What's Affecting Markets Today

Asia-Pacific Markets Slide Amid Escalating U.S. Tariffs

Asia-Pacific equities fell on Monday following U.S. President Donald Trump’s announcement of new tariffs on Canada, Mexico, and China.

Australia’s S&P/ASX 200 declined 1.61%, while Japan’s Nikkei 225 and Topix fell 1.99% and 1.87%, respectively. South Korea’s Kospi dropped 2.52%, with the Kosdaq down 2.79%. Hong Kong’s Hang Seng Index opened 1.23% lower.

In India, the Nifty 50 fell 0.69% and the Sensex lost 0.88%. The declines followed the government’s Union Budget, which included significant income tax relief and a commitment to reduce the fiscal deficit to 4.4% of GDP, down from 4.8%.

Chinese markets remained closed for the Lunar New Year holiday, with Caixin/S&P Global services PMI data expected later in the day. Estimates suggest a reading of 50.5.

Trump’s tariffs include a 25% duty on Mexican and Canadian imports and 10% on Chinese goods, with a reduced 10% tariff on Canadian energy exports. These measures, affecting $1.6 trillion in trade, take effect Tuesday.

ASX Stocks

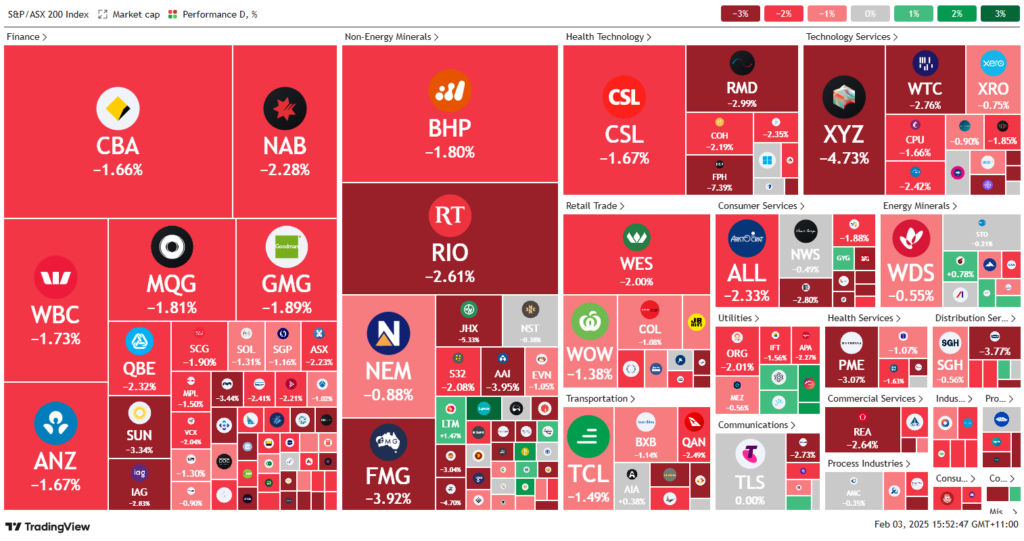

ASX 200 - 8,377.1 (-1.80%)

Key Highlights:

ASX Tumbles as US Tariffs Escalate Trade War Fears

The S&P/ASX 200 fell 1.8% (155.6 points) to 8376.7 in early afternoon trading on Monday, as investors reacted to escalating US trade tensions. The Australian dollar hit a four-year low, slipping below US61¢. All 11 ASX sectors declined, with consumer discretionary and materials losing over 2%.

Market concerns intensified after Donald Trump signed orders imposing a 25% tariff on Canadian and Mexican goods and 10% on Chinese imports. S&P 500 futures fell 122.25 points as uncertainty grew over inflation, central bank policy, and broader US trade strategy.

Major ASX stocks suffered losses, with Commonwealth Bank down 1.2% after earlier falling over 2%. NAB, WiseTech, and BHP each dropped more than 2%. Iron ore futures slid over 1%, dragging Fortescue (-4.6%) and Champion Iron (-6.1%) lower.

Cettire tumbled 15% on tariff concerns, while Resolute Mining fell 7.2% after its CEO resigned. Westgold cut full-year guidance, sending shares down 12%. Fisher & Paykel Healthcare warned of rising costs, falling 7.5%.

Leaders

LYC – Lynas Rare Earths Ltd (+3.32%)

RMS – Ramelius Resources Ltd (+2.43%)

HSN – Hansen Technologies Ltd (+2.29%)

GNE – Genesis Energy Ltd (+2.28%)

ABG – Abacus Group (+2.17%)

Laggards

WGX – Westgold Resources Ltd (-12.40%)

MFG – Magellan Financial Group Ltd (-8.56%)

RSG – Resolute Mining Ltd (-7.83%)

VUL – Vulcan Energy Resources Ltd (-7.78%)

PNV – Polynovo Ltd (-7.66%)