What's Affecting Markets Today

Asia-Pacific Markets Decline Despite Wall Street Gains

Asia-Pacific equities were mostly lower on Wednesday, diverging from Wall Street, where the S&P 500 closed at a record high as investors shrugged off tariff and inflation concerns.

Japan’s Nikkei 225 fell 0.62%, while the broader Topix declined 0.59%, as the country reported its largest trade deficit in two years. However, business sentiment among Japanese manufacturers improved for a second consecutive month, with the Reuters Tankan index rising to +3 in February from +2 in January.

South Korea’s Kospi gained 1.49%, and the small-cap Kosdaq edged up 0.13%. Meanwhile, China’s CSI 300 opened 0.16% lower, and Hong Kong’s Hang Seng fell 1.16%.

Australia’s S&P/ASX 200 slipped 0.41% following the Reserve Bank of Australia’s 25-basis-point rate cut to 4.10%—its first easing since November 2020.

New Zealand’s central bank lowered rates by 50 basis points to 3.75%, its fourth consecutive cut, aligning with expectations as economic growth slows. The New Zealand dollar strengthened 0.28% to 0.568 against the U.S. dollar.

ASX Stocks

ASX 200 - 8,433.3 (-0.60%)

ASX Declines as Banks Weigh on Market

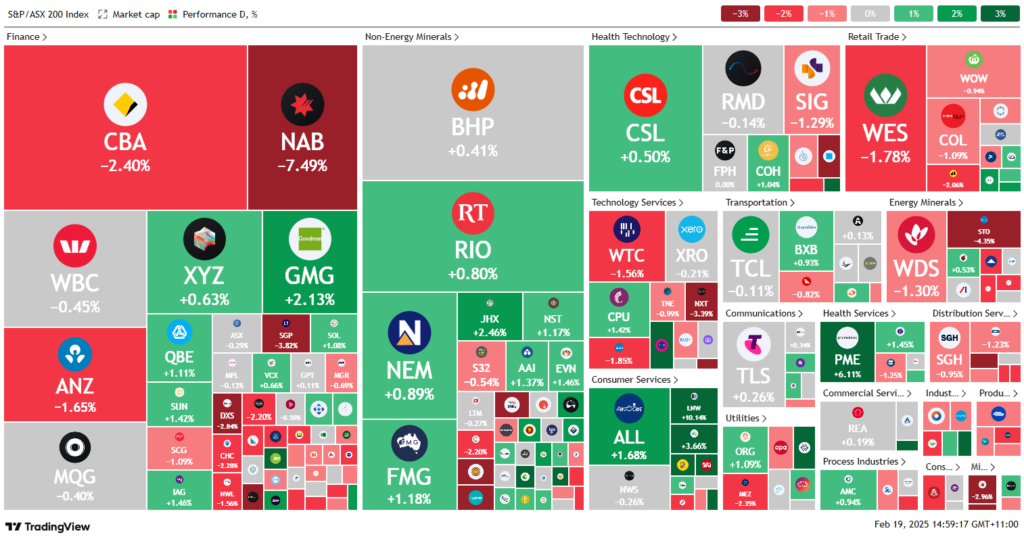

The S&P/ASX 200 fell 0.7% (55.2 points) on Wednesday to 8425.80, as banking and energy stocks dragged the index lower. Seven of the 11 sectors finished in positive territory.

National Australia Bank dropped 6.7% after its December quarter earnings missed expectations due to rising funding costs and intense competition. This pressured the broader banking sector, with Commonwealth Bank down 0.7%, ANZ falling 1.4%, and Westpac slipping 0.1%.

Earnings season delivered mixed results. Santos fell 4.8% after reporting a 14% decline in full-year profit and cutting its dividend. Mineral Resources plunged 15.9% on an $800 million loss and scrapped interim dividend.

Stockland declined 3.8% despite doubling its first-half profit, while Cleanaway fell 1.7% on a weaker-than-expected cash position. Conversely, Lottery Corporation gained 4.2%, and Ventia surged 57.4% after strong earnings.

Corporate Travel rose 9.7% despite a profit slump, while Fletcher Building jumped 6% on cost-cutting progress. James Hardie added 2.4% as earnings exceeded forecasts. Meanwhile, gold prices hovered near record highs amid geopolitical uncertainty.

Leaders

NGI – Navigator Global (+15.50%)

LNW – Light & Wonder Inc (+10.57%)

CTD – Corporate Travel (+9.73%)

ADT – Adriatic Metals Plc (+7.41%)

VNT – Ventia Services (+7.38%)

Laggards

MIN – Mineral Resources Ltd (-15.51%)

NAB – National Australia Bank Ltd (-6.77%)

AD8 – Audinate Group Ltd (-5.09%)

OPT – Opthea Ltd (-5.00%)

ARF – Arena REIT (-4.56%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!