Overnight – Futures Rally as Trump becomes 47th President

Investors welcomed Donald Trump’s second inauguration, anticipating a pro-business agenda, while remaining wary of his protectionist trade policies, particularly his stance on tariffs.

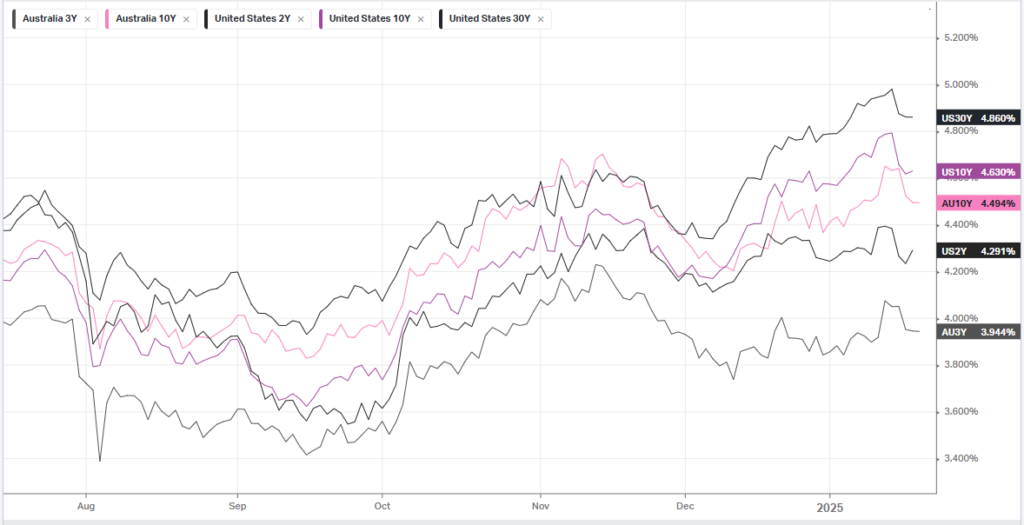

The dollar has weakened in anticipation of the inauguration, with the Trump administration indicating that new tariffs would not be immediately imposed. Investors and economists are closely watching Trump’s inaugural address for signals that could trigger near-term market movements, particularly in areas such as trade reform, immigration, tax cuts, and cryptocurrency regulation.

Despite the uncertainty surrounding Trump’s ambitious agenda, many experts anticipate a relatively muted initial market response to his comments and actions. Michael Arone, chief investment officer at State Street Global Advisors, suggests that “The Trump bark might be worse than the Trump bite in the early going,” expecting the most significant policy changes to unfold over a longer period. However, there are concerns that Trump’s tariff plans could exacerbate inflation fears, potentially impacting bond and stock prices, while efforts to tighten immigration controls may also reverberate through the markets.

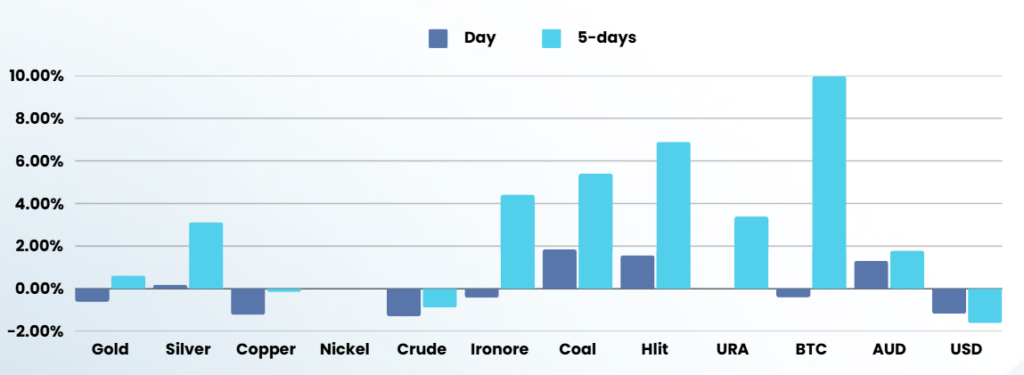

The cryptocurrency industry is particularly optimistic about Trump’s second term, expecting him to fulfill his “crypto president” campaign promises by creating a federal bitcoin stockpile, expanding bank access, and establishing a crypto council. During Trump’s first term, the S&P 500 rose nearly 68%, although markets experienced periods of volatility, partly due to the trade war with China. As investors adjust their portfolios across asset classes, they remain alert to potential market-moving announcements, including the creation of an “External Revenue Service” to collect tariffs from foreign trading partners, as mentioned in Trump’s inaugural speech.

Read more about Trump Inauguration

ASX SPI 8355 (+0.33%)

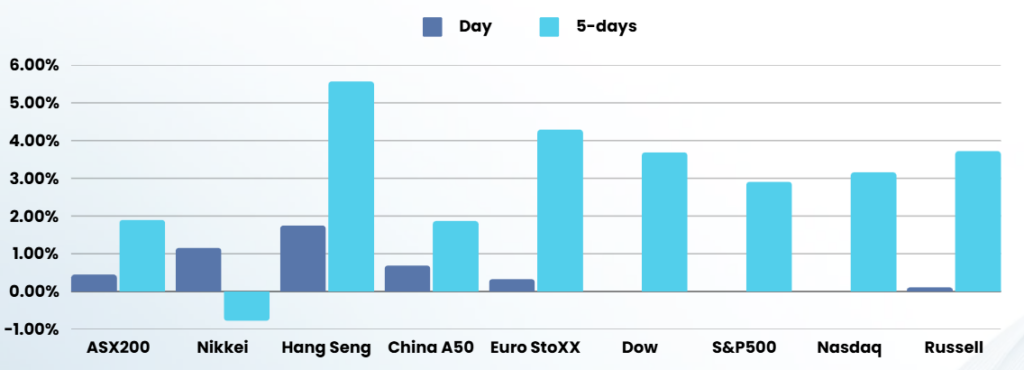

We will likely see some further strength on the ASX today as Trump became the 47th President.

Expect there to be a number of “announcements” and speculation that could turn the market either way.

The likelihood for the next 24-48 hours is a rally on good ol’ USA patriotism, until reality of having an Irrational/bold (we will let you decide) policy maker in the Whitehouse sinks in

Company specific

- Quarterly trading and production updates are scheduled for BHP, HUB24, Liontown Resources, Northern Star Resources and Yancoal