What's Affecting Markets Today

Asia-Pacific markets retreated on Monday, reversing earlier gains as investors turned cautious ahead of major central bank decisions this week, including the Bank of Japan (BOJ) and the People’s Bank of China (PBOC).

The Federal Reserve decision on December 18 remains a key focus, with the CME FedWatch tool indicating a 96% chance of a 25-basis-point rate cut. The BOJ is expected to hold rates on Thursday, while the PBOC will announce its loan prime rates on Friday. The one-year LPR impacts corporate and household loans, while the five-year LPR serves as China’s mortgage benchmark.

Markets digested China’s economic data for November, including industrial production, retail sales, and home prices.

Hong Kong’s Hang Seng Index led regional declines, falling 1% in late trade. China’s CSI 300 slipped 0.54% to 3,911.84.

In South Korea, the Kospi shed 0.22% to 2,488.97, while the small-cap Kosdaq gained 0.67%, marking its fifth consecutive advance. The market remained on edge following President Yoon Suk Yeol’s impeachment.

Japan’s Nikkei 225 dipped marginally to 39,457.49, while the broader Topix declined 0.3% to 2,738.33.

ASX Stocks

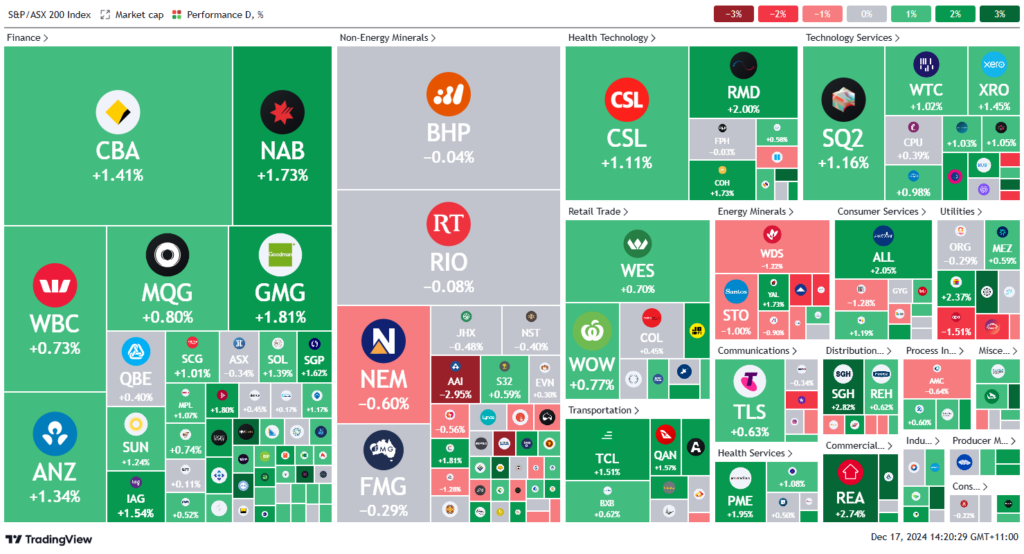

ASX 200 - 8,314.9 (+0.8%)

Key Highlights:

The S&P/ASX 200 rose 0.8% (66.9 points) to 8316.40 on Tuesday, supported by gains in the major banks, while falling oil prices weighed on energy stocks. The All Ordinaries Index also climbed 0.8%.

The financial sector led the market higher, with Commonwealth Bank rising 1.4% by afternoon trade. HMC Capital rebounded 2.8%, recovering some ground after Monday’s sharp decline following DigiCo’s underwhelming debut.

Healthcare, real estate, and industrials performed strongly. PEXA Group surged 9.7% after appointing a successor to outgoing CEO Glenn King.

Energy stocks were the market’s main drag, falling 1.1% as Brent Crude prices slumped overnight on weakening demand concerns from China, which reported subdued retail and housing data for November.

In stock highlights, Novonix rose 6.8% after securing a conditional $US755 million loan from the US Department of Energy. Karoon Energy fell 8.5% following a production guidance downgrade.

Data#3 dropped 9.9% after announcing reduced incentives on Microsoft Enterprise Agreements, while APA Group slid 1.7% amid regulatory challenges for its Basslink asset.

Westpac added 0.8% as CFO Michael Rowland announced his 2024 retirement.

Leaders

DTL: Data#3 Ltd (-9.84%)

KAR: Karoon Energy Ltd (-8.42%)

WA1: WA1 Resources Ltd (-8.14%)

CEN: Contact Energy Ltd (-3.74%)

ZIM: Zimplats Holdings Ltd (-3.73%)

Laggards

PXA: Pexa Group Ltd (+9.58%)

DGT: Digico Infrastructure REIT (+5.81%)

MCY: Mercury NZ Ltd (+5.29%)

A4N: Alpha HPA Ltd (+4.22%)

WGX: Westgold Resources Ltd (+3.97%)