Overnight – Stocks fall as poor Walmart results spark economic concern

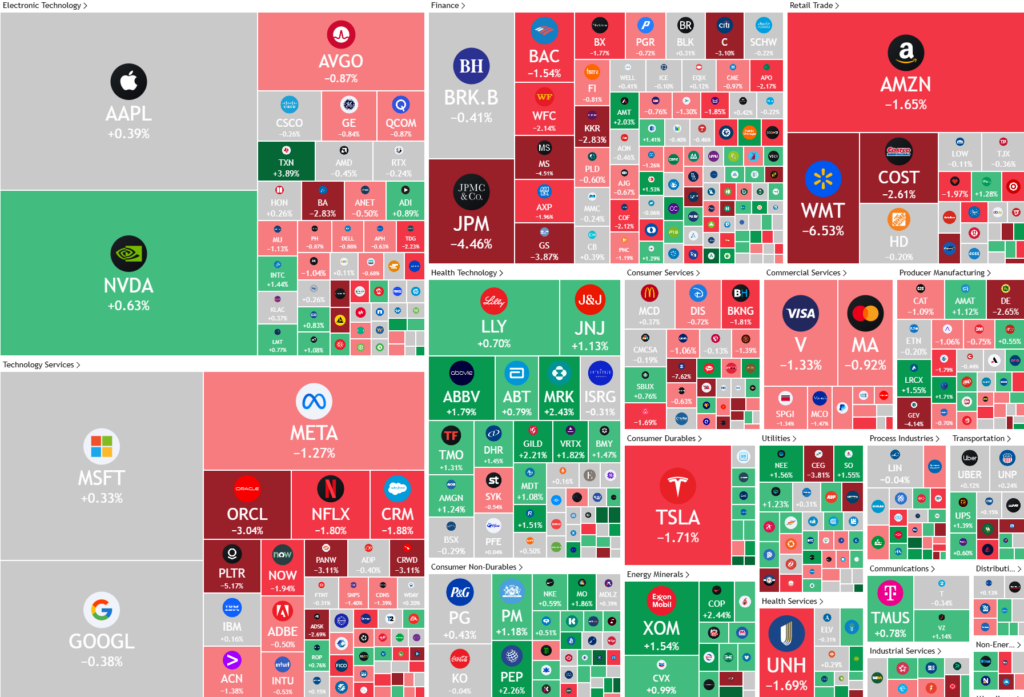

Stocks fell overnight after disappointing sales outlook from big-box retailer Walmart raised concerns about the consumer and underlying economic strength.

Walmart fell more than 6% after unveiling an outlook for sales in its 2026 fiscal year that were below forecasts, in a potential sign that the big-box retailer may feel the impact of fading optimism among inflation-hit consumers. Analysts have widely viewed the ubiquitous chain that offers everything from retail goods to groceries as a possible bellwether for the state of the U.S. consumer during the early months of 2025. Arkansas-based Walmart said it expects annual consolidated net sales to increase in the range of 3% to 4%, versus analyst projections of a 4% uptick, according to LSEG data cited by Reuters.

Still the warning from Walmart rattled other retailers, with Target Corp and Costco Wholesale Corp also trading in the red.

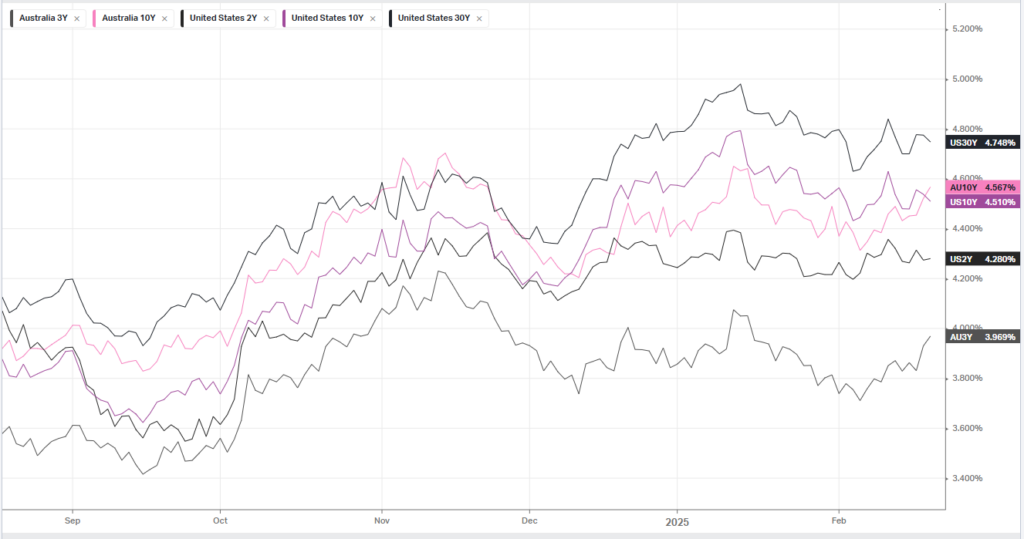

St. Louis Federal Reserve President Alberto Musalem said Thursday that while he continues to expect inflation slow toward the Fed’s 2% target, he backs the rate cuts to remain on hold “until inflation convergence is assured.” The remarks mainly echoed that other Fed members calling for the evidence of disinflation progress. Atlanta Fed president Raphael Bostic, however, leaned slightly dovish on Wednesday, forecasting that the Fed will cut rates twice this year, though acknowledged that uncertainty has increased.

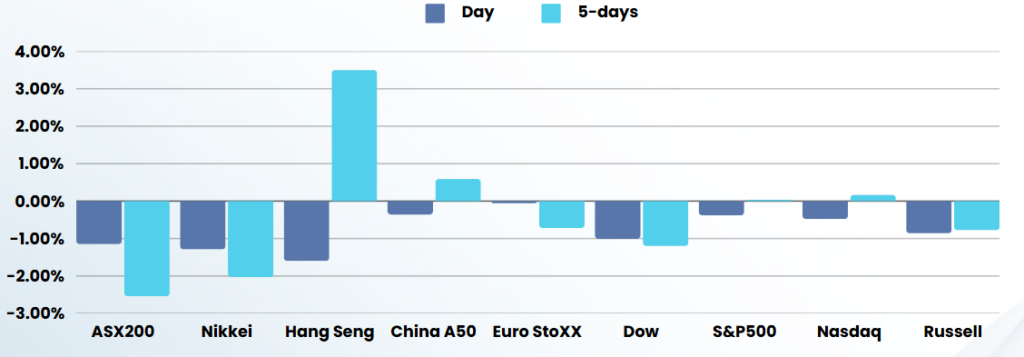

ASX SPI 8304 (+0.19%)

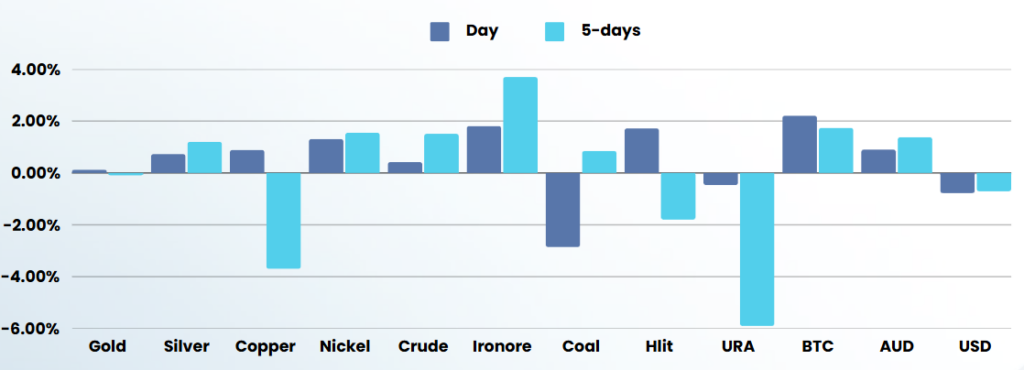

The ASX should open higher today as commodities and earnings drag the market higher. Gold and a late 2% rally in iron ore should see the materials sector shift higher although the banks may weigh as financials were the worst performing sector overnight in the US

Company Specific

- Telix – See in depth analysis from MPC here

- Newmont – beat analysts’ estimate for fourth-quarter profit on Thursday, as the world’s biggest gold miner benefited from a rally in bullion prices. Newmont’s quarterly gold production was at 1.90 million ounces, compared with 1.74 million ounces a year earlier. Quarterly average realized price for gold was at $2,643 per ounce, compared with $2,004 per ounce a year ago. On an adjusted basis, the company earned $1.40 per share for the quarter ended December 31, compared with analysts’ average estimate of $1.08 per share, according to data compiled by LSEG.

- QBE– has reported a higher net profit and lifted its dividend, after paying out fewer claims for natural catastrophes over the past year.

- Guzman y Gomez – said it expects to exceed its full-year profit forecast in 2025 owing to strong progress made in the first half. The food retailer’s global network sales increased 23 per cent to $578 million. Sales momentum translated to strong earnings growth, with earnings increasing 28 per cent to $32 million. Profit jumped 91 per cent to $7.3 million. Guzman’s Australian business saw sales growth of 9.4 per cent, driving $573 million in sales.

- Gold Road Resources– posted record revenue from gold sales of $528 million for the 2024 financial year. Record net profit for the year was $142.7 million and operating cash flow was a record $250.6 million. Gold Road declared a fully franked final dividend of 1.5¢ a share.

- Yancoal has set its 2025 production guidance to a range of 35 million and 39 million tonnes, warning that output would be lower in the first quarter due to mine plan sequencing. The coal miner’s attributable coal production hit 36.9 million tonnes in 2024, up 10 per cent year-on-year. Revenue fell to $6.9 billion from $7.8 billion the year before, owing to a 24 per cent decrease in realised coal prices to $176 a tonne. The board declared a fully franked final dividend of $687 million, or 52¢ at a 56 per cent payout ratio.