Overnight – Equities ease as Powell says Trump Policies means no rush on rate cuts

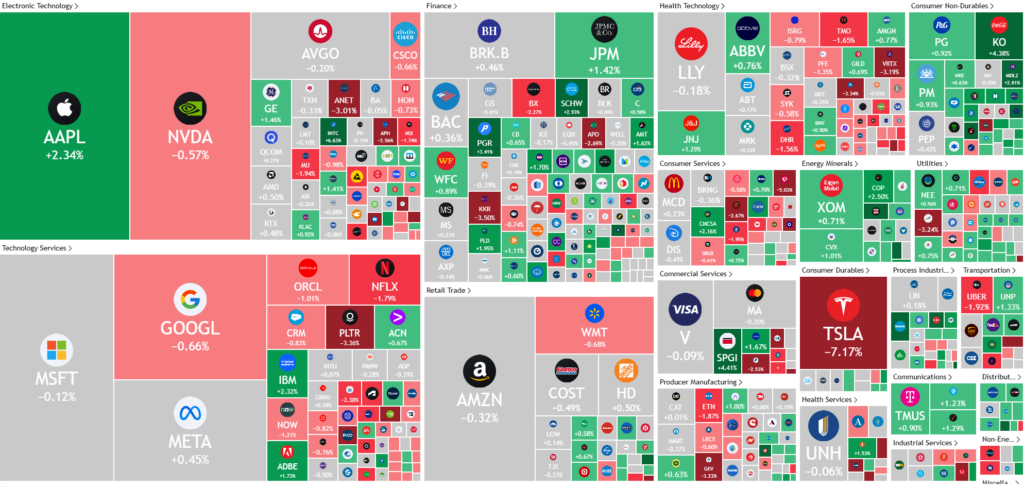

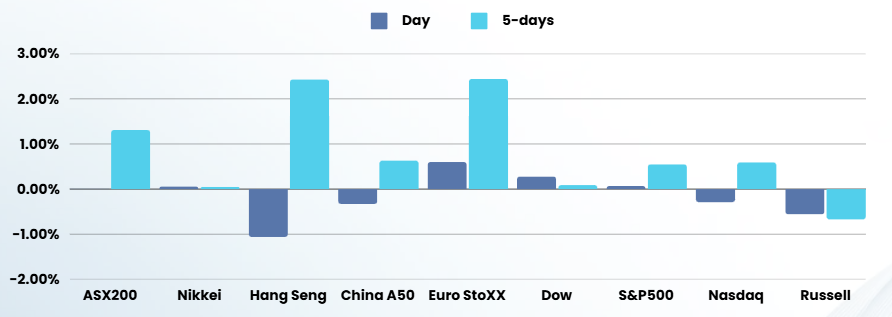

Stocks were heavy overnight after Federal Reserve Chairman Jerome Powell said the Fed doesn’t need to be hurry to cut rates again at a time when many are concerned that President Donald Trump’s tariffs could fuel inflation.

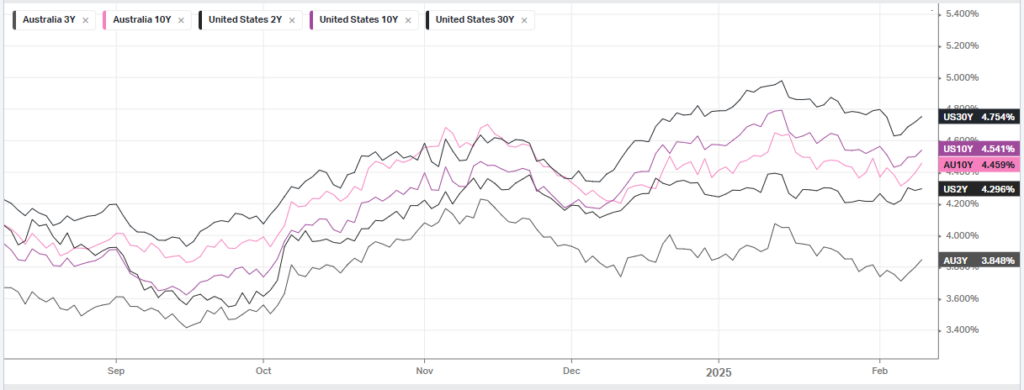

Powell told the Senate Banking committee Tuesday that there wasn’t a need for the Fed to “to be in a hurry” to lower interest rates as monetary policy is already less restrictive and the economy remains strong. “With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to adjust our policy stance,” Powell said. The remarks echoed that of recent Fed members and the Powell’s remarks at the FOMC January press conference, when the Fed kept interest rates hold. Treasury yields climbed following the remarks as bets on a rate cuts dwindled, with the Fed now is expected to stand pat on rates at the March meeting, according to Fed Rate Monitor Tool.

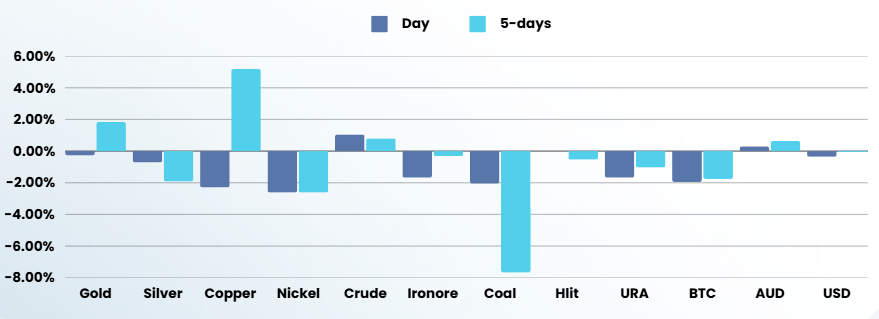

President Trump followed up his threat late on Monday, and signed executive orders imposing 25% tariffs on steel and aluminum imports, while also stating that there would be no exceptions to the duties. Major steel exporters such as Canada, Mexico, and Brazil were subject to some quota-based tariff exceptions, which will now be revoked. Trump warned that tariffs on metals could go higher, and that he was considering tariffs on cars, chips, and pharmaceuticals. The president also flagged plans to raise U.S. import tariffs to match foreign duties on the import of U.S. goods. Investors are now gauging if Trump will follow through on a separate threat to impose reciprocal tariffs, with worries swirling around a potential increase in international trade tensions.

Looking ahead, investors are focusing on several key events that could influence market direction. Federal Reserve Chair Jerome Powell is scheduled to deliver his biannual monetary policy report to the Senate Budget Committee on Tuesday and the House of Representatives Financial Services Committee on Wednesday. Additionally, the market is anticipating the release of important economic data, including January’s Core CPI, US retail sales, and PPI data.

With the fourth-quarter reporting season more than halfway through, S&P 500 companies are expected to post year-over-year earnings growth of 14.8%, surpassing initial expectations of less than 10% at the start of 2025

Corporate Earnings

- Coca-Cola – rose over 3% after the soft drinks giant beat estimates for fourth-quarter profit and revenue, helped by resilient demand for its sodas and juices and higher prices.

- Shopfiy – stock was flat after the e-commerce company’s posted better-than-expected holiday-quarter sales on the back of healthy consumer spending and its rollout of AI features, overshadowing its downbeat first-quarter profit outlook.

ASX SPI 8440 (+0.04%)

ASX earnings will dominate today with Australia’s largest company, CBA releasing slightly better than expected results at first glance.

Company Specific

- Commonwealth Bank – reported better-than-expected first-half cash earnings on Wednesday, helped by robust volume growth across its home lending and deposit products portfolio as well as a lower loan impairment expense. The country’s biggest lender said its cash net profit after tax was A$5.13 billion ($3.23 billion) for the six months ended December 31, compared with A$5.02 billion a year earlier, and beating a Visible Alpha consensus estimate of A$5.06 billion.

CBA’s net interest margin, a key profitability metric defined as the gap between loan interest and the interest paid to depositors, rose 2 basis points from last year to 2.08%.

CBA said the effects of competitive pressure on deposits and lending pricing were offset by higher earnings on capital hedges and the replicating portfolio.

It declared an interim dividend of A$2.25 per share, compared with A$2.15 apiece last year.