What's Affecting Markets Today

Asia-Pacific markets were mixed on Monday following a volatile week in global equities. Japan’s Nikkei 225 gained 0.57%, while the broader Topix rose 0.22%, as cash earnings growth slowed to 2.8% in January, down from December’s revised 4.4%. South Korea’s Kospi added 0.47%, with the small-cap Kosdaq rising 0.48%.

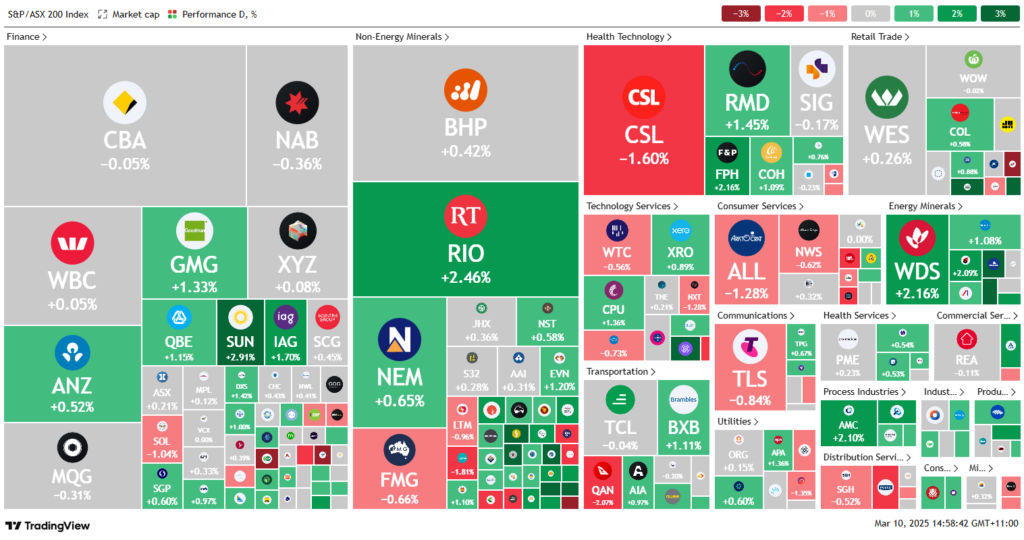

In Australia, the S&P/ASX 200 climbed 0.2%, after closing at a six-month high in the prior session. However, Hong Kong’s Hang Seng Index fell 1.69%, while China’s CSI 300 dropped 0.7%, as deflationary concerns weighed on sentiment. China’s consumer price index declined 0.7% in February, the first negative reading in 13 months.

Investor focus remains on U.S. tariffs on steel and aluminum imports, set to take effect Wednesday. Meanwhile, China announced retaliatory tariffs on Canadian agricultural goods, imposing 100% duties on rapeseed oil, oil cakes, and peas, alongside a 25% levy on aquatic products and pork. The move follows Ottawa’s tariffs on Chinese electric vehicles, steel, and aluminum.

ASX Stocks

ASX 200 - 7,967.2 (+0.20%)

The Australian share market edged higher on Monday after hitting a six-month low in the previous session, as investor caution persisted amid ongoing tariff concerns. The S&P/ASX 200 Index rose 0.2% to 7,967.6 points, while the All Ordinaries Index also gained 0.2%. Energy stocks led the gains, with Woodside up 1.9%, Yancoal rising 2.2%, and Whitehaven Coal advancing 3.1%.

Market sentiment remains fragile ahead of 25% tariffs on Australian steel and aluminium exports to the U.S., set to take effect Wednesday, with little optimism for an exemption. China’s consumer price index fell 0.7% in February, adding to investor unease.

CSL declined 1.4% after going ex-dividend, while power firms weakened, with Origin Energy down 1.1% and AGL losing 1.3%. Macquarie slipped 0.2% after Citi flagged potential overestimations of its commodities income.

In corporate news, Johns Lyng Group plunged 14.6% after its removal from the ASX 200, while Cobre climbed 5.1% on a funding deal with BHP. Mayur Resources gained 3.7% following an investment by Harvey Norman chairman Gerry Harvey.

Leaders

CYL – Catalyst Metals Ltd (+10.51%)

DRO – Droneshield Ltd (+9.66%)

SPR – Spartan Resources Ltd (+6.51%)

PNR – Pantoro Ltd (+5.36%)

TPW – Temple & Webster Group Ltd (+4.81%)

Laggards

JLG – Johns LYNG Group Ltd (-14.29%)

DYL – Deep Yellow Ltd (-4.48%)

WA1 – WA1 Resources Ltd (-4.33%)

OPT – Opthea Ltd (-3.57%)

BOE – Boss Energy Ltd (-3.48%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!