Overnight – MAG7 earnings start well as Netflix adds record subscribers

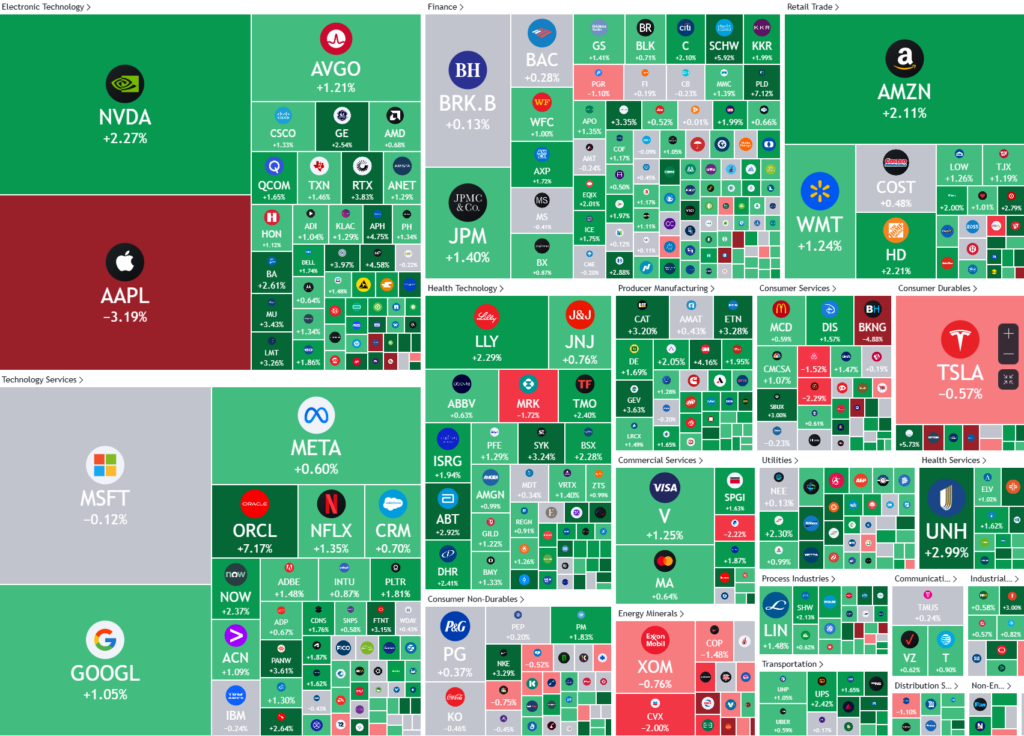

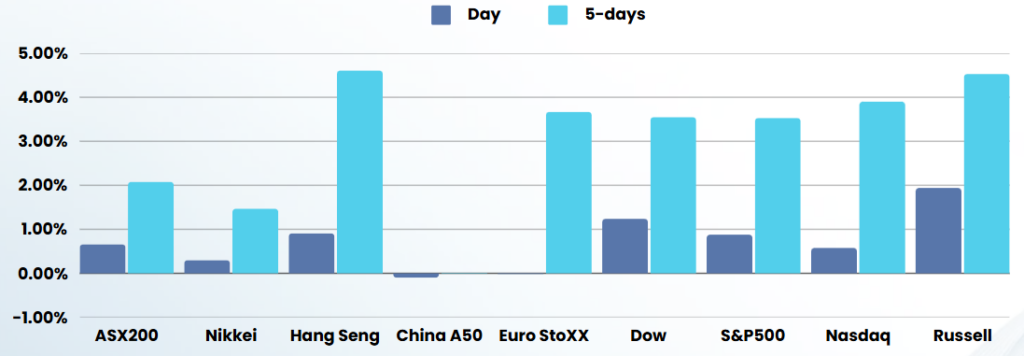

Stock markets gained Tuesday, as traders weighed expectations for President Donald Trump’s policies to accelerate economic growth and the threat of tariffs on Canada and Mexico as soon as Feb. 1.

Trump aside, Netflix started the MAG7 earnings season well with a significant beat and “proof of concept” of their new business model starting to get traction.

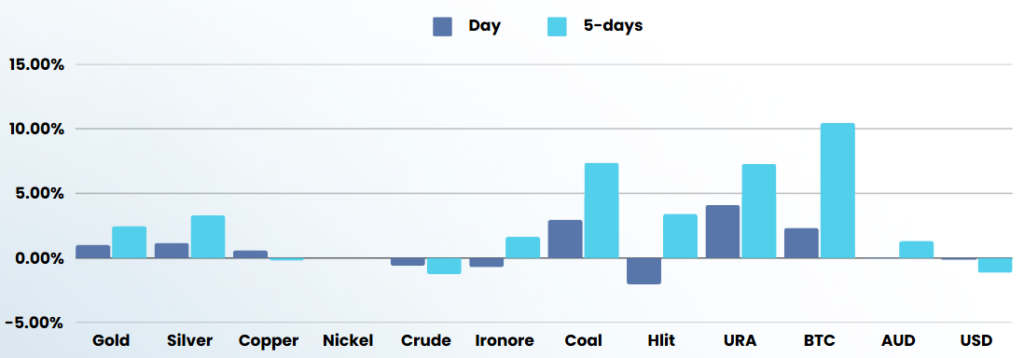

After In the wake of the Trump Inauguration, Trumps first day in office, saw the newly crowned President unveil a series of executive actions and potential policy changes, signalling a significant shift in various areas of governance including immigration, trade & tariffs, AI investment and the reversal of many internation agreements

He announced the consideration of 25% tariffs on Canada and Mexico starting February 1, citing concerns about their border policies, while also directing federal agencies to investigate US trade deficits and perceived unfair trade practices. In the realm of immigration, Trump signed executive orders on border security and announced plans to end automatic birthright citizenship, a decision set to take effect in 30 days and likely to face legal challenges. The president also withdrew the US from international agreements, including the Paris Climate Accord and the World Health Organization. Additionally, Trump delayed the TikTok ban by 75 days, ended diversity, equity, and inclusion programs in the federal government, and created a new Department of Government Efficiency to be led by Elon Musk. Despite these sweeping changes, analysts predict that while market volatility may persist in the short term, Trump’s first year in office could coincide with a rally in both stocks and the US dollar.

Corporate Earnings

- Netflix jumped 10% after market close after the streaming giant’s fourth-quarter results exceeded expectations and robust subscriber growth of 18.9 million in the holiday quarter bolstered investor confidence. The success of popular content like “Squid Game” and live sporting events, leading to price increases in several markets. The company also announced an additional $15B buy back, a significant expansion of its stock repurchase program.

- 3M Co. posted fourth-quarter results that exceeded analyst expectations, while its 2025 earnings outlook was largely in line with consensus estimates. Its shares rose more than 4%.

- Charles Schwab shares spiked 4% after the financial services company unveiled adjusted fourth-quarter earnings per share that beat average analyst estimates.

ASX SPI 8406 (+0.32%)

It will be a cautious day on the ASX with a general positive tone. Quarterly updates are filtering through from the miners

Company Specific

- Regal Partners posted a 63.7 per cent jump in funds under management in 2024, buoyed by broad gains.

- Iluka Resources’ output rose 23.7 per cent in the December quarter, while full-year production exceeded guidance.

- Internal figures show true cost of Endeavour’s split with Woolworths | The retailer behind BWS and Dan Murphy’s has never disclosed the cost of its 2021 separation from the supermarket giant, but it seems more than many expected.