Overnight – Gold strides to new record highs as Elon launches bid for OpenAI

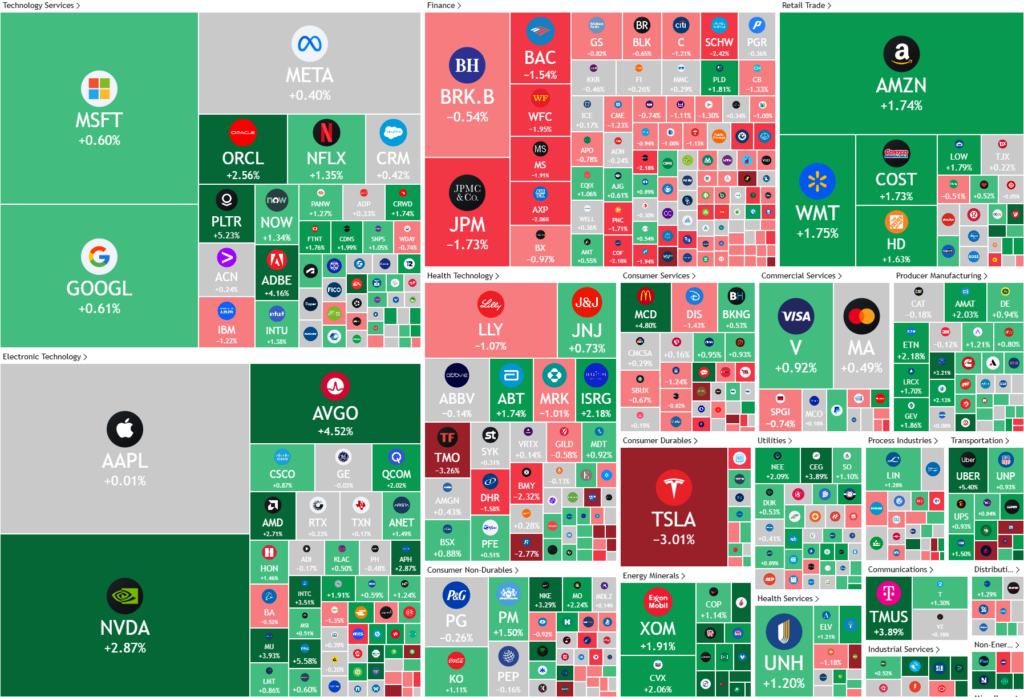

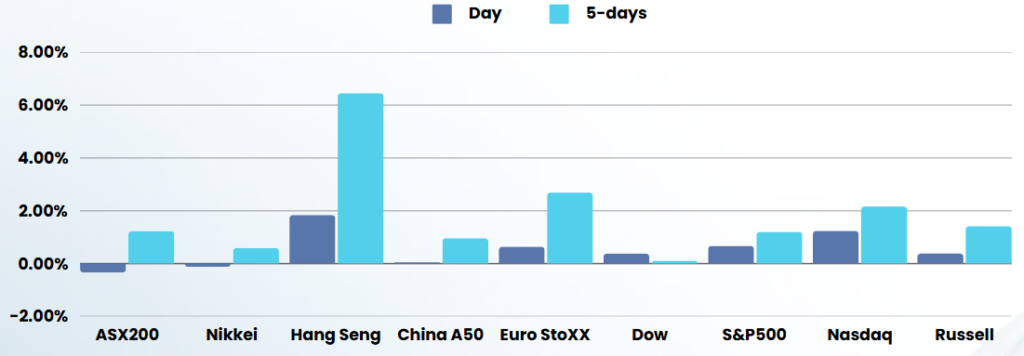

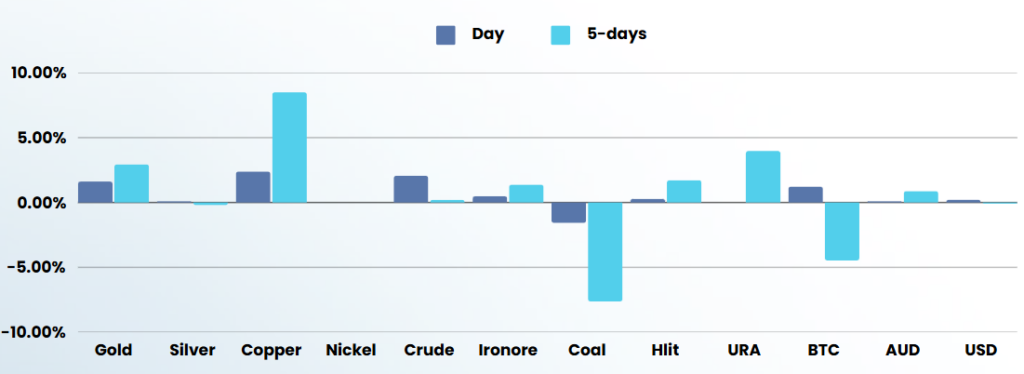

Stocks bounced overnight, driven by the technology, commodities and energy sectors as gold reached a new record high and Elon Musk launched a $95B bid for OpenAI

Tech giants played a crucial role in the market’s upward movement. Nvidia and Broadcom, both AI chipmakers, saw substantial increases of 3.6% and 4.5%, respectively. Amazon also contributed to the rally with a 1.5% gain. The strong performance of these tech-related stocks helped offset the sharp declines experienced in the sector on Friday, which were triggered by President Trump’s announcement of reciprocal tariffs on all countries.

President Trump’s announcement of plans to impose 25% tariffs on all steel and aluminum imports had a significant impact on the market. US metals producers, who stand to benefit from these tariffs, saw their stocks surge. Nucor, Steel Dynamics, and Cleveland-Cliffs experienced gains between 5% and 13%, while Century Aluminum and Alcoa rose by 11% and 3%, respectively. U.S. Steel’s shares also received a boost, climbing 4.7%. The potential for these tariffs has raised concerns about trade tensions and their impact on global markets.

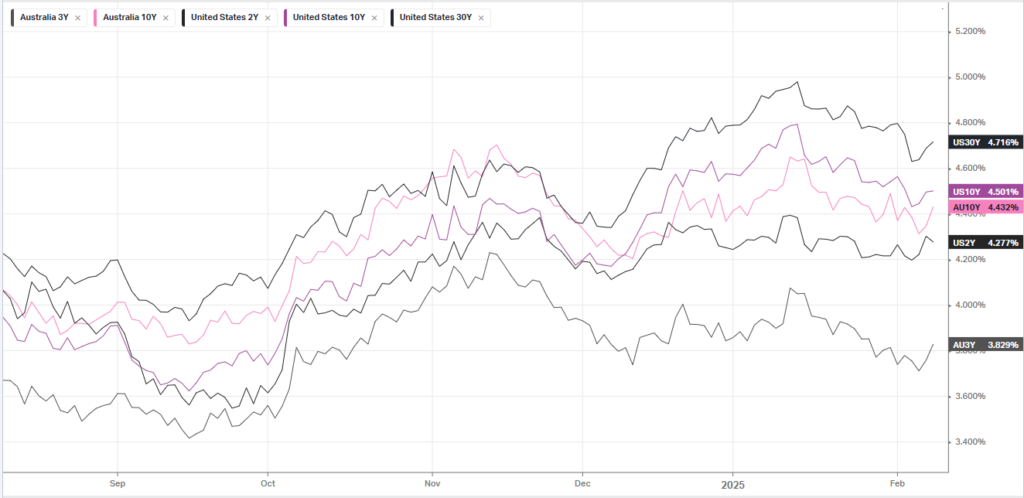

Looking ahead, investors are focusing on several key events that could influence market direction. Federal Reserve Chair Jerome Powell is scheduled to deliver his biannual monetary policy report to the Senate Budget Committee on Tuesday and the House of Representatives Financial Services Committee on Wednesday. Additionally, the market is anticipating the release of important economic data, including January’s Core CPI, US retail sales, and PPI data.

With the fourth-quarter reporting season more than halfway through, S&P 500 companies are expected to post year-over-year earnings growth of 14.8%, surpassing initial expectations of less than 10% at the start of 2025

Corporate Earnings

- McDonald’s – jumped nearly 5% after the hamburger chain posted a surprise rise in its global comparable sales in the fourth quarter.

- Rockwell Automation – surged 14% after the automation products maker posted higher-than-expected profit for the fiscal first quarter.

ASX SPI 8465 (+0.65%)

The ASX will be due for a bounce today as commodities and energy will help the index along with the overnight offshore lead. Gold hit another record high overnight, while copper reached a 9 month high at 4.70

Westpac will release its February consumer confidence report at 10.30am, while NAB follows an hour later with its January business confidence and conditions reports.

Todays earnings will be focused on Breville, Macquarie, CSL, Seven Group and Seven West

Company Specific

- Macquarie Group’s profits were flat in nine months to December, as a substantial boost from the firm’s asset management, banking and financial services divisions were offset by a fall in profit from the commodities and global markets divisions, and Macquarie Capital.

- CSL’snet income rose 6 per cent to $US2.01 billion ($3.2 billion) in the first half of fiscal 2025, thanks to strong sales led by CSL Behring. The biotech giant also reaffirmed full-year earnings guidance of $US3.2 billion to $US3.3 billion

- Seven West Media’s revenues fell 6 per cent in the six months to December, the company reported, with a decline in TV advertising revenue a key detractor.

- SGH Ltd, formerly known as Seven Group Holdings, hiked its dividend by 30 per cent as its newly acquired building products business Boral delivered strong returns from cost control and price rises.

- Breville – Small appliance maker Breville’s net profit jumped 16 per cent from a year ago to $97.5 million in the first half of fiscal 2025.