What's Affecting Markets Today

Gold Holds Near 11-Week High

Gold prices remained steady near an 11-week high of $US2745 an ounce, driven by President Trump’s tariff threats and economic policies. The demand for gold as a haven asset surged following a 1.4% increase in the previous session, fueled by concerns over tariffs on Chinese goods, Canada, and Mexico. Investors are watching the impact of Trump’s fiscal policies, which could strain U.S. finances and spark inflation, potentially constraining the Federal Reserve’s monetary easing. Gold’s strong 2024 performance was bolstered by geopolitical tensions, Fed policy shifts, and central-bank buying. Silver, platinum, and palladium saw minor fluctuations.

Paladin’s Output Slips

Paladin Energy reported a decline in production at its Langer Heinrich Mine for the December quarter, with total mined output falling to 750,000 tonnes from 830,000 tonnes. Uranium oxide production was 638,409 pounds, slightly lower than the previous quarter’s 639,679 pounds. Despite the decline, the results met management’s expectations, and the mine remains on track to achieve its revised annual production guidance of 3 to 3.6 million pounds of uranium oxide for the 2025 financial year. Paladin holds a 75% stake in the mine and continues to focus on maintaining its production targets.

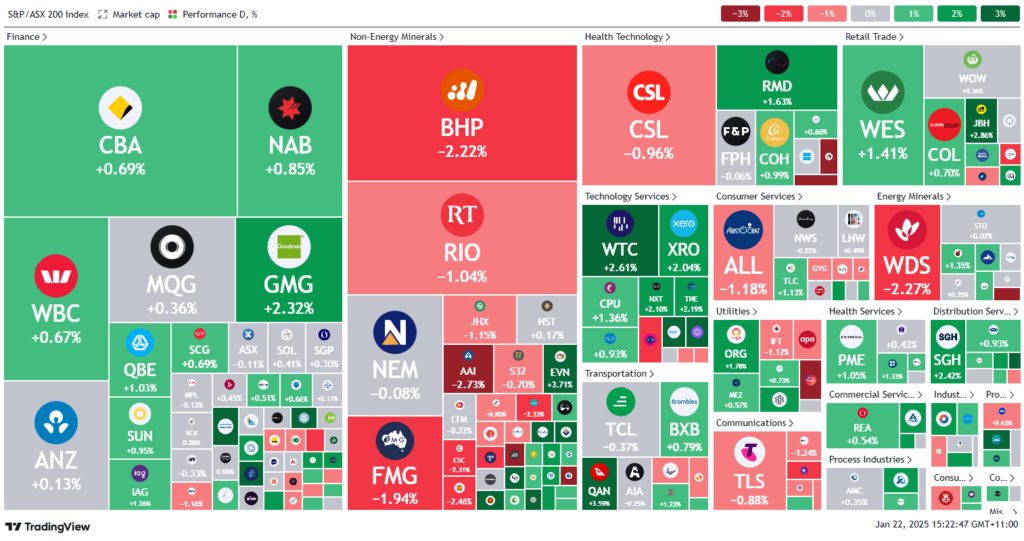

ASX Stocks

ASX 200 - 8,421.5 (+0.2%)

Key Highlights:

The S&P/ASX 200 rose 0.3% to 8428.1 on Wednesday, driven by gains in technology stocks despite a sell-off in Australian miners following U.S. President Donald Trump’s tariff announcements. Technology shares rallied as traders adopted a risk-on sentiment, with WiseTech, NextDC, and TechnologyOne each climbing around 2%. Bitcoin also gained 2.7% after the SEC announced a cryptocurrency taskforce.

Trump’s consideration of a 10% tariff on China, citing fentanyl issues, and proposed higher tariffs on Mexico and Canada caused iron ore prices to dip. BHP and Fortescue Metals fell 1.9% and 1.2%, respectively, while Singapore’s benchmark iron ore futures dropped 0.9% to $US103.85 a tonne.

Uranium-focused stocks Paladin Energy and Boss Energy soared 11.1% and 12.9%, respectively, after Trump indicated potential tariffs on Canadian uranium. Conversely, energy stocks declined as Woodside fell 2% despite record 2024 output, citing seasonal production impacts. Iluka Resources dropped 7.2% amid profit-taking despite strong production growth. Generation Development rose 5.4% after reporting a 22% increase in net inflows, bolstering investor confidence.

Leaders

BRN – Brainchip Holdings Ltd (+14.93%)

OCC – Orthocell Ltd (+14.62%)

BOE – Boss Energy Ltd (+12.23%)

PDN – Paladin Energy Ltd (+10.00%)

CAY – Canyon Resources Ltd (+6.98%)

Laggards

ERA – Energy Resources of Australia Ltd (-33.33%)

TBN – Tamboran Resources Corporation (-8.57%)

ILU – Iluka Resources Ltd (-7.33%)

SGR – The Star Entertainment Group Ltd (-6.25%)

CTT – Cettire Ltd (-6.06%)