Overnight – Stocks rally on little catalyst

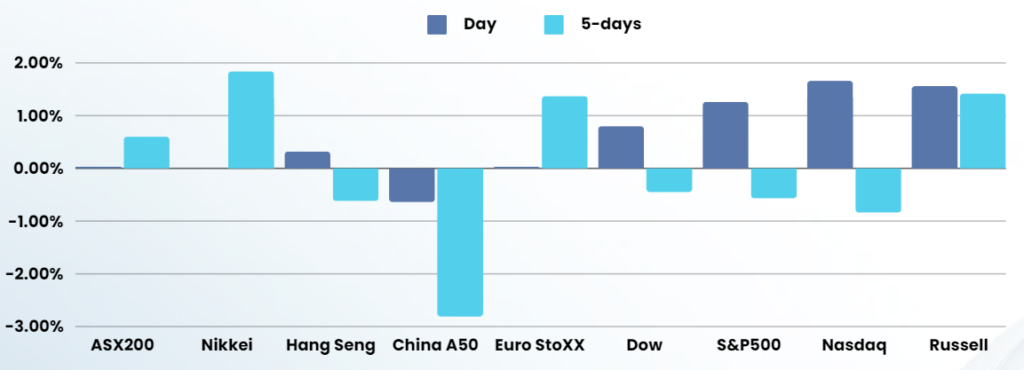

Stocks closed higher on Friday, ending the first week of the new year on a positive note ahead of data that should provide more insights on the health of the largest economy in the world.

In a relatively quiet day for economic data, investors will have the chance to parse through US factory activity figures for December later in the session.

The Institute for Supply Management’s purchasing managers’ index for the manufacturing sector is seen cooling slightly to 48.2 last month, down from a five-month high of 48.4 in November. A reading below 50 typically denotes contraction in the industry, which makes up over 10% of the US economy.

It was the eighth consecutive month that the measure was below the 50-point threshold, although the number remained above a level of 42.5 that the ISM says indicates broader economic expansion.

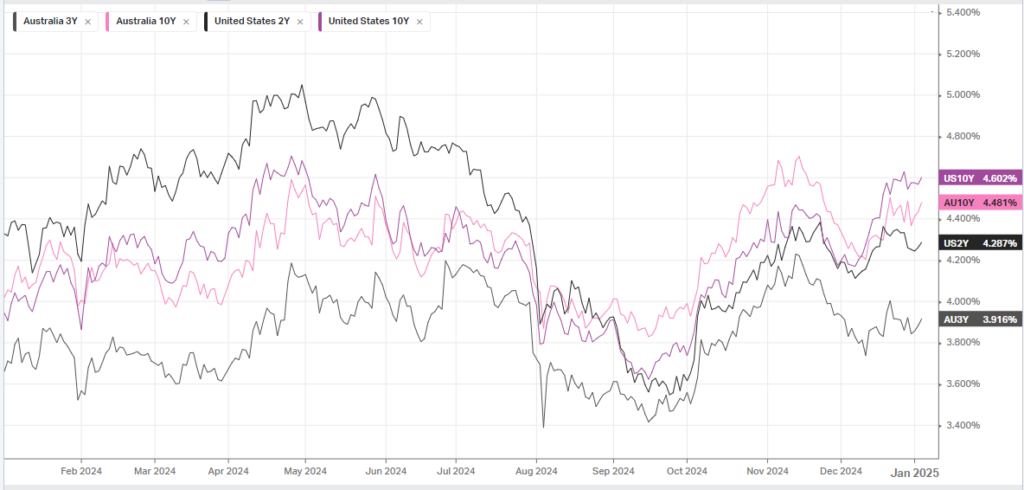

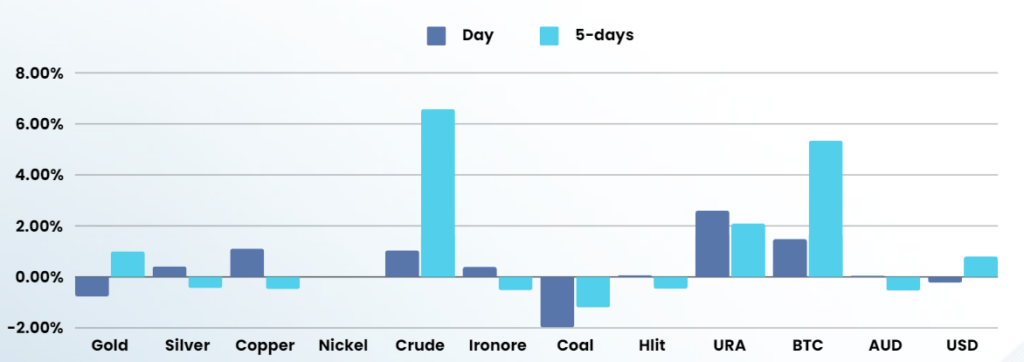

Oil prices edged higher Friday, adding to the prior session’s gains amid hopes of policy support to revive economic growth in China, the world’s largest crude importer.

China’s President Xi Jinping pledged more proactive policies to boost growth earlier this week, while the Financial Times reported on Friday that the Chinese central bank is planning to cut interest rates from the current 1.5% level “at an appropriate time” this year.

Company News

- United States Steel Corporation stock slumped over 6.6% after President Joe Biden said on Friday he would block Japanese company Nippon Steel’s $14.9 billion buyout of the US steel company, citing reasons related to national security and keeping the storied American firm domestically owned and run.

- Rivian Automotive stock gained over 24% in the best day since November 2021 after the EV manufacturer surpassed analysts’ expectations for fourth-quarter deliveries and said its production was no longer constrained by a component shortage, a positive sign for the electric vehicle maker aiming to turn its first profit.

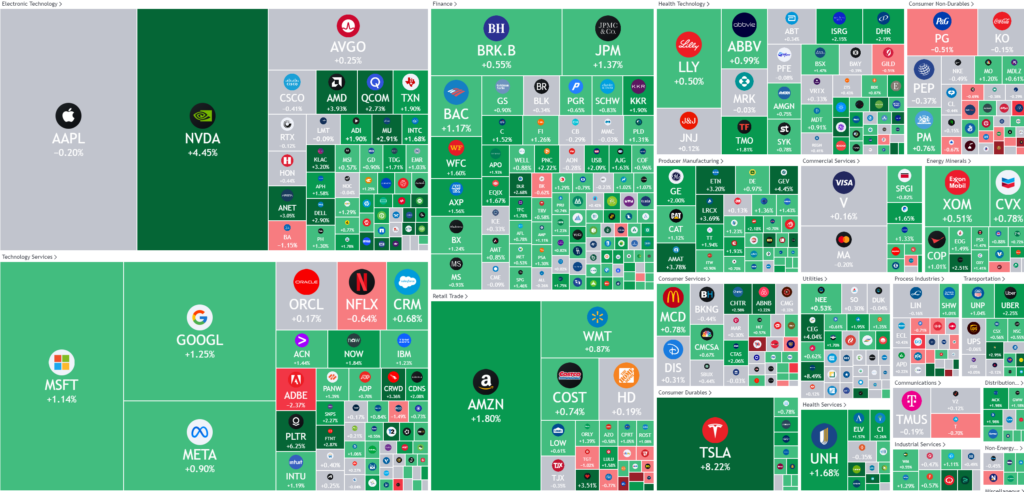

- Apple stock slipped 0.2%, adding to the previous session’s losses, after data released on Friday from a government-affiliated research firm, showed that shipments to China of foreign-branded smartphones, including the iPhone, fell by 47.4% in November from a year earlier, down for the fourth month.

- Meta stock rose 0.9% after the Facebook-owner has elevated prominent Republican Joel Kaplan to be its chief global affairs officer, replacing Nick Clegg, who was formerly British deputy prime minister and leader of the country’s center-left Liberal Democrats.

ASX SPI 8264 (+0.27%)

Although volume wont be back to normal levels, we are likely to see many participants return today in the first real day of trading for 2025. The ASX is likely to head higher following the US lead and the hopes of China rate cuts, combined with the general optimism that comes with a return from a holiday period