What's Affecting Markets Today

Gold Rises Amid US Tariff Fears

The price of gold edged higher on Monday following US President Donald Trump’s announcement of new tariffs on aluminium and steel imports. Spot gold rose 0.4% to $US2873.15 at 2:19 PM, after briefly peaking at $US2886.06 an ounce on Friday before pulling back. The renewed bullish sentiment came as Trump confirmed the 25% tariffs would take immediate effect, raising concerns over global trade tensions and boosting demand for safe-haven assets.

ASIC Takes Star Entertainment to Court

The Australian Securities and Investments Commission (ASIC) has initiated a major legal case against former executives and directors of Star Entertainment, including ex-CEO Matt Bekier and former chairman John O’Neill. ASIC alleges they failed to manage money laundering risks and allowed criminal infiltration of the casino between November 2016 and March 2022. Representing ASIC, Dr. Ruth Higgins told the court that the case highlights the significant legal, financial, and reputational risks Star’s leadership permitted to develop.

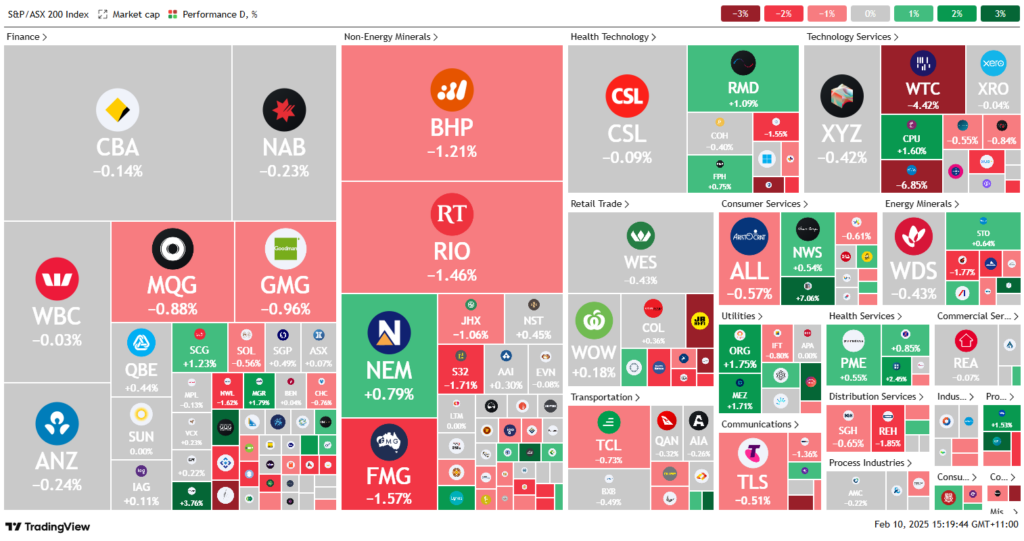

ASX Stocks

ASX 200 - 8,480.3 (-0.40%)

The S&P/ASX 200 index fell 0.6% in early trading on Monday, tracking Wall Street’s decline, before recovering slightly to trade 0.3% lower by 2:01 PM. Investor sentiment was initially rattled by concerns over US President Donald Trump’s 25% tariffs on aluminium and steel, but the realization that China’s steel exports to the US were minimal helped temper fears. A strong US jobs report, which saw the unemployment rate fall to 4%, also dampened hopes for imminent Fed rate cuts. Defensive sectors such as utilities, healthcare, and consumer staples gained, while technology stocks fell 1.7%, with WiseTech leading the decline, dropping 3.9% amid misconduct allegations against its founder.

Key Stock Movements

- Star Entertainment Group surged 18.2% after rejecting a takeover bid from Chow Tai Fook Enterprises and Far East Consortium for its 50% stake in Brisbane’s Queen’s Wharf complex.

- BlueScope Steel climbed 1.8% as investors saw it benefiting from US steel tariffs, given its significant North American presence.

- Mayne Pharma soared 20.5% after forecasting a 275% jump in EBITDA, driven by strong growth in its women’s health division.

- Ansell rose 6.5% following plans to raise prices to offset US tariffs.

- JB Hi-Fi fell 4.4% despite reporting nearly 10% sales growth to $5.67 billion, exceeding market expectations.

Leaders

MYX – Mayne Pharma (+24.36%)

SGR – Star Entertainment (+13.64%)

CEN – Contact Energy (+8.26%)

ANN – Ansell (+8.13%)

LNW – Light & Wonder (+7.85%)

Laggards

WA1 – WA1 Resources (-9.82%)

CAR – CAR Group (-6.51%)

BRE – Brazilian Rare Earths (-5.29%)

VYS – Vysarn (-5.05%)

HGH – Heartland Group (-4.81%)