What's Affecting Markets Today

Star Entertainment Faces Financial Crisis

Star Entertainment may be insolvent within weeks as its cash reserves dwindle, with just $79 million remaining by December 31 after burning through $107 million in three months. The casino operator, facing mounting fines and reduced patronage, has received no bailout support from NSW or Queensland governments. Morningstar estimates a 50% chance of administration, risking investor losses. The board is considering asset sales and liquidity solutions, with lenders offering $100 million contingent on raising an additional $150 million. Star has already raised $1.5 billion through equity offerings but still struggles with compliance costs, penalties, and weak trading conditions.

Mesoblast Trading Halt

Mesoblast has entered a trading halt pending a market announcement, expected by January 14 or earlier. The stock, which dropped 4% on Friday, has surged over 60% since mid-December following US regulatory approval of its first commercial product. Traders are awaiting further updates that could significantly impact its valuation and market trajectory.

Catastrophe Bonds and LA Wildfires

Wildfires in Los Angeles, with $20 billion in projected insured losses, are unlikely to impact the $80 billion catastrophe bond market significantly. Cat bonds, primarily used by insurers to hedge risks, seldom cover fire alone and instead bundle risks like hurricanes. Analysts suggest that primary insurers and reinsurance layers will absorb most losses, sparing bondholders. Despite this, cumulative natural disasters may still pose risks as thresholds are reached. Last year, the Swiss Re Global Cat Bond Index grew 17%, underscoring its profitability in the absence of significant catastrophes.

ASX Stocks

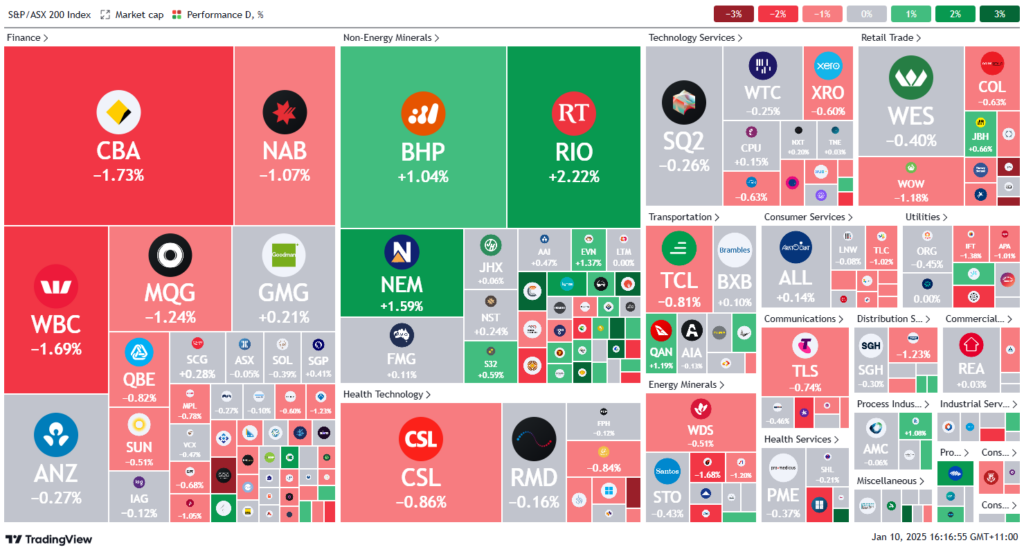

ASX 200 - 8,294.1 (-0.40%)

Key Highlights:

Australian shares dropped on Friday, led by declines in the banking and consumer staples sectors. The S&P/ASX 200 Index reversed early gains, down 0.5% to 8287.1 by mid-afternoon. Banks led losses, with Westpac falling 1.9% after a Morgan Stanley downgrade. Commonwealth Bank, NAB, and Macquarie also dropped between 1.2% and 1.5%. In contrast, mining stocks rose on higher iron ore prices, with Rio Tinto up 2.1%, BHP gaining 1.3%, and Iluka Resources jumping 3.7%.

Star Entertainment plunged 17.7%, extending prior losses amid warnings it may enter administration if a rescue deal fails. Recycled metals firm Sims surged 5.9% after Goldman Sachs rated it “neutral.” Meanwhile, Insignia Financial rose 2.2% despite denying Brookfield’s interest in a takeover, and Novonix dropped 2.1% following a licensing deal announcement.

The Australian dollar traded at $US61.99¢, recovering slightly from a two-year low. Global sentiment was cautious ahead of a US jobs report expected to influence inflation fears. Domestically, ANZ predicted an earlier rate cut in February, aligning with Westpac’s outlook.

Leaders

LRV – Larvotto Resources Ltd (+15.67%)

SBM – ST Barbara Ltd (+12.00%)

BC8 – Black Cat Syndicate Ltd (+11.81%)

DXB – Dimerix Ltd (+7.37%)

PNR – Pantoro Ltd (+7.14%)

Laggards

ERA – Energy Resources of Australia Ltd (-16.67%)

SGR – The Star Entertainment Group Ltd (-9.62%)

WC8 – Wildcat Resources Ltd (-5.56%)

HGH – Heartland Group Holdings Ltd (-5.21%)

WAT – Waterco Ltd (-5.00%)