What's Affecting Markets Today

Hong Kong stocks edged higher on Tuesday, with the Hang Seng Index gaining 0.33%, as regional markets remained closed for the Lunar New Year holiday. Meanwhile, Wall Street’s sharp decline in tech stocks weighed on sentiment in Asia.

Japan’s Nikkei 225 slipped 0.65%, and the Topix fell 0.41%. Chip-related stocks in Japan extended losses for a second day amid concerns over DeepSeek, a Chinese AI startup challenging the U.S.’s dominance in artificial intelligence. The potential disruption to the U.S. AI value chain impacted Asian tech firms. Advantest plunged 9.66%, Tokyo Electron dropped 4.05%, and Renesas Electronics declined 1.54%.

Markets in Taiwan, South Korea, and mainland China remained closed for the holiday break.

Attention is turning to India, where markets are set to react to the Reserve Bank of India’s announcement of a $17 billion liquidity injection through bond purchases and currency swaps. The measures aim to bolster the financial system, with investors closely monitoring their impact on equities and bonds.

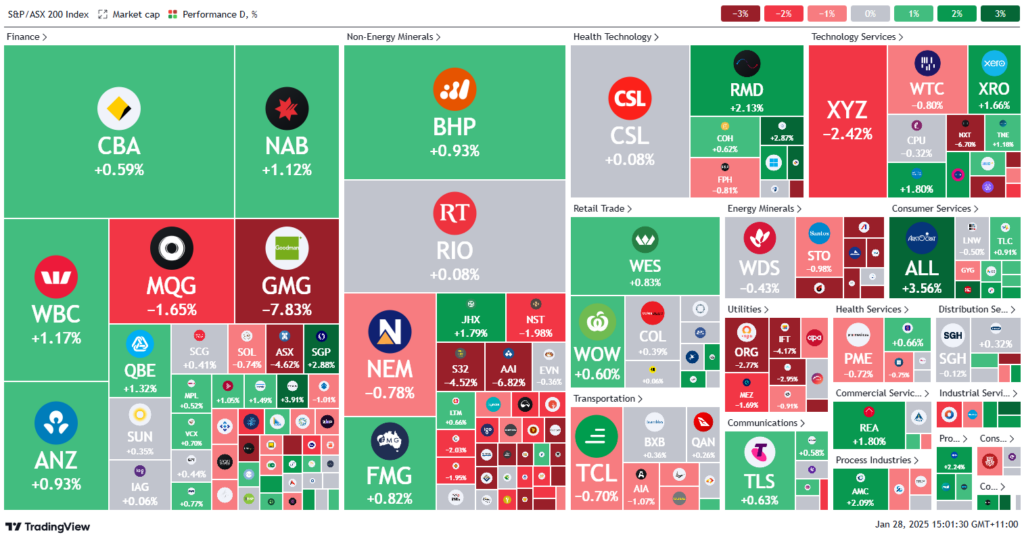

ASX Stocks

ASX 200 - 8,412.5 (+0.10%)

Key Highlights:

Technology, electricity, and data centre companies faced significant sell-offs on Tuesday amid investor concerns that China’s advancements in cost-effective AI could pressure earnings for firms like Nvidia and reduce demand for energy-intensive data centres.

The S&P/ASX 200 was higher in early afternoon trading, up just 2.1 points to 8411, reversing earlier gains. Overnight, Wall Street tumbled, with the Nasdaq dropping 3% as traders feared the Chinese start-up DeepSeek’s AI could disrupt the US tech sector. Nvidia shares plunged 16.7%, while Constellation Energy dropped over 20%.

On the ASX, NextDC fell 6.3%, Goodman Group declined 7.6%, and DigiCo slumped 11%. Origin Energy and AGL shed 2.3% and 2.5%, respectively. Uranium miners Paladin Energy and Boss Energy dropped over 10%, reflecting concerns about reduced nuclear power demand.

Notable moves included Nuix tumbling 18.4% after lower earnings guidance, while Sigma Healthcare surged 12.6% on Chemist Warehouse’s record sales. Telix Pharmaceuticals gained 3.5% following its $US230 million RLS Radiopharmacies acquisition. Aristocrat Leisure and consumer stocks provided some relief to the market.

Leaders

SIG Sigma Healthcare Ltd (+12.22%)

FLT Flight Centre Travel Group Ltd (+4.63%)

DXS Dexus (+4.06%)

MND Monadelphous Group Ltd (+3.90%)

ALL Aristocrat Leisure Ltd (+3.71%)

Laggards

NXL Nuix Ltd (-18.06%)

DYL Deep Yellow Ltd (-17.70%)

NXG Nexgen Energy (Canada) Ltd (-13.03%)

DGT Digico Infrastructure REIT (-10.90%)

BOE Boss Energy Ltd (-10.73%)