MPC ETF Elite - Holdings Change Feb 2025

The ETF Elite Portfolio investment committee meeting involved a detailed discussion on portfolio performance, strategic adjustments, and potential reallocations. Here are the key points and insights from the discussion:

Portfolio Performance and Strategy

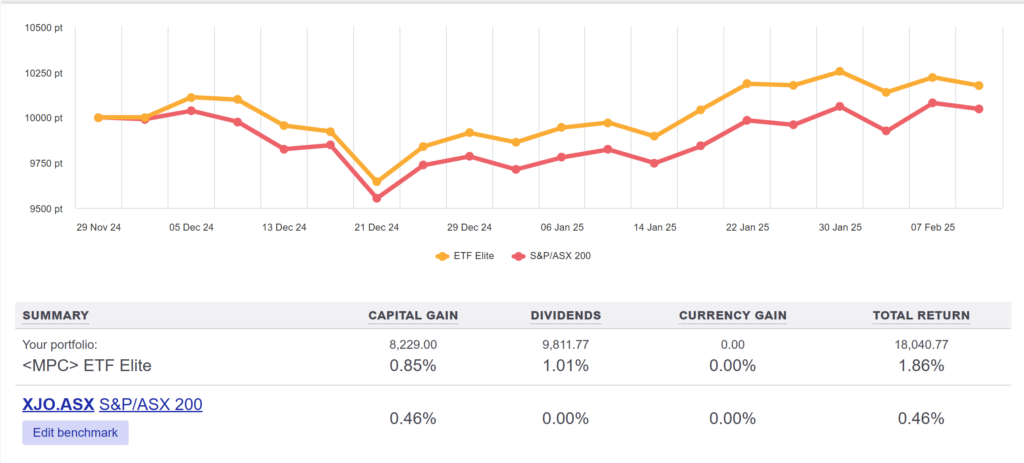

- The ETF Elite Portfolio has performed well, with a return of 1.86% since inception after fees, aligning with its goal of outperforming the ASX 200 benchmark by a couple of percentage points annually.

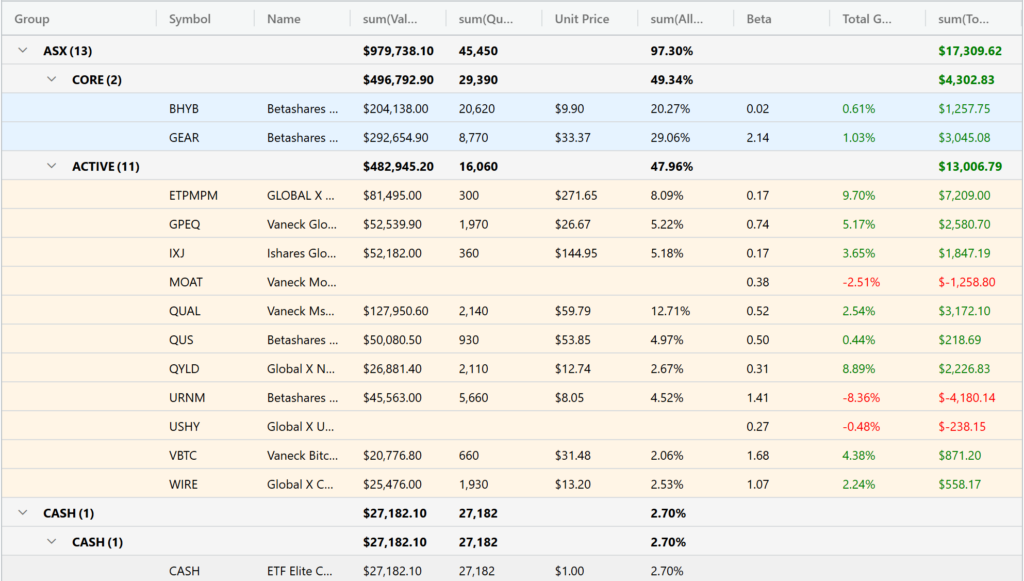

- The portfolio is structured into core holdings (designed to track the ASX 200 index) and active allocations (focused on high-conviction thematic plays). Currently, it leans more toward active holdings due to market conditions perceived as “peaky.”

- The committee emphasized maintaining transparency, liquidity, and simplicity in the portfolio while balancing risk and return.

Market Observations

- The metals sector, particularly gold, was noted for strong performance, with gold nearing $3,000 per ounce. The committee is confident in maintaining current allocations but may consider adjustments if gold surpasses key levels.

- Concerns were raised about geopolitical risks, including tariffs and energy policies under the Trump administration, which could impact certain holdings.

- Bitcoin’s price action was discussed briefly; no immediate changes were proposed, but the committee is open to opportunistic additions if prices dip further.

Broader Insights

- The portfolio’s beta is currently at 0.91, within the target range of 0.8–1.2. This reflects its design to closely track the index while allowing room for active thematic plays.

- The committee stressed the importance of avoiding unnecessary complexity and focusing on high-quality assets with predictable returns.

- A potential future idea involves exploring a US-based food ETF that includes agricultural machinery and packaged food companies as a hedge against tariff risks.

Decisions on Reallocation

Immediate Action

- Fixed Income Adjustments:

- Sell 5% of USHY (USD High Yield Bond ETF), citing its unpredictable quarterly distributions and currency complexities.

- Reallocate:

- 2% to GEAR, a leveraged ASX 200 ETF, to optimize capital efficiency and enhance returns.

- 3% to BHYB, an Australian Hybrid Securities ETF, offering more predictable monthly yields around 7.2%.

- Equity Simplification:

- Sell 5% of MOAT (VanEck Morningstar Wide Moat ETF), which has underperformed relative to expectations.

- Consolidate this allocation into QUAL (iShares MSCI Quality Factor ETF), which has demonstrated consistent performance and fits better as a core holding.

Potential Future Action

- Uranium Exposure:

- The committee debated reducing exposure to URNM (Sprott Uranium Miners ETF), currently at 4.5%, due to underwhelming market performance despite positive fundamentals for uranium demand.

- They decided to monitor its technicals further before making a final decision but flagged it for potential trimming or exit.

- Future Allocation Considerations:

- Expressed interest in adding up to 3% in IIND, an Indian quality index ETF, citing India’s demographic advantages and economic resilience. The committee plans to wait for further technical confirmation before proceeding.

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.