Overnight – Stocks hammered as Trump uncertainty finally sees investors capitulate

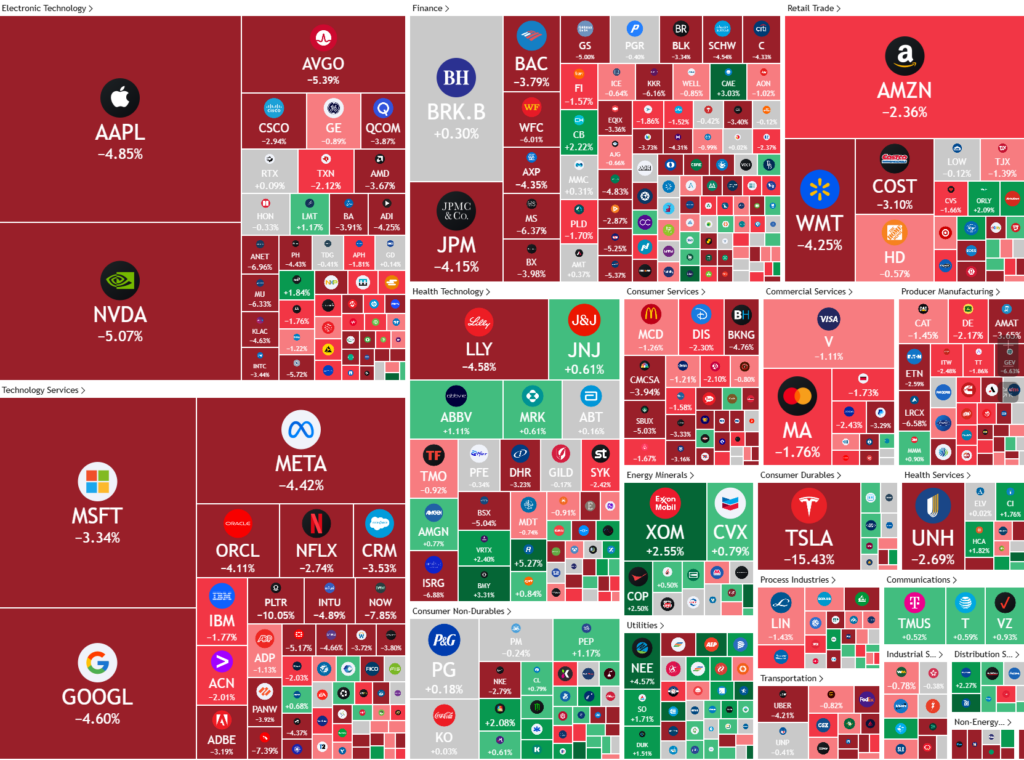

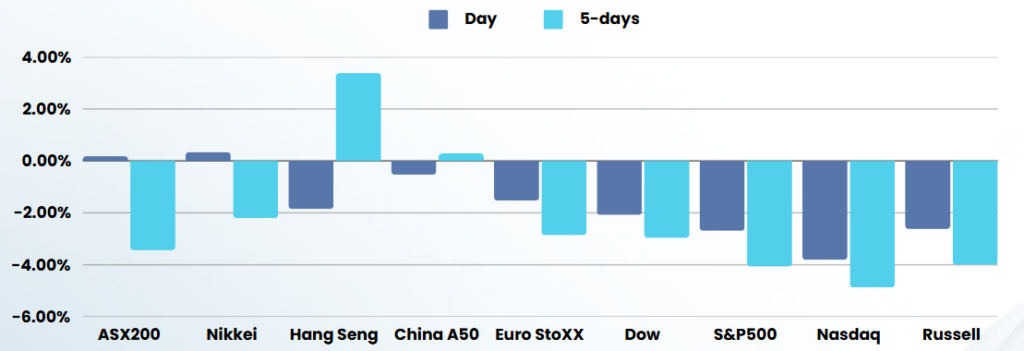

Investors finally capitulated overnight, driven by concerns over President Donald Trump’s tariff policies and their potential to push the economy into recession. The Dow Jones Industrial Average fell by 889 points, or 2.1%, while the S&P 500 dropped 2.8%, and the NASDAQ Composite plummeted 4%.

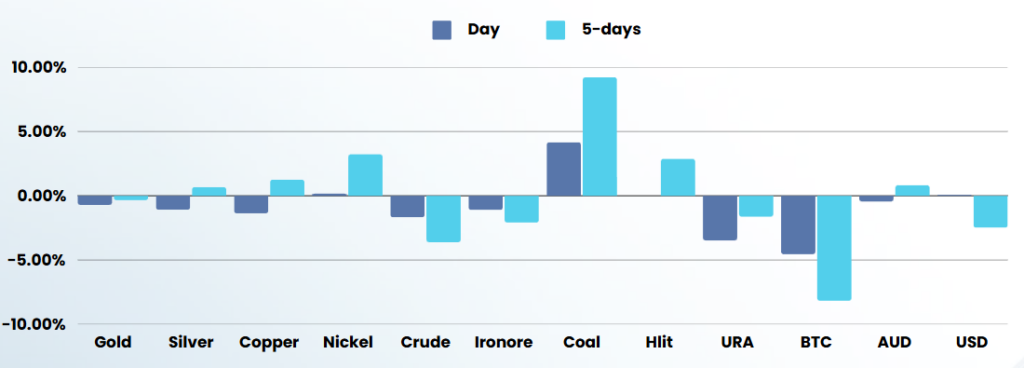

President Trump’s comments on Sunday, where he did not rule out the possibility of a recession and highlighted short-term economic turbulence due to his trade policies, further dampened investor sentiment. The recent imposition of tariffs on Mexico and Canada, as well as increased tariffs on Chinese goods, has created uncertainty and prompted retaliatory measures from China.

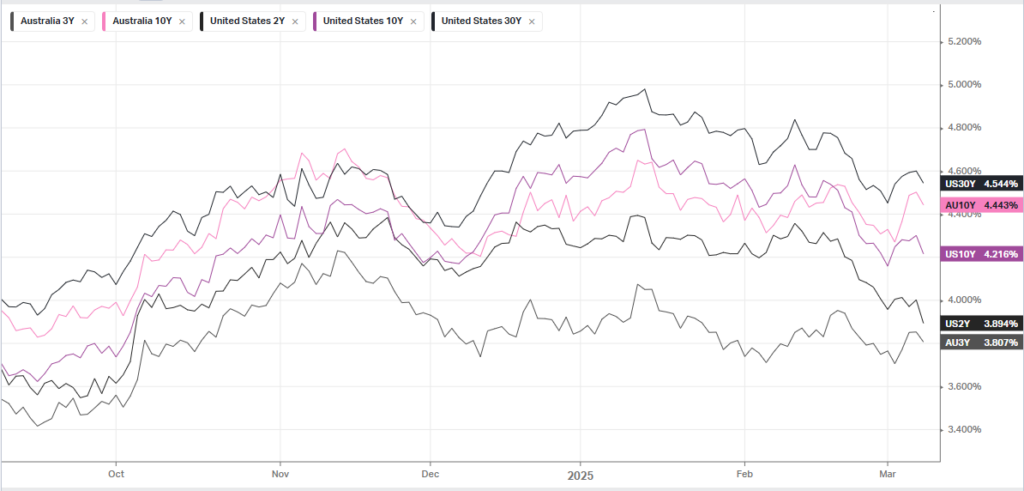

In other news, Mark Carney, a former central banker, won a leadership election in Canada’s Liberal Party, criticizing Trump’s policies for affecting Canadian workers and businesses. Meanwhile, markets are awaiting key economic reports, including the consumer price index for February, which will provide insights into U.S. inflation trends. This data is crucial as it will be one of the last indicators the Federal Reserve considers before its policy meeting on March 18-19.

The tech sector led the decline, with companies like NVIDIA and Broadcom experiencing significant losses due to concerns about enterprise spending amid recession fears. Upcoming earnings reports from major tech companies, including Oracle, Tesla, Adobe, and DocuSign, will be closely watched for signs of economic resilience.

We have long thought the market was vulnerable to a significant pullback and we have been recommending high cash balances for portfolios.

ASX SPI 7895 (-0.88%)

The ASX will be ugly to say the least from the open, likely concentrated in high PE growth names and consumer discretionary stocks (2 categories that MPC clients don’t have) The market darlings like CBA, JBH, WTC, 360, HUB, NWL, GYG will experience their first test in over 18 months, be wary of capitulation in these stocks

Defensive sectors like communications, consumer staples and utilities are likely to fare the best