Overnight – Stocks higher as Trump delays Tariffs

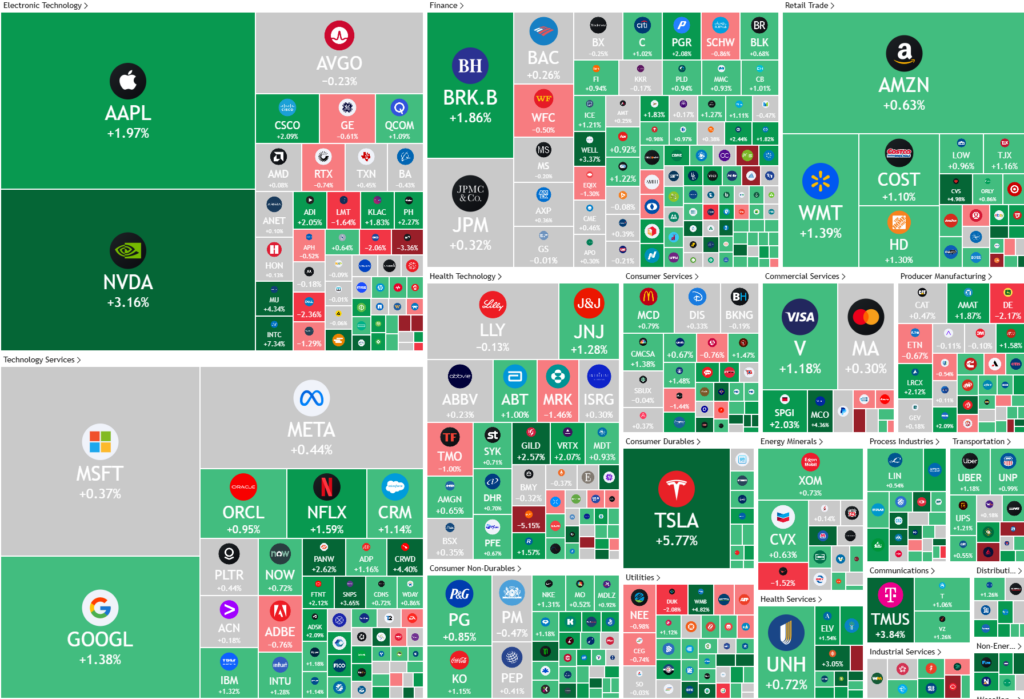

Stock closed higher overnight after President Donald Trump signed an order to explore reciprocal tariffs on U.S. trading partners, but stopped of implementing the measures immediately as some had feared.

Trump signed order to explore how the U.S. can match the levies and rates imposed by other nations on imported U.S. goods, though stopped short of imposing them immediately. While Trump had teed up the news that tariffs would be announced today, some feared the measures could go into effect immediately.

Trump signed order to explore how the U.S. can match the levies and rates imposed by other nations on imported U.S. goods, though stopped short of imposing them immediately. While Trump had teed up the news that tariffs would be announced today, some feared the measures could go into effect immediately.

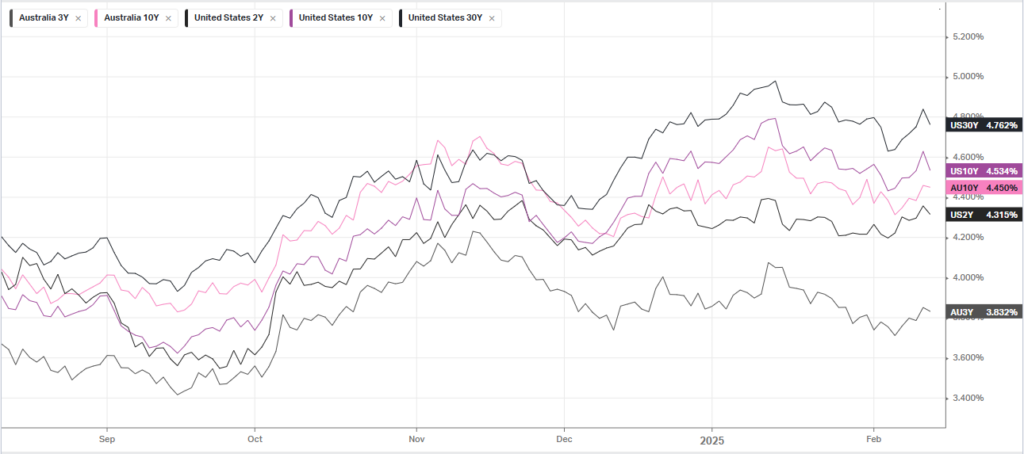

However, investors are also having to cope with lingering inflationary pressures in the world’s largest economy. Headline U.S. producer prices increased at a hotter-than-anticipated pace in January, with the producer price index (PPI) for final demand rising 0.4% on a month-on-month basis, data from the Labor Department showed on Thursday. Economists had predicted a PPI reading of 0.3%. In the twelve months through January, the PPI grew by 3.5%, compared with 3.5% in the preceding month and expectations of 3.2%. A hotter-than-expected producer price report on the heels of yesterday’s rise in the CPI report reinforces concerns of ingrained inflationary pressures in the economy and further upside price risks given an aggressive fiscal policy agenda

Corporate Earnings

- Cisco Systems –stock gained 2% after the technology conglomerate lifted its annual revenue guidance thanks in large part to artificial intelligence-fueled demand for its cloud networking gear.

- Robinhood Markets – stock gained 14% after the cryptocurrency trading platform reported record fourth-quarter revenue and profit on the back of a resurgence in retail trading.

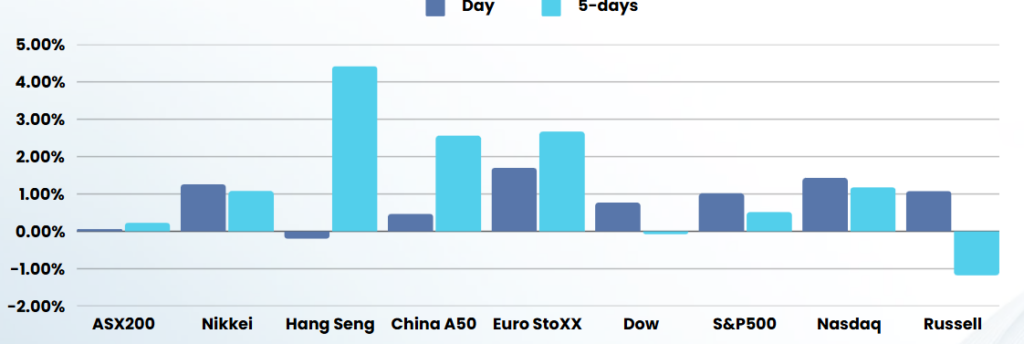

ASX SPI 8573 (+0.96%)

The ASX will have a positive end to the week as earnings and offshore positivity lift investor sentiment

Company Specific

- Cochlearhas increased its interim dividend 8 per cent to $2.15 per share owing to strong cashflow generation, the company said, but cautioned full-year profit would be at the lower end of range guided.

- AMP’s profit nearly halved to $150 million in the 2024 financial year – but chief executive Alexis George says this reflects the sale of the firm’s advice arm and simplification of its business.

- Mirvacsaid operating profit after tax fell 6 per cent to $236 million in the six months to December, while earnings fell to zero.

- GQG’s doubled its net flows in the half-year to December, boosting funds under management, which rose by more than a quarter to $US153 billion. The fund manager also lifted its dividend.