Overnight – Stocks higher as “Trade war” becomes “Trade bore”

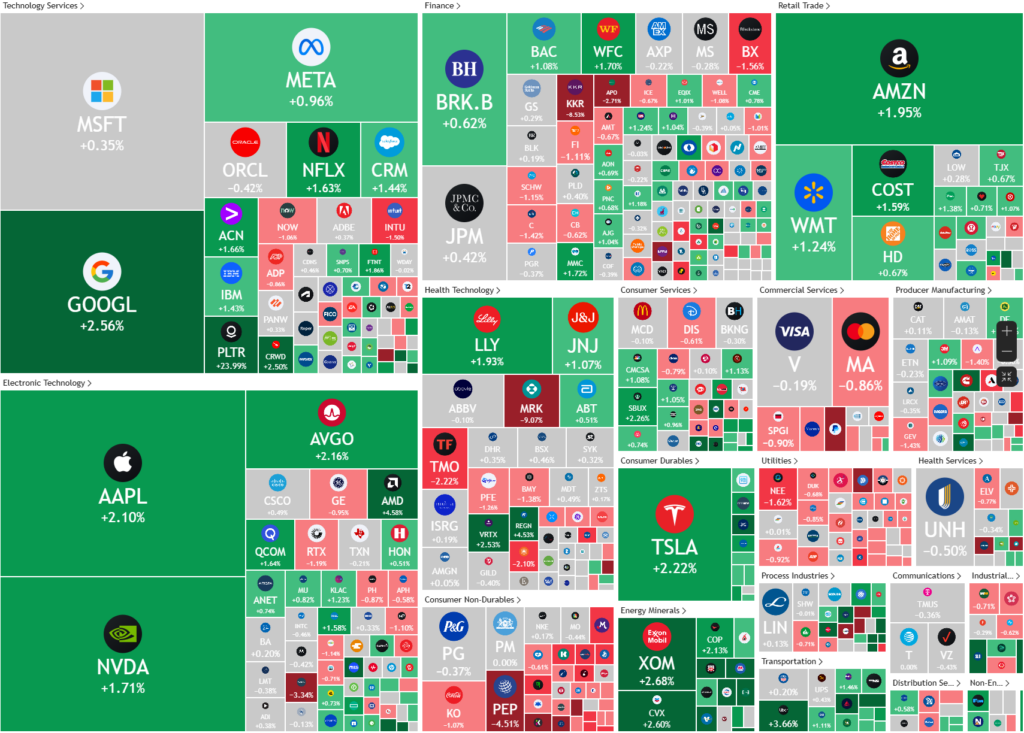

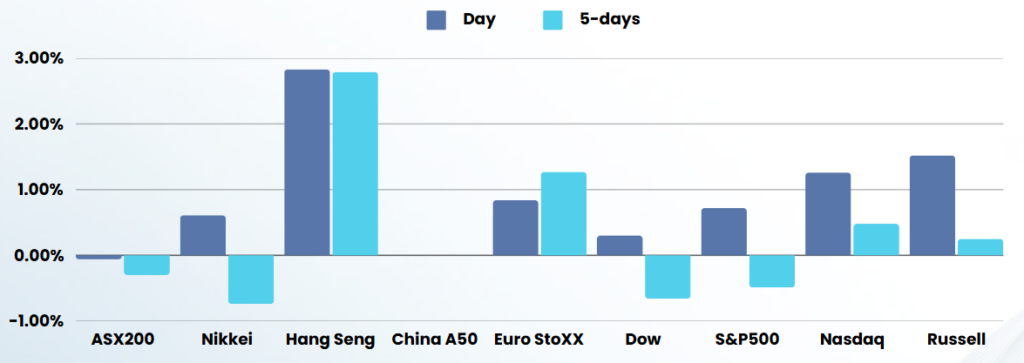

Stocks traded higher overnight as investors digested the start of a trade war between China and the US and a slew of quarterly corporate earnings.

In a play ripped straight from Trumps book “the Art of the Deal” Trump delayed tariffs on Canada and Mexico for at least 30 days on Monday after both countries agreed to secure their borders better. While coming to a deal with China may prove more complicated, the leeway Trump showed with Canada and Mexico indicates he can move quickly to reverse any tariff decision

US President Donald Trump postponed proposed 25% import duties on Canada and Mexico by 30 days, but he offered no such forgiveness for Beijing, with his 10% tariffs on goods from China taking effect earlier Tuesday. Beijing retaliated, slapping a 15% tariff on coal and liquified natural gas imports from the U.S., and an additional 10% duty on crude oil, agricultural equipment and automobiles from Feb. 10. China’s commerce ministry also placed export controls on rare earths and exotic materials, of which the country is a top producer. The materials covered included tungsten, tellurium, ruthhenium, and molybdenum.

The retaliatory measures pointed to the start of a renewed trade war between the world’s biggest economies, with investors now bracing for further escalation, given Trump’s hawkish stance against Beijing. China accounts for substantial portion of US imports, with any retaliation from Beijing likely to further destabilize global trade. China is the US’s third-biggest trading partner behind Mexico and Canada.

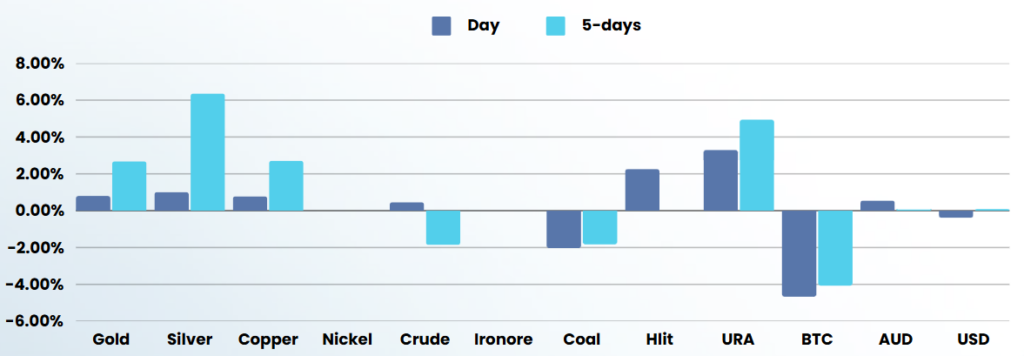

Commodities made a recovery with precious metals pushing new record highs in gold and 3-month highs in Silver

Corporate Earnings

- Palantir – stock soared 22% after the data analytics company forecast upbeat annual revenue fueled by strong demand for its software and data analytics services from businesses racing to adopt generative AI.

Palantir is an MPC Markets High Conviction Pick +43% in 1 month

- PepsiCo – stock fell 2.3% after the soft drinks giant reported tepid organic revenue growth as price hikes weighed on demand from cost-conscious U.S. shoppers.

- Spotify – stock surged 7% after the music streaming company reported fourth-quarter 2024 results that exceeded revenue expectations while also providing upbeat guidance.

- Estee Lauder – stock fell 9% after the cosmetic giant issued a fiscal third-quarter outlook that missed expectations, with the company citing weak retail sales trends in its Asia travel retail business.

- Merck & Company –stock fell 10% after the drugmaker said it will pause shipments of Gardasil to China through at least mid-year, as continued weak demand for the HPV vaccine there is expected to hurt 2025 revenue. This overshadowed a strong fourth-quarter profit on sales of cancer drug Keytruda.

ASX SPI 8396 (+0.63%)

The local market should continue to grind higher as Australia’s name has not been mentioned, 3 days into the “Tariff/Trade War” posturing.

Expect the precious metals sector to have another good day