stocks are highlighted as potential investments due to increased spending needs.

Read more from this month investment committee.

Investment Comittee March 2025

Summary of Actions:

Sell: 5% Betashares S&P 500 Equal Weight ETF (QUS)

Sell: 2% Vaneck Bitcoin ETF (VBTC)

- Buy: 2.5% Betashares Geared Aus Equity Fund (Hedge Fund) (GEAR)

Buy: 5% ASX 200 Covered Call ETF (AYLD)

- Buy: 5% Vaneck Global Defence ETF (DFND)

- Buy: 2% Vaneck MSCI International Quality ETF (QUAL)

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.