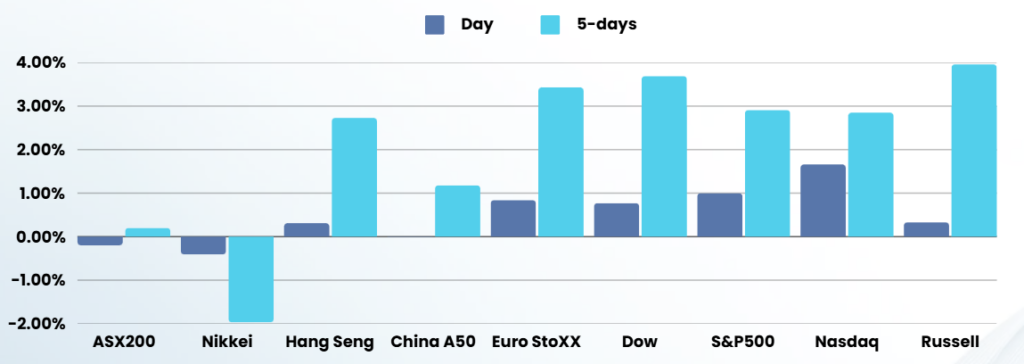

US stocks ended a strong week on a high Friday, as bullish bets on stocks continued just days ahead of President-elect Donald Trump inauguration on Monday, which marks the transfer of presidential power.

As the inauguration of President-elect Donald Trump approaches, investors remain confident but cautious, awaiting clarity on his planned trade policies, particularly regarding China. Trump’s recent phone call with Chinese President Xi Jinping has sparked optimism for improved relations between the two nations, with discussions covering topics such as trade balancing, fentanyl, TikTok, and global peace.

The focus on Wall Street is shifting towards the earnings season, with major tech, industrial, and consumer stocks set to report next week. Recent positive earnings reports from banks like Morgan Stanley and Bank of America have set an encouraging tone for the market. However, some companies, such as JB Hunt Transport Services, have missed expectations, while others like Schlumberger have surpassed estimates.

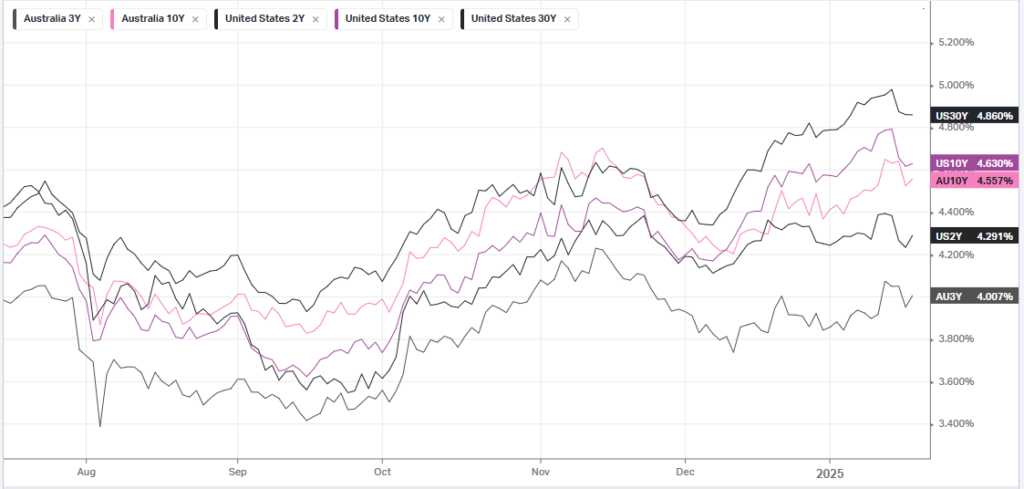

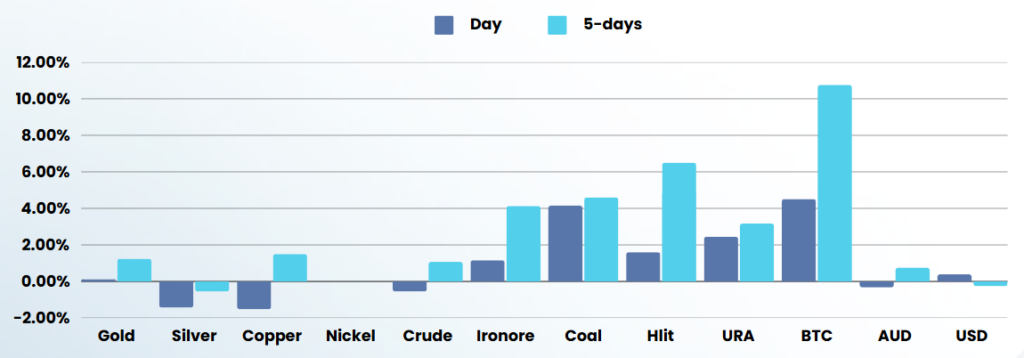

Crypto-related stocks have seen a significant boost, driven by a rally in Bitcoin prices. This surge is attributed to reports suggesting that Trump may designate cryptocurrency as a policy priority through executive orders. Meanwhile, gold prices have retreated from one-month highs as uncertainty over U.S. interest rates and Trump’s policies continues to influence market sentiment

The broader market has shown resilience, with major U.S. indexes registering substantial weekly gains. Positive economic data, including increased manufacturing output and a rise in single-family homebuilding, have contributed to investor confidence. However, analysts remain cautious about potential market volatility following Trump’s inauguration, as his fiscal policies and day-one executive orders could significantly impact various sectors

ASX SPI 8317 (+0.33%)

It will be a cautious day on the ASX with the Trump Inauguration likely to cause some volatility as the incoming President announces bold (or irrational depending on your views) policies.

Bloomberg is reporting that Rio Tinto and Glencore are holding talks about merging their businesses, a combination that would leapfrog BHP as the world’s largest mining group. To learn more click here