What's Affecting Markets Today

Asia-Pacific markets advanced Thursday, tracking strong gains on Wall Street, driven by an unexpected decline in U.S. core inflation for December and robust bank earnings.

South Korea’s Kospi climbed 1.16%, while the Kosdaq added 1.65%, after the Bank of Korea surprised markets by holding its benchmark rate steady at 3%, defying expectations of a 25-basis-point cut.

In Japan, the Nikkei 225 rose 0.61%, and the Topix was up 0.23%, as the country’s producer price index increased 3.8% year-on-year in December, aligning with economist forecasts.

Hong Kong’s Hang Seng index jumped 1.43% at the open, and mainland China’s CSI 300 inched up 0.67%.

Overnight in the U.S., equities surged, with the Nasdaq Composite leading at 2.45%, followed by the S&P 500 at 1.83%, and the Dow Jones edging 1.65% lower. The benchmark 10-year Treasury yield fell 13 basis points to 4.65% amid the inflation report.

Oil prices gained as Brent crude rose 3.22%, and WTI settled 0.3% higher at $80.28 per barrel, supported by an Israel-Hamas ceasefire agreement.

ASX Stocks

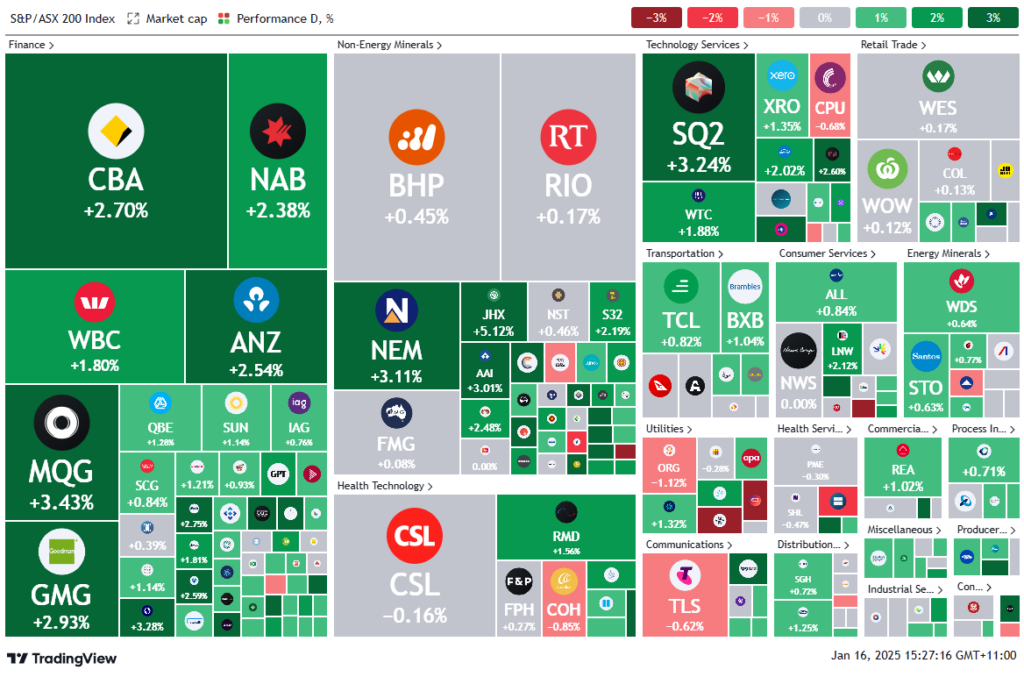

ASX 200 - 8,321.1 (+1.30%)

Key Highlights:

The S&P/ASX 200 Index maintained its 1.4% gain, trading 123.8 points higher at 8327.1 by mid afternoon Thursday, while the All Ordinaries rose 1.3%. All 11 sectors advanced, led by banks and technology stocks, as global markets rallied on a softer US consumer price index reading, easing inflation concerns.

Australia’s December employment data exceeded expectations, with 56,300 jobs added versus forecasts of 15,000, while the unemployment rate edged up to 4%. Despite the robust labor market, the Reserve Bank of Australia (RBA) is unlikely to cut rates before May, as the data suggests no urgency to loosen policy settings.

On the ASX, major banks outperformed, with Commonwealth Bank up 2.7% and Macquarie Group rising 2.8%. Interest-rate-sensitive sectors also gained, with WiseTech up 1.1% and Goodman Group climbing 3%. Neuren Pharmaceuticals surged 9.8%, recovering prior losses.

In corporate news, Zip Co jumped 7.1% after Sezzle raised revenue guidance, citing strong holiday demand. Tabcorp Holdings rose 6.3% following a key executive appointment, and MLG Oz advanced 8.7% on a Northern Star Resources contract.

Leaders

NEU Neuren Pharmaceuticals Ltd (+10.45%)

ZIP ZIP Co Ltd (+7.30%)

TAH Tabcorp Holdings Ltd (+6.78%)

CTD Corporate Travel Management Ltd (+6.16%)

JHX James Hardie Industries Plc (+4.81%)

Laggards

VUL Vulcan Energy Resources Ltd (-4.03%)

VSL Vulcan Steel Ltd (-3.79%)

SPR Spartan Resources Ltd (-3.55%)

MCY Mercury NZ Ltd (-2.89%)

CEN Contact Energy Ltd (-2.85%)