Overnight – Tech shines once again to drive market higher

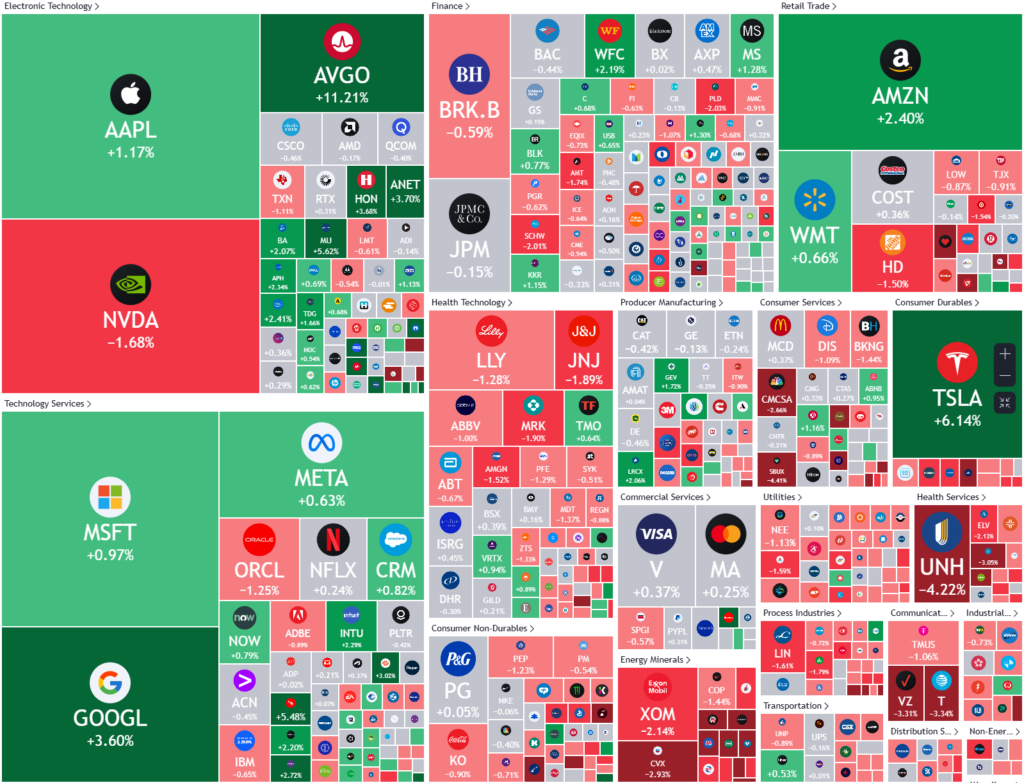

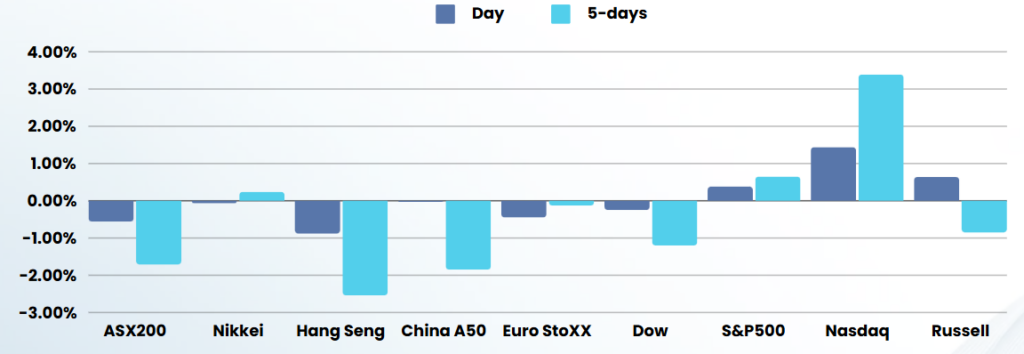

Stocks headed higher overnight as tech continued to shine ahead of the last Federal Reserve policy meeting of the year.

Broadcom rose more than 10%, lifting the broader semiconductor sector as Wall Street continues to make bullish calls on the stock following the chipmaker’s stronger quarterly results released last week.

Broadcom market has increased more than $300B since reporting earnings Thursday night, Vital Knowledge said in a Monday note.

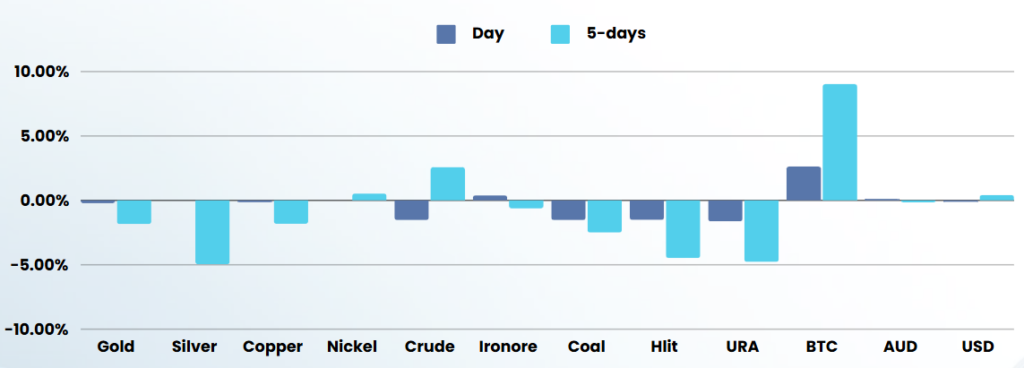

Tesla meanwhile, close at fresh record high as the EV maker continues its post-election rally that has pushed its market cap to around $1.45T. Wedbush lifted its price target on the company to $515 from $400, forecasting that it could hit $650 by the end of next year. MicroStrategy stock gave up gains to close flat even as it was announced as a new addition to the Nasdaq 100 index.

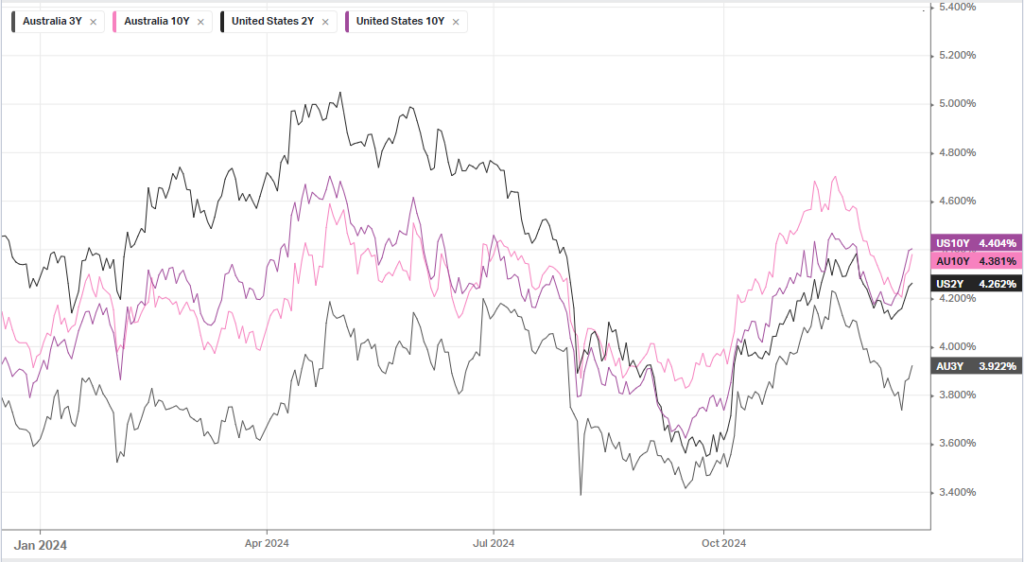

The Fed is widely expected to cut interest rates by 25 basis points at the conclusion of a two-day meeting on Wednesday, after the central bank kicked off an easing cycle earlier in the year. The move will bring rates down by a total of 100 bps in 2024. But focus this week will be squarely on the central bank’s plans for future easing, especially in the face of potentially sticky inflation and resilience in the labour market.

Analysts broadly expected the central bank to signal a slower pace of rate cuts in the coming year, with recent comments from Fed officials also suggesting as much. Traders were seen pricing in a 79.7% chance the Fed will leave rates unchanged when it meets in January, CME Fedwatch showed. Preliminary S&P Global PMI activity data will also be studied for clues of the strength of the economy.

ASX SPI 8244 (-0.17%)

The local market is in for a mixed day with little economic data and catalyst from offshore markets to speak of outside of the tech sector (which is a tiny weighting of our index)

In a Goldman Sach review on the ASX a number of stocks were flagged with potential headwinds from increasing trade tensions include industrial exporters James Hardie Industries, Brambles and Reliance Worldwide Corporation, Goldman said. Technology player WiseTech and healthcare names with manufacturing hubs in Mexico, including Fandango Holdings and CSL, are also exposed