Overnight – Tech surges as Trump pours $500b into AI infrastructure

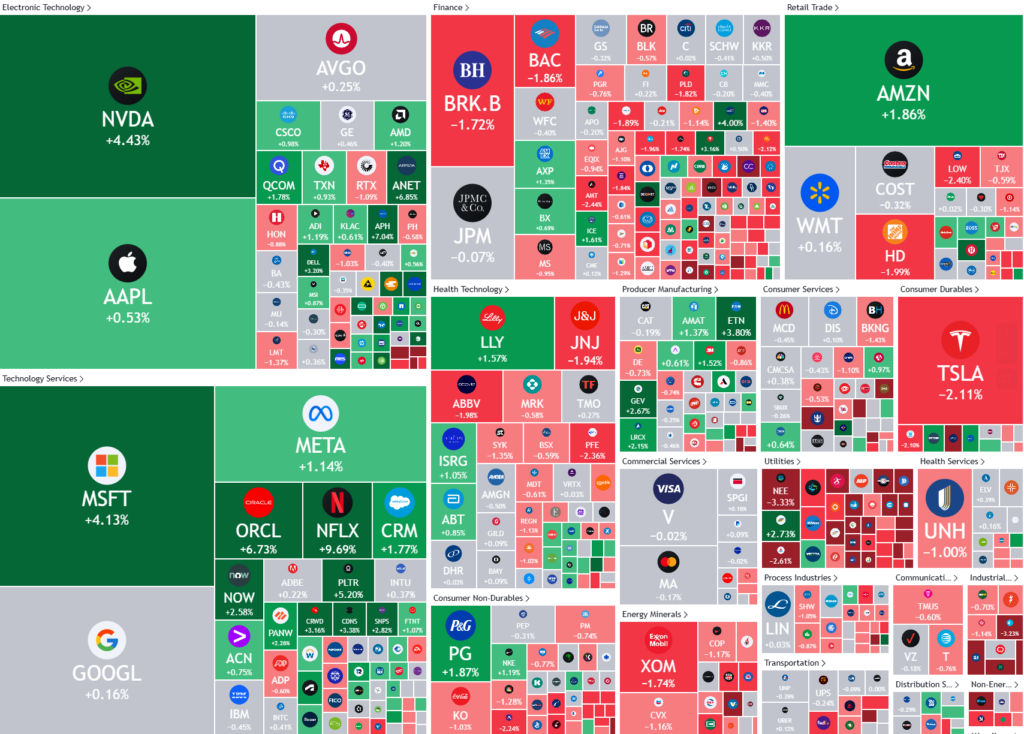

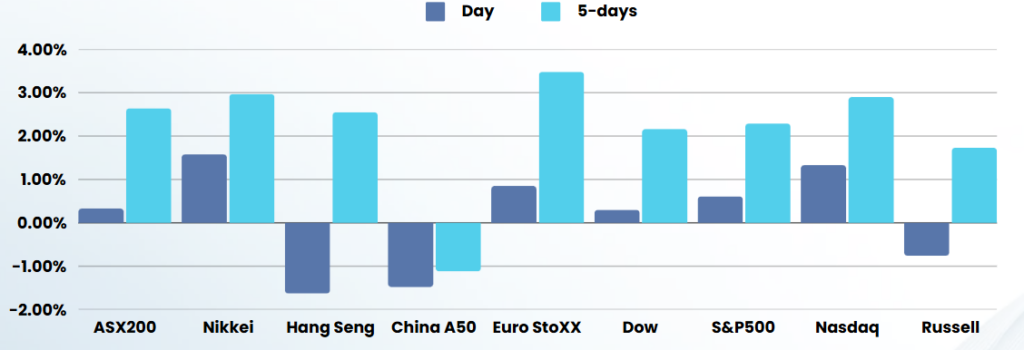

by a Netflix-led surge in tech as well as a rally in AI stocks after President Donald Trump unveiled a major $500 billion project to boost domestic AI development.

Netflix’s remarkable performance in the fourth quarter of 2024 propelled positive market sentiment on Wednesday, with the streaming giant’s shares surging nearly 10%. The company reported an unprecedented 19 million new subscriber additions, far exceeding Wall Street’s expectations. This exceptional growth was attributed to a combination of blockbuster content releases, including highly acclaimed new seasons and original films, as well as the successful implementation of regionally tailored programming that resonated with diverse global audiences.

The positive market sentiment extended beyond Netflix, with AI-related stocks also experiencing significant gains. This surge was triggered by the announcement of a $500 billion joint venture called Stargate, unveiled by President Trump, Softbank, OpenAI, and Oracle. The project aims to construct extensive AI data centers and electricity generation facilities in Texas over the next four years, with an initial commitment of $100 billion from the tech heavyweights. As a result of this announcement, Oracle and Nvidia saw sharp increases in their stock prices, further contributing to the overall market optimism.

Read more about the Stargate AI infrastructure policy

Corporate Earnings

- Procter & Gamble – stock rose 1.9% after the consumer goods giant reported net sales in its fiscal second quarter that topped analysts’ estimates, fueled in large part by strong demand in its key US market.

- Travelers Companies – stock closed 3.2% higher after the insurer beat estimates for fourth-quarter profit, as strength in its underwriting business cushioned a blow from elevated catastrophe losses.

- United Airlines – stock gave up gains to close 2.3% lower despite the carrier issueing better than expected fourth-quarter results, painting a upbeat outlook.

- Johnson & Johnson – stock fell 1.9%, weighed by a hefty dip in sales of its blockbuster psoriasis treatment Stelara, even as the pharmaceutical firm posted better-than-expected fourth-quarter adjusted earnings and sales.

ASX SPI 8377 (-0.41%)

The local market wont share the enthusiasm of the US overnight as the gains were primarily MAG7 based.

Company Specific

- Myer/Premier Investments – It’s decision day for shareholders at Myer on the company’s plan to merge with Premier Investments’ Apparel Brands. The meeting begins at 9am Melbourne time.

- Star – Star Entertainment’s safe harbour adviser has begun preparing its lender group for a potential voluntary administration, as the embattled casino operator runs out of solutions to solve a potentially terminal cash crunch.