Overnight – Market rescued by cyclicals after early session selling

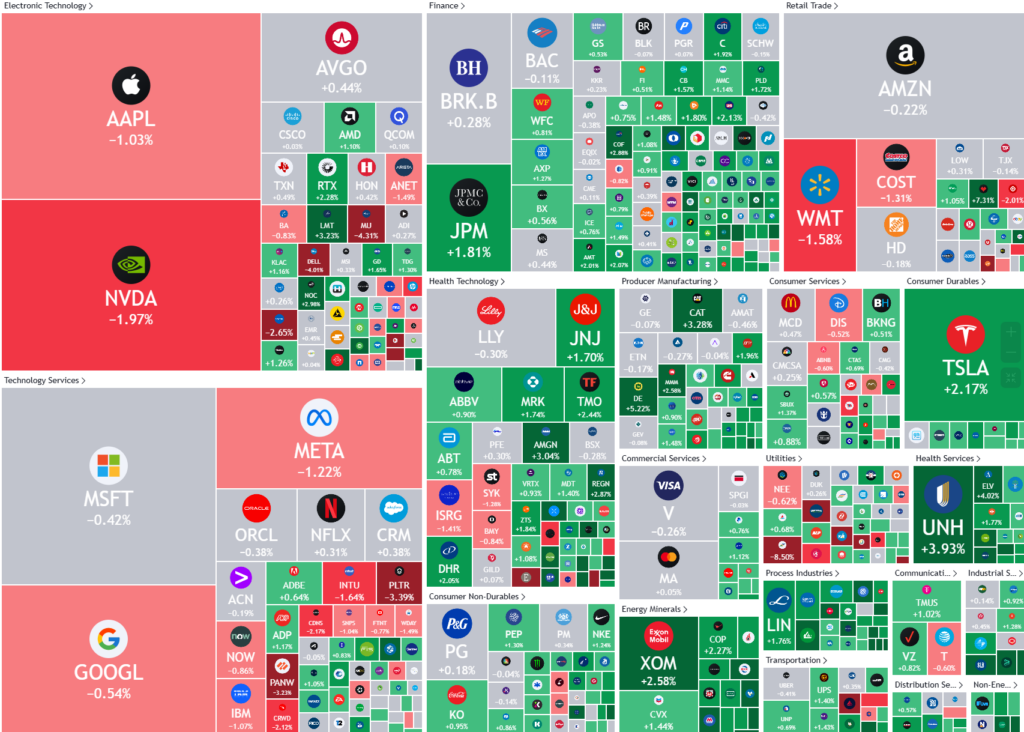

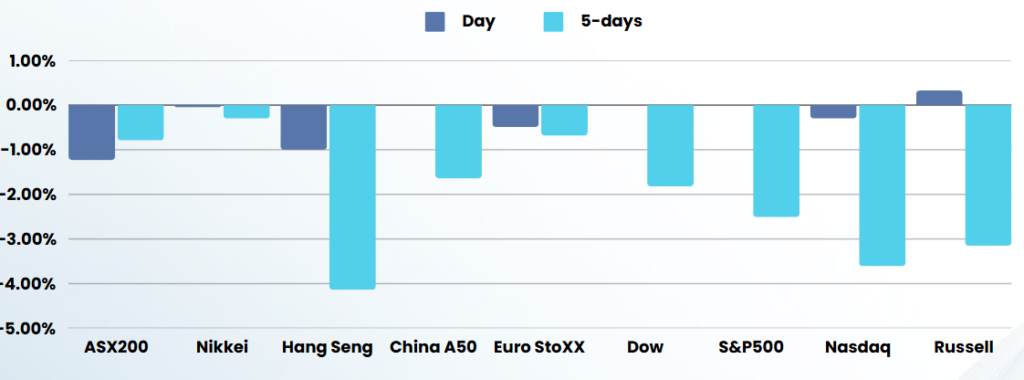

Stocks closed higher after cutting losses Monday as a jump in cyclical stocks including energy helped offset a rotation out of growth stocks including tech amid growing worries about a Federal Reserve pause just days ahead of key inflation data.

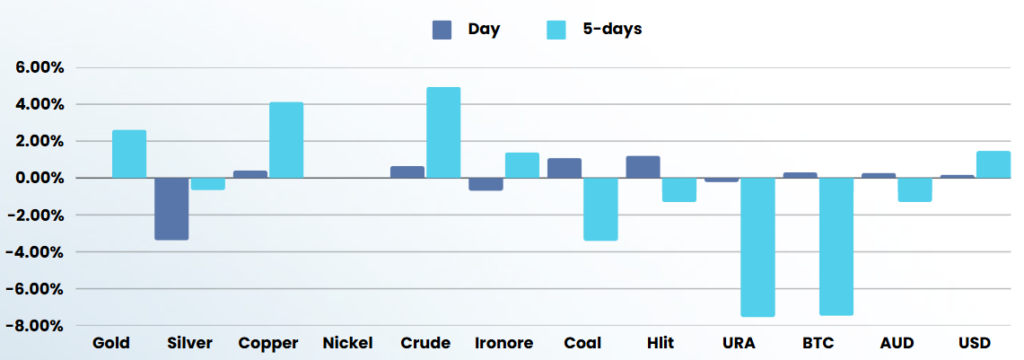

The market experienced a notable shift as cyclical stocks, particularly in the energy and materials sectors, led a broader market recovery. This rotation was driven by investors moving away from growth stocks, including technology, due to concerns about prolonged higher interest rates. Energy stocks such as Valero Energy, Baker Hughes, and Schlumberger saw significant gains, buoyed by rising oil prices and potential supply disruptions following U.S. sanctions on Russian oil exports.

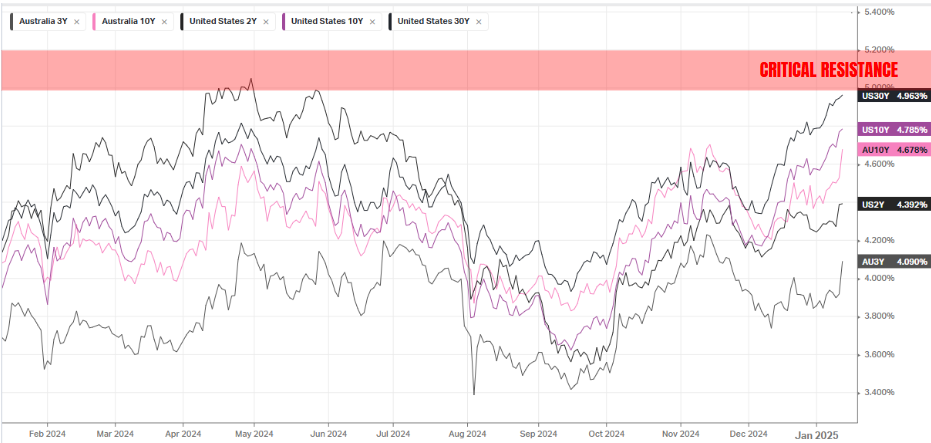

The technology sector faced headwinds as semiconductor stocks, including NVIDIA, declined following the White House’s announcement of new rules on AI chip exports to countries like China. Additionally, the broader tech sector was impacted by expectations of a prolonged Federal Reserve pause and higher Treasury yields, with some analysts predicting only one rate cut this year due to persistent inflation concerns

Investors are closely watching the upcoming consumer price index (CPI) data, with economists expecting a 2.9% year-over-year increase for December. This inflation data comes at a time when market participants are anticipating fewer Fed rate cuts in light of the strong December nonfarm payrolls report.

Us10Y, 30Y and au 10Y government bond yields are currently sitting at 52 week highs with any further momentum to the upside potentially damaging for the equity market

The earnings season is also set to begin, with major Wall Street banks reporting their fourth-quarter results this week. Meanwhile, some retailers, such as Macy’s and Abercrombie & Fitch, faced stock declines due to softer guidance and concerns about maintaining growth rates.

ASX SPI 8208 (+0.45%)

The continued switch to cyclicals will be advantageous for the local index, with the miners likely to support the market again today

In commodities, iron ore rose to $US98.90 a tonne overnight in what could be a boost to Australian miners. Brent crude soared another 1.6 per cent to trade at $US81.01 a barrel, extending Monday’s gains after further US sanctions against Russia.