China’s dominance in critical minerals, advanced manufacturing, and artificial intelligence has become a major concern for Western nations, particularly the United States. This multifaceted control over key industries has significant implications for global trade and geopolitics.

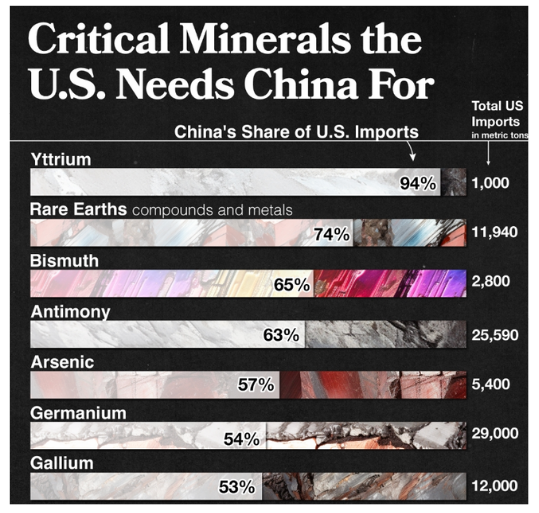

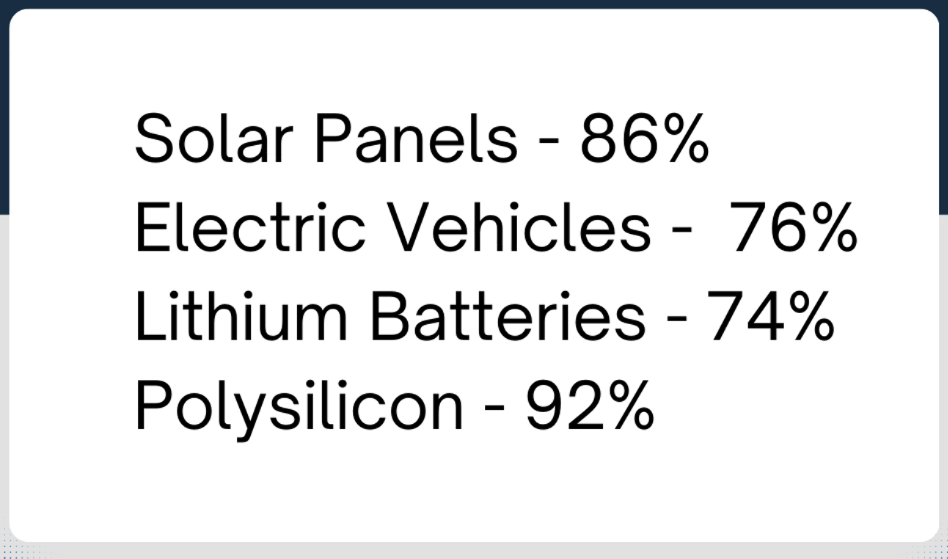

China has established itself as a “critical mineral monolith,” controlling a substantial portion of the global supply chain for essential materials used in advanced technology and renewable energy. The country produces 99% of battery-grade graphite, over 60% of lithium chemicals, 40% of refined copper, and 80% of refined magnet rare earths. This strategic approach extends beyond domestic resources, with Chinese companies actively acquiring mineral assets in resource-rich regions like Africa.

In manufacturing, China’s “Made in China 2025” initiative has successfully positioned the country as a leader in future-focused industries. China has achieved global leadership in high-speed rail, graphene, unmanned aerial vehicles, solar panels, and electric vehicles. This success comes despite U.S. efforts to impede China’s technological advancement through tariffs, export controls, and financial sanctions.

The recent emergence of DeepSeek, a Chinese AI startup, has further demonstrated China’s growing technological prowess. DeepSeek has developed competitive AI models at a fraction of the cost typically associated with such systems, challenging the dominance of American companies like OpenAI and Google.

In response to China’s growing influence, former U.S. President Donald Trump has proposed imposing tariffs as high as 60% on Chinese imports, as well as 25% tariffs on goods from Canada and Mexico. However, the effectiveness of such measures is increasingly questioned, especially in light of China’s technological advancements.

Economic analyses suggest that Trump’s proposed tariffs could reduce U.S. GDP by 0.64%, China’s by 0.68%, and have ripple effects on other economies. A potential trade war could lead to a 1.08% drop in world GDP by 2028. Moreover, tariffs may disrupt global supply chains, particularly in critical mineral sectors where China holds significant leverage.

The situation underscores the need for a comprehensive strategy that goes beyond tariffs and trade wars. As China continues to advance in critical industries and technologies, the global community must find ways to address concerns while maintaining economic cooperation and fostering innovation. The challenge lies in balancing national interests with the realities of an interconnected global economy, where unilateral actions may have far-reaching and often unintended consequences.

Disclaimer: The content presented in this content is general advice only. It does not take into account your personal objectives, financial situation, or specific needs.

Please note that past performance is not a reliable indicator of future results. The recommendations provided in are hypothetical and may not include certain fees, hence, should not be relied upon for making investment decisions. This information should not be your sole resource when making such decisions.

We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.

For further details about our services, please refer to our Financial Services Guide. MPC Markets Pty Ltd. is not responsible for any actions taken based on the information provided in this Review