What's Affecting Markets Today

Asia-Pacific markets mostly advanced Monday as investors awaited further details on U.S. President Donald Trump’s tariff plans for key trading partners. U.S. Commerce Secretary Howard Lutnick suggested on Fox News that the 25% tariffs on Mexico and Canada, set to take effect Tuesday, remain “fluid”, while the additional 10% duty on Chinese imports is confirmed.

Japan’s Nikkei 225 gained 1.14%, while the Topix index rose 1.27%. Hong Kong’s Hang Seng climbed 1.33%, and China’s CSI300 edged 0.44% higher. Meanwhile, Taiwan’s Taiex dropped 1.68%, hitting a seven-week low.

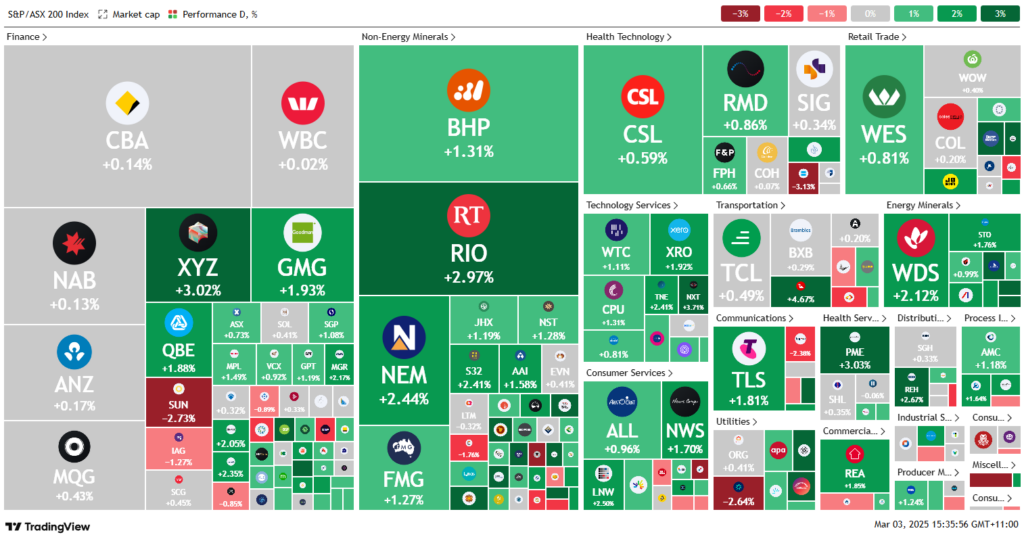

In Australia, the S&P/ASX 200 advanced 0.5%, supported by real estate and technology stocks. The S&P Global Manufacturing PMI came in at 50.4, steady from January’s 50.6.

China’s Caixin/S&P Global Manufacturing PMI exceeded expectations at 50.8 (vs. 50.3 forecast). Investors are also monitoring India, where GDP growth rebounded to 6.2% in Q3, up from 5.6% in the prior quarter.

South Korean markets remained closed for a public holiday.

ASX Stocks

ASX 200 - 8,161.7 (-1.3%)

The S&P/ASX 200 rebounded on Monday, rising 0.5% (41.5 points) to 8,213.90, recovering from Friday’s losses despite looming US tariffs. The All Ordinaries also gained 0.5%, with eight of eleven sectors advancing. Real estate stocks led gains, while financials and defensive sectors underperformed.

Investors bought back into sold-off stocks, particularly miners, which had declined sharply on Friday following US President Donald Trump’s announcement of a 10% tariff on Chinese goods and 25% tariffs on Canada and Mexico. Despite iron ore prices slipping below $101.90 per tonne, Rio Tinto (+2.2%), Newmont (+3.1%), and BHP (+0.9%) all rose.

Goodman Group (+2.1%) boosted real estate stocks, while technology stocks rebounded after last week’s 11.3% decline. Suncorp (-3.2%) and IAG (-1.0%) fell on concerns about rising insurance claims.

In corporate news, Star Entertainment was suspended for failing to lodge financials. NRW Holdings (-11.1%) slumped amid uncertainty over a $113.3 million debt recovery, while Pro Medicus (+3.7%) gained on a $40 million US contract.

Leaders

BOE Boss Energy Ltd (+6.86%)

A4N Alpha HPA Ltd (+6.47%)

KLS Kelsian Group Ltd (+6.13%)

RPL Regal Partners Ltd (+5.28%)

RSG Resolute Mining Ltd (+4.80%)

Laggards

CU6 Clarity Pharma (-15.17%)

NWH NRW Holdings Ltd (-10.20%)

BOT Botanix Pharma (-4.55%)

QAL Qualitas Ltd (-4.48%)

PNR Pantoro Ltd (-3.57%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!