Overnight – Trade war jitters ease as stocks recoup Asian session tariff panic

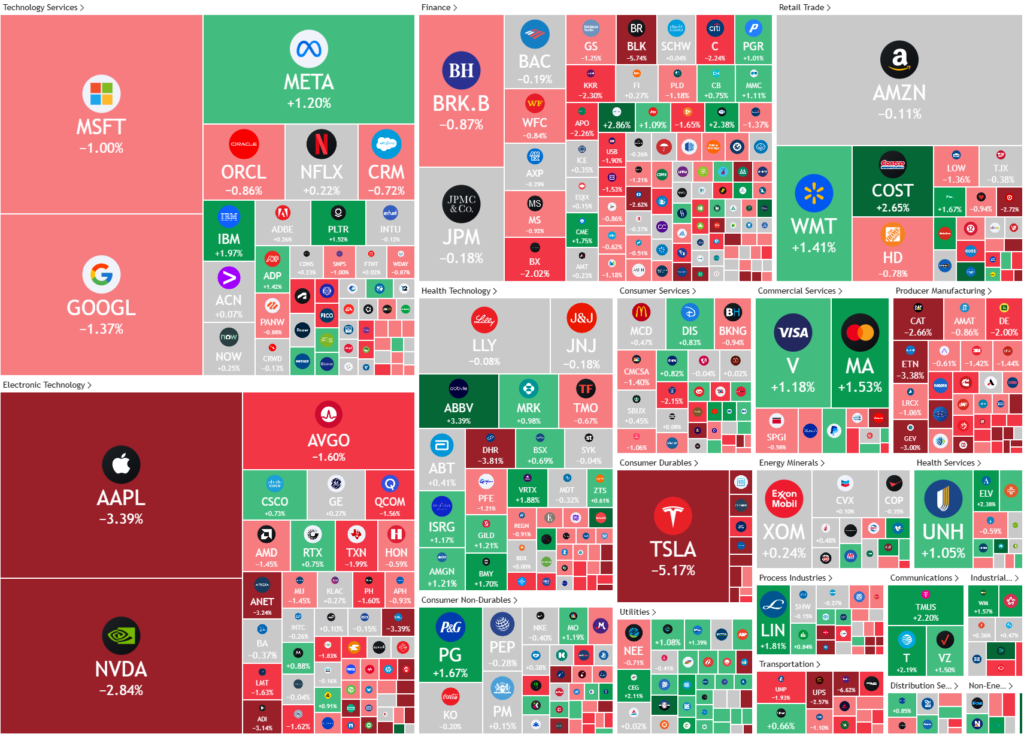

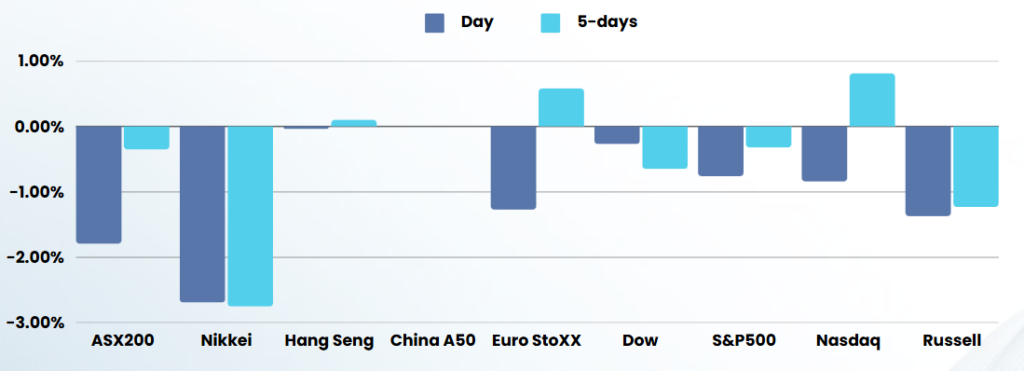

Stocks finished lower overnight, but well above Asian session lows after President Donald Trump’s decision to pause tariffs on Mexico eased fears somewhat about the economic impact of a bruising global trade war.

Following a “very friendly” call with Mexico, President Trump said that he would pause tariffs on Mexico for a month after his Mexican counterpart Claudia Sheinbuam agreed to supply 10,000 troops to help secure the U.S.-Mexico border against illegal immigration.

During the interim, the U.S. and Mexico would continue talks on reaching a more permanent deal. The delay to tariffs, which Trump announced on Saturday, and included a 25% tariff on Canada and 10% on China,offered hope that the president would likely use tariffs as tool to negotiate rather than risking a major trade war.

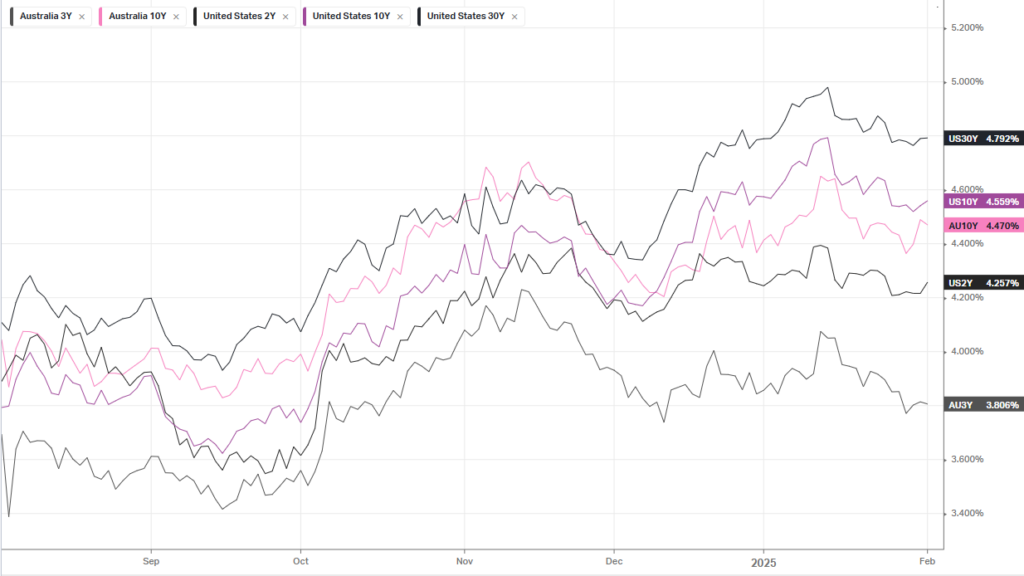

Analysts expect the tariffs to drive up US inflation, given that they will be paid largely by domestic importers. Higher inflation diminishes the prospect of more interest rate cuts from the Federal Reserve.

Away from the turmoil surrounding tariffs, this week will be the biggest to date for fourth-quarter earnings, which have become increasingly important in determining the state of the market.

More than 120 companies in the S&P 500 are set to report their results, including the likes of Google-parent Alphabet and e-commerce giant Amazon, which are set to unveil their quarterly figures on Tuesday and Thursday, respectively.

As far as economic data is concerned, the January manufacturing PMI number is out later in the session, but most eyes will be on the January nonfarm payrolls report will also be out Friday.

ASX SPI 8385 (+0.46%)

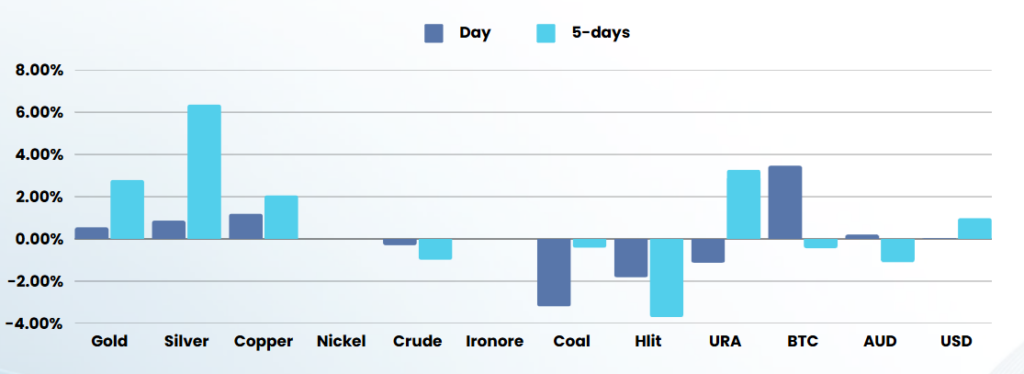

The ASX should open low and grind higher over the day as the fall-out of Trumps Tariff threats, turning to a 30 day suspension for Canada and Mexico, eased fears for markets. Expect the materials sector to bounce and companies dependent on the US Export market, claw back ground

Company Specific

- Nufarm has told investors a previously announced cost-savings program remains “on track” as the company aims to turn around its lower revenue and profit in the 2024 financial year.

- Amcor will post half-year corporate results later today.