Understanding Trump’s Tariffs

The latest tariff policy proposed by Donald Trump aims to reshape global trade relationships by imposing higher import duties on goods from key trading partners. Specifically, the U.S. has announced a 25% tariff on imports from Mexico and Canada and a 10% tariff on goods from China. These measures are part of a broader strategy to encourage domestic production while reducing reliance on foreign manufacturing. However, the policy has sparked investor concerns regarding potential supply chain disruptions and retaliatory trade measures. Companies like Fisher & Paykel Healthcare, which manufactures a significant portion of its products in Mexico, face increased costs and potential margin pressure. On the other hand, ResMed, which primarily produces in Singapore and Australia, stands to benefit from these tariffs as its competitors face pricing disadvantages.

Fisher & Paykel Turbulance Ahead

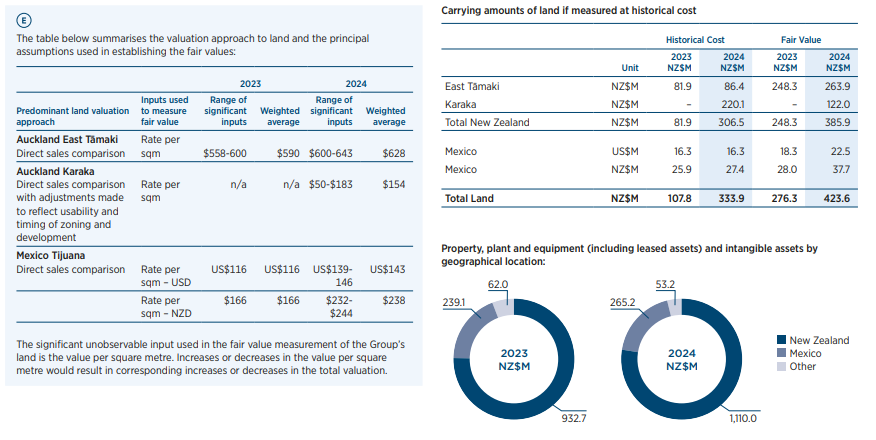

Fisher & Paykel Healthcare, a key player in the medical device industry, has significant exposure to these tariffs due to its manufacturing footprint in Mexico. Approximately 45% of the company’s total production occurs in Mexico, with 60% of those products destined for the U.S. market. The newly imposed 25% tariff on Mexican imports will directly increase production costs for these goods, raising concerns about pricing pressures and profit margins. The company may face difficult choices, such as whether to absorb these higher costs, pass them on to consumers, or restructure its supply chain to minimize exposure.

Despite this headwind, Fisher & Paykel management has downplayed the immediate financial impact for the 2025 financial year. However, the company anticipates cost pressures mounting in 2026, potentially delaying its long-term gross margin target of 65% by two to three years. With a significant portion of its revenue tied to the U.S. market, any sustained increase in costs could lead to a shift in competitive positioning, particularly if rival firms not affected by tariffs capitalize on the pricing gap.

In response, the firm is exploring mitigation strategies, including efficiency improvements, potential production relocation, and supplier renegotiations. Additionally, management has signaled that it will provide further updates in May, outlining potential adaptations to navigate the evolving tariff landscape. Investors and analysts will closely watch these developments, as they may determine the company’s ability to maintain its market share and profitability in a rapidly changing economic environment.

ResMed’s Competitive Advantage

In contrast to Fisher & Paykel, its key competitor, ResMed, stands to benefit from these trade policies. ResMed, which manufactures its sleep apnea and respiratory devices primarily in Singapore and Australia, is not subject to the new tariff burdens. This allows the company to maintain stable production costs while its competitors face rising expenses due to U.S. trade barriers.

CEO Mick Farrell has expressed optimism about the Trump administration’s policies, noting potential advantages beyond tariffs. The extension of corporate tax cuts, initially introduced in 2017, could provide additional financial benefits for U.S.-based medical technology firms. ResMed’s robust financial performance, including a strong revenue outlook and market confidence, has reinforced its ability to leverage this favorable policy environment. Moreover, the company continues to expand into under-served markets, such as China and Latin America, further diversifying its revenue streams and strengthening its competitive position.

Overall, Trump’s tariffs have introduced significant market dynamics, negatively impacting companies with Mexican-based production while offering a competitive edge to firms like ResMed with diversified manufacturing operations. As investors assess the long-term implications, Fisher & Paykel will need to adapt its strategies to mitigate these new challenges, while ResMed is poised to capitalize on its advantageous position in the evolving global trade environment.

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.