Structured Investment - Fixed Coupon

CLOSES 31ST JANUARY 2025

WHOLESALE INVESTORS ONLY (S708)

***GENERAL ADVICE ONLY***

Date: 20/01/2025

Strategy Profile

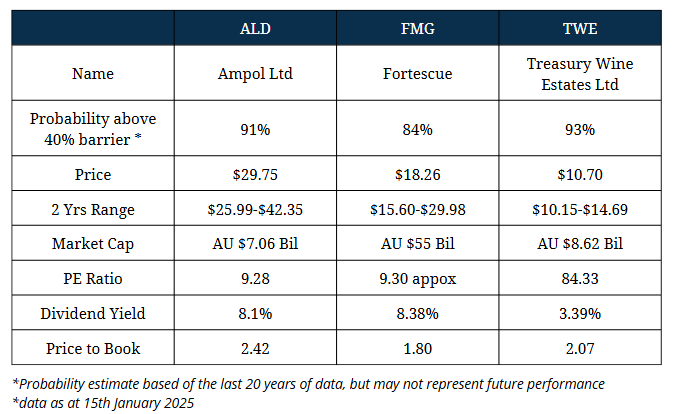

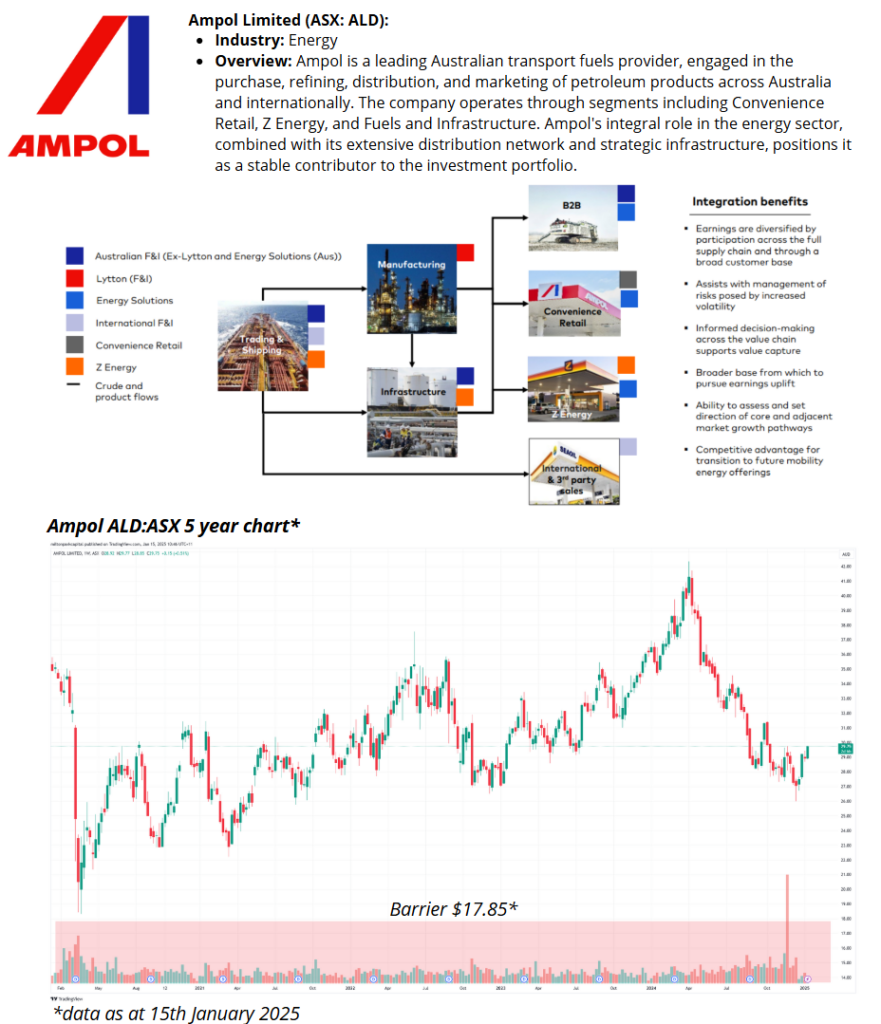

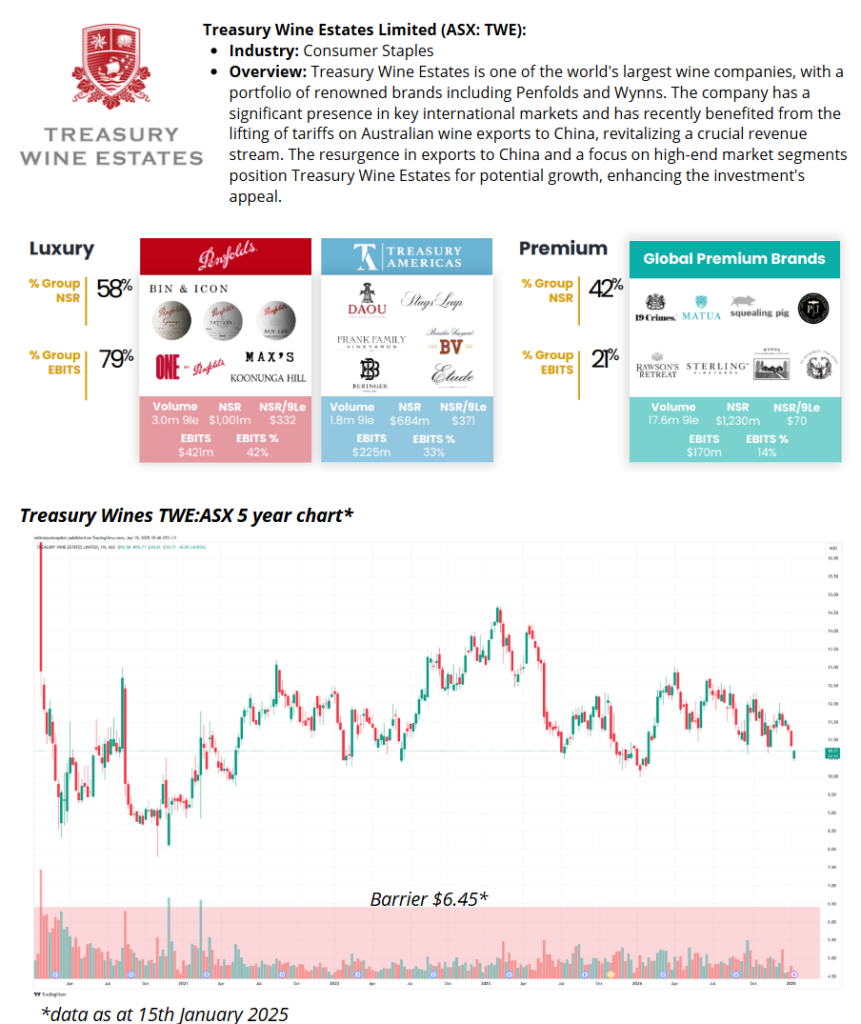

This Fixed Coupon Note is linked to a diversified basket of Australian companies: Ampol Limited (ALD), Fortescue (FMG), and Treasury Wine Estates Limited (TWE). By investing in this note, you gain exposure to these sectors while benefiting from fixed quarterly interest payments.

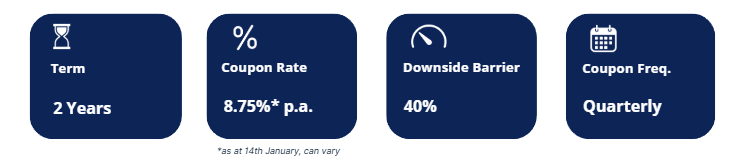

- Term: The investment has a duration of 2 years

- Coupon Rate: You receive a fixed annual interest rate of 8.75%

- Downside Barrier: Set at 40% of the initial strike price, this feature offers partial protection against significant declines in the underlying assets’ value.

- Payment Frequency: Interest payments are made quarterly, ensuring regular cash flow throughout the investment term.

Scenarios (with $100,000 Investment Example):

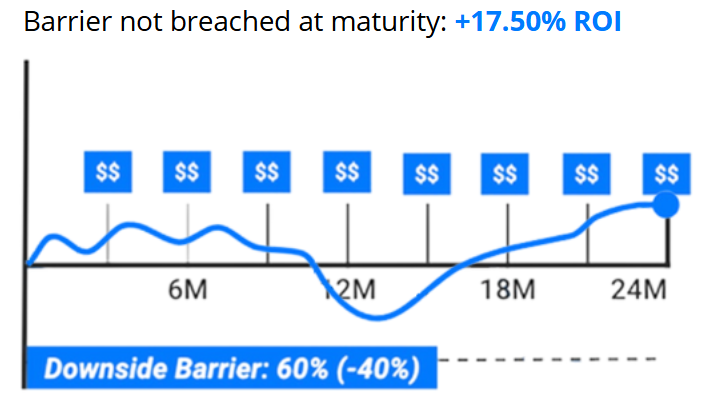

- Scenario 1: Stocks Remain Above the Barrier at Expiry

- The worst performing stock in the basket is +10%.

- The downside barrier (40% of the strike price) is not breached by any stock at maturity.

- Investor Receives =

$117,500

($100,000 initial capital + $17,500 2 years at 8.75% p.a. fixed coupon)

- Scenario 2: Stocks Drop Below the Barrier but Recover by Expiry

- During the term, one or more stocks fall below 40% of the strike price, but the final prices of all stocks recover above the barrier by expiry.

- The downside barrier (40% of the strike price) is not breached by any stock at maturity.

- Investor Receives =

$117,500

($100,000 initial capital + $17,500 2 years at 8.75% p.a. fixed coupon)

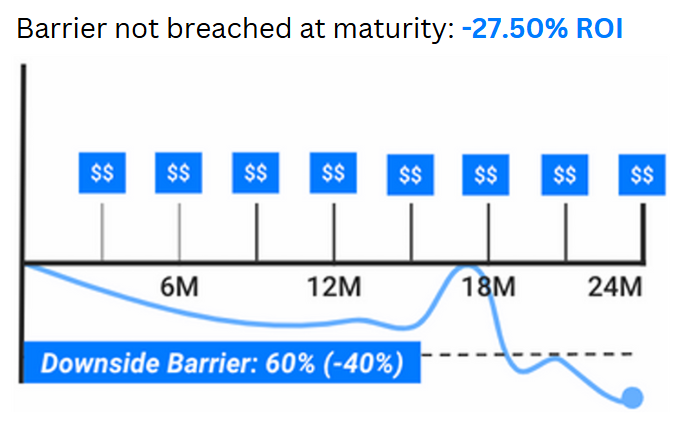

- Scenario 3: Stocks Remain Below the Barrier at Expiry

- At expiry, one or more stocks remain below the 45% downside barrier.

- Outcome: If the worst-performing stock drops 45% from its initial price, the investor would receive $55,000 worth of shares in that stock (or cash equivalent).

- Investor Receives =

$72,500

($55,000 stock (or cash) + $17,500 2 years at 8.75% p.a. fixed coupon)

REFERENCE ASSET INFORMATION

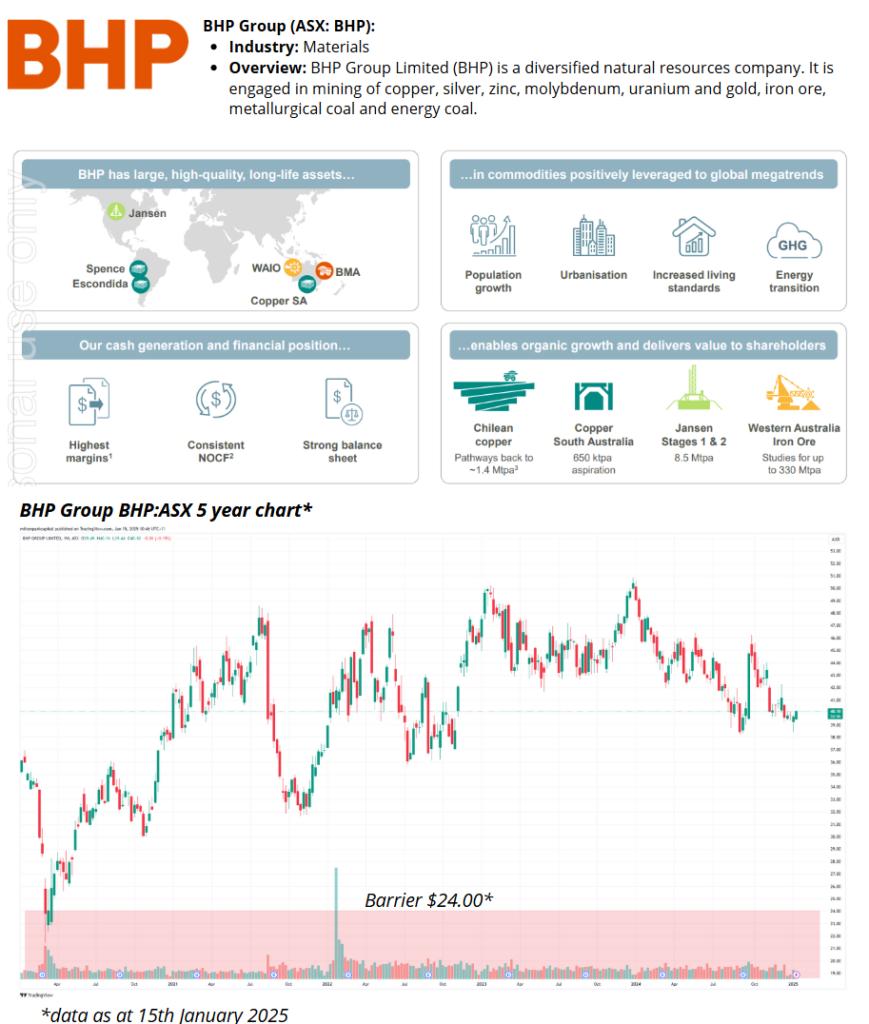

The Australian Diversified Fixed Coupon Note offers investors a stable income stream by focusing on a selection of prominent Australian companies: Ampol Limited (ASX: ALD), BHP Group Limited (ASX: BHP), and Treasury Wine Estates Limited (ASX: TWE). This diversified basket brings exposure in the energy, industrials, and consumer staple sectors.

Investment Highlights:

- Diversification: Investing in these three companies provides exposure to distinct sectors—energy, building materials, and consumer goods—mitigating sector-specific risks and enhancing portfolio stability.

- Stable Income Stream: The fixed coupon structure offers predictable quarterly payments, appealing to investors seeking regular income.

- Market Position: Each company holds a leading position within its industry, supported by strong brand recognition and strategic operations, contributing to the overall robustness of the investment.

Considerations:

- Market Volatility: While the selected companies have demonstrated resilience, market fluctuations can impact performance.

- Sector-Specific Risks: Investors should be aware of risks inherent to each industry, such as regulatory changes in energy, construction market dynamics, and international trade policies affecting wine exports.

Our Commitment – recommendations, managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith. Our evaluations and projections are grounded in the known facts at the time of creation and aim to provide a comprehensive view of the anticipated financial landscape in 2024. However, readers should be aware that these projections are estimates and may not fully materialize.

Scope and Application – The insights within MPC Markets are crafted for a broad audience and do not specifically cater to individual investment objectives, financial situations, or needs. Readers should consider the suitability of the advice in relation to their personal circumstances before making any investment decisions.

Research Integrity and Use – The research and content of MPC Markets are intended solely for our readers and should not be copied, distributed, or shared without proper attribution. While we strive to ensure accuracy and relevance, MPC Markets cannot guarantee the continuous updating or correction of the information or opinions expressed within the publication.

Disclaimer of Liability – MPC Markets, in its capacity as a Corporate Authorised Representative of LemSec, disclaims any responsibility for losses or damages arising from reliance on the opinions, advice, recommendations, or information—whether direct or implied—contained in this document, notwithstanding any errors, omissions, or instances of negligence.

Analyst Objectivity – All research analysts contributing to the MPC Markets affirm that the views expressed represent their personal opinions regarding the subject companies and financial products covered in the publication.

Copyright and Usage Rights – The content of this document is the property of MPC Markets Pty Ltd, either through ownership or licensing agreements. Unauthorized reproduction, adaptation, linkage, framing, broadcasting, distribution, or transmission of this material is prohibited without express written permission from MPC Markets, except for personal use or as allowed by applicable laws.

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.