Overnight

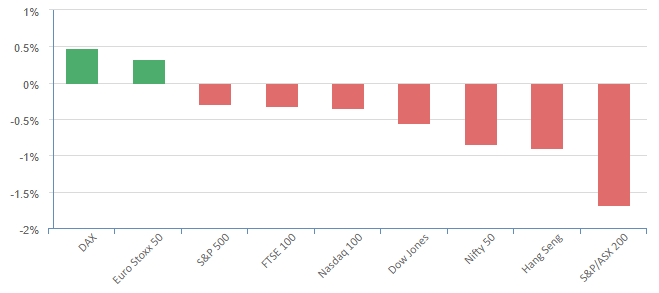

Market Summary

Equities drifted lower overnight in response to slower than expected U.S. jobs growth in June. This eased investor worries about the potential for more aggressive Federal Reserve rate hikes.

Key points to note include:

- Early in the session, investors held out hope for a less hawkish Fed. U.S. nonfarm payrolls showed 209,000 new hires in June, below forecasts, and May numbers were revised down by 33,000 to 306,000.

- The unemployment rate dropped slightly to 3.6% in June from 3.7% in May, while average hourly earnings increased by 0.4%.

- Despite these mixed signals, markets looked ahead to key U.S. inflation readings and the start of the second-quarter earnings season.

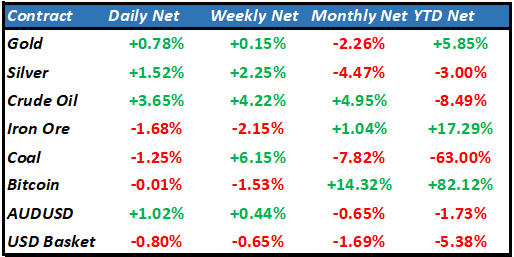

Energy stocks emerged as the standout performers, leading the broader market higher. These were boosted by eased worries about a recession and a more favorable oil demand outlook, as a less aggressive stance from the Fed is expected.

- Among the biggest gainers were Halliburton, Diamondback Energy, and Schlumberger, with the latter up more than 8% as oil prices rose over 2%.

- The biggest losers on the day were defensive sectors including consumer staples and utilities, dragged lower by Walmart and Costco.

Commodities

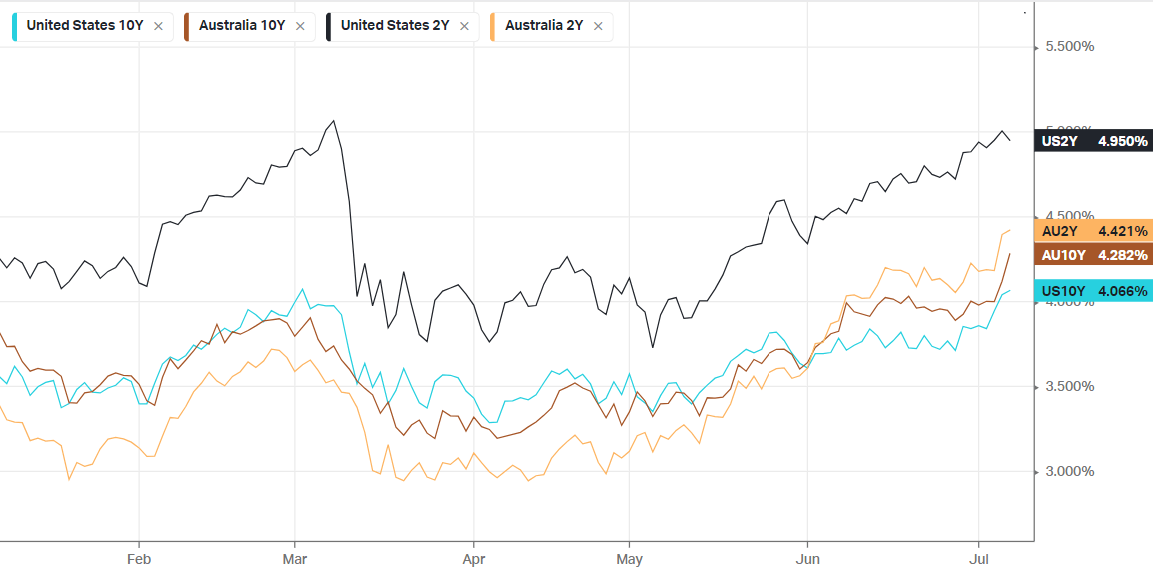

Bonds

The Day Ahead

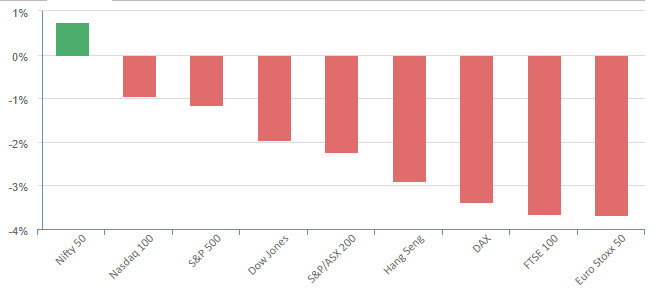

The Australian market is anticipated to face another negative day, closing at near 3-month lows. The energy and gold sectors are expected to be the only bright spots amid approximately 1% declines in iron ore and coal.

Looking ahead, the mood may not improve due to several factors:

- The upcoming data-heavy week in the U.S., including key inflation readings and the start of earnings season, could increase market volatility.

- Overvaluation concerns in the U.S. market and China’s continued slow growth pose additional challenges for the Australian market.

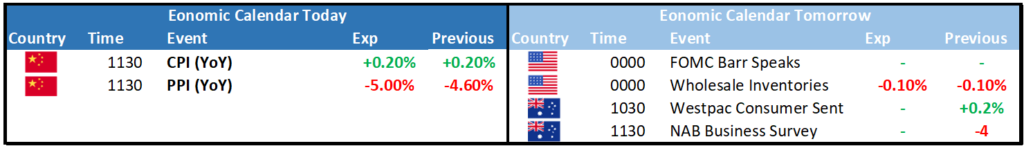

Calendar

Economic