Overnight – Stocks rally as despite Trumps fiery Zelensky exchange. Crypto added to US reserves

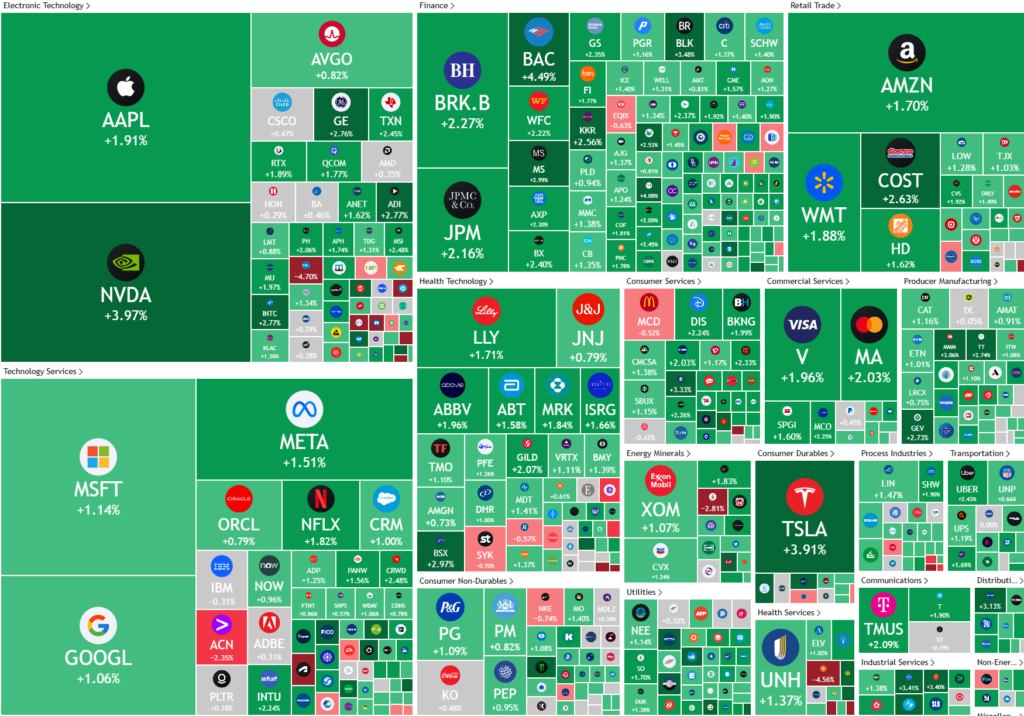

Stocks closed sharply higher Friday following a brief stumble after an explosive meeting between President Donald Trump Ukraine President Volodymyr Zelensky stoked worries about geopolitical risks. Over the weekend, Trump signed an order to add 5 crypto currencies into the US reserves

President Donald Trump and Ukraine President Volodymyr Zelensky clashed at the Oval Office on Friday as Trump criticized for not being grateful enough for the U.S. support in its war with Russia.

Trump said Zelenskyy held no leverage in the current war, adding that a proposed rare earth minerals deal would put Ukraine in a better negotiating position to end the war.

“You’re gambling with the lives of millions of people. You’re gambling with World War Three, and what you’re doing is very disrespectful to this country,” Trump told Zelenskyy. Following his meeting with Trump, Zelensky took to social media platform X, thanking America and the Trump administration for the visit and the support.

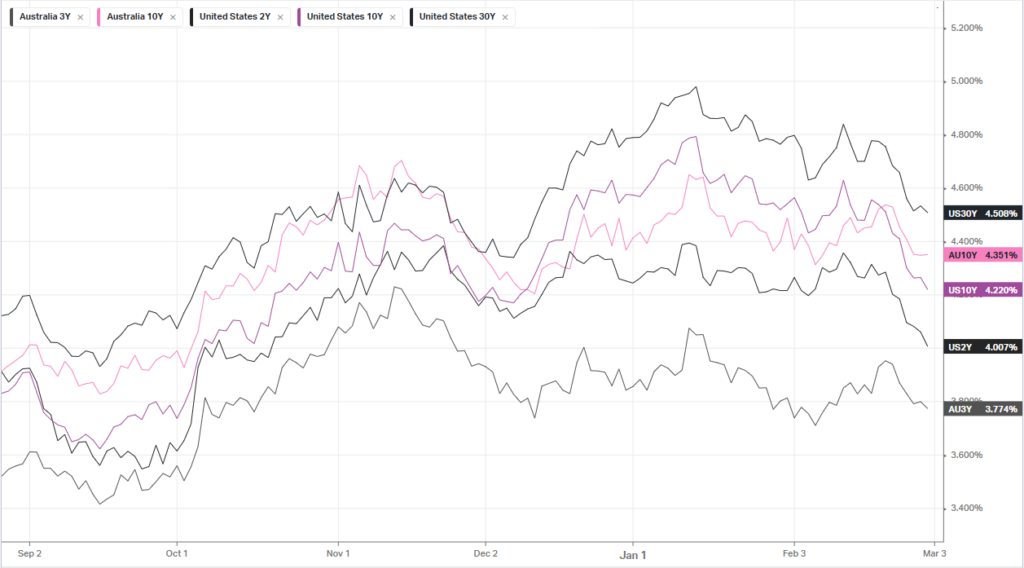

U.S. inflation matched the prior month’s pace and slowed on an annualized basis in January, while consumer spending unexpectedly contracted, presenting a muddled economic picture for Federal Reserve policymakers considering the path ahead for interest rates. The Personal Consumption Expenditures (PCE) Price Index ticked up by 0.3% last month, according to data from the Commerce Department’s Bureau of Economic Analysis on Friday. The figure was in line with December’s pace, which was itself the largest increase since April 2024. In the 12 months through January, PCE inflation eased slightly to 2.5% from 2.6%, meeting economists’ estimates.

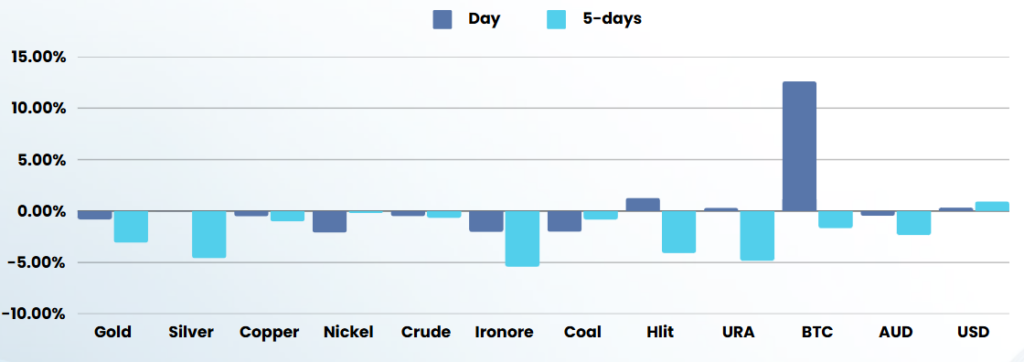

U.S. President Donald Trump on social media announced the names of five digital assets he expects to include in a new U.S. strategic reserve of cryptocurrencies on Sunday, spiking the market value of each

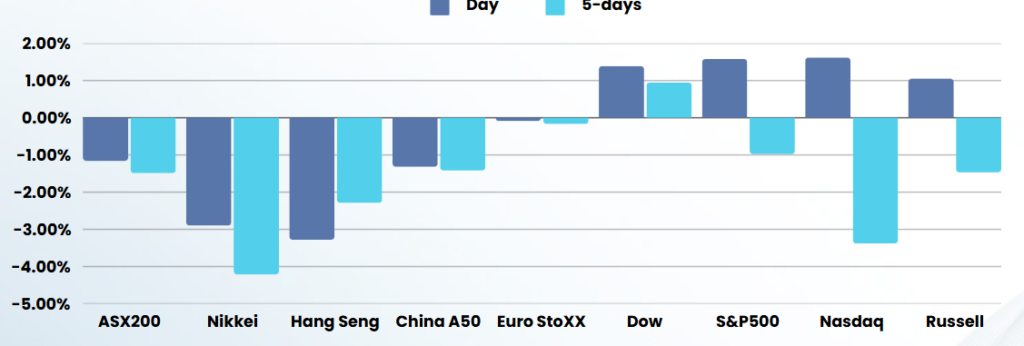

ASX SPI 8180 (+0.59%)

While there will be initial optimism and buying after Friday nights rally, a wild week ahead for Trump and tariffs may keep a cap on the optimism.

Tuesday is likely to see the 25% tariffs put in place for Canada and Mexico, while AU GDP and RBA minutes are also due this week. PBIC national congress is also later in the week