What's Affecting Markets Today

Asian markets declined on Friday, with Chinese stocks leading losses after Beijing reaffirmed its recent policy shifts and outlined plans to boost growth during a high-profile meeting on Thursday.

Hong Kong’s Hang Seng index dropped 1.39%, while the mainland’s CSI 300 fell 0.94%. Other Asia-Pacific markets mirrored Wall Street’s overnight losses following a hotter-than-expected U.S. producer price inflation reading.

Japan’s Nikkei 225 declined 1.16%, and the Topix slipped 1.12%. However, optimism among large Japanese manufacturers improved, as the Bank of Japan’s Tankan survey showed the index for large manufacturing firms rose to 14 in Q4, surpassing expectations of 12. The data signals growing business confidence ahead of the BOJ’s policy considerations.

South Korea’s Kospi edged down 0.1%, while the Kosdaq gained 0.8%, supported by small-cap strength. Meanwhile, political uncertainty loomed as the South Korean president faces a potential impeachment vote.

India’s wholesale inflation figures are due later, with expectations of a decline to 2.2%, reflecting easing consumer inflation.

ASX Stocks

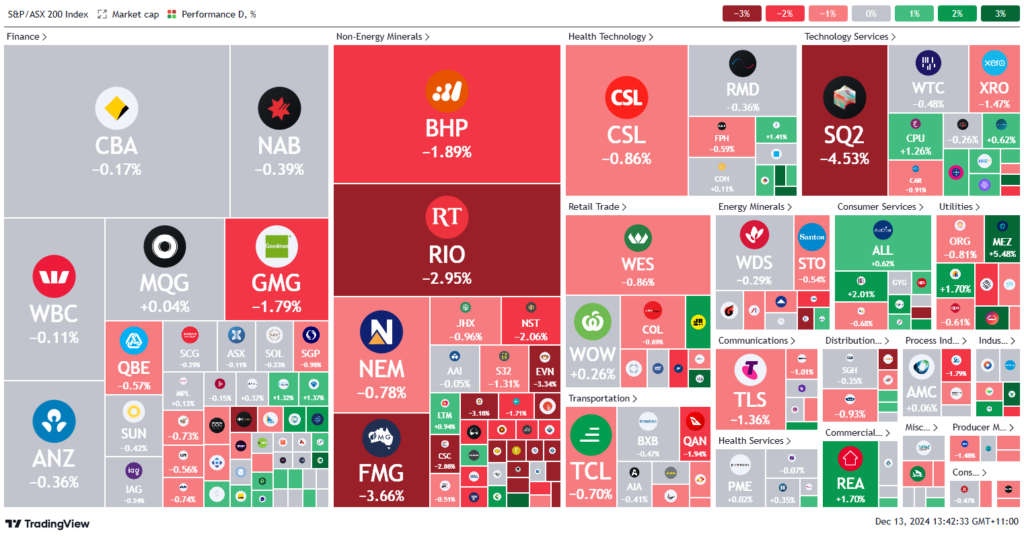

ASX 200 - 8,274 (-0.70%)

Key Highlights:

Australian shares hit a four-week low on Friday, with the S&P/ASX 200 falling 0.6% to 8280.8 by midday, extending Thursday’s 0.3% drop. The index has lost 1.7% this week, marking its sharpest decline since August, as investors grapple with a robust jobs report that dampened hopes for a near-term Reserve Bank rate cut.

Miners led the declines: Rio Tinto dropped 2.2%, BHP Group lost 1.4%, and Fortescue fell 2.4%. Financials also faced pressure, with National Australia Bank sliding 0.5%.

Insignia Financial surged nearly 8% to $3.67 after receiving a $4 per share takeover bid from Bain Capital, hitting a three-year high. Iress gained nearly 5% to $9.09, buoyed by reaffirmed earnings guidance and dividend reinstatement.

DigiCo Infrastructure REIT added 1% in early trade after debuting in the largest IPO of the year. Meanwhile, Rio Tinto committed $2.5 billion to its Rincon project, while South32 and Transurban posted modest losses despite positive developments.

Leaders

IFL Insignia Financial Ltd (+8.53%)

MSB Mesoblast Ltd (+7.43%)

IRE Iress Ltd (+7.04%)

MEZ Meridian Energy Ltd (+4.87%)

PDN Paladin Energy Ltd (+4.74%)

Laggards

VUL Vulcan Energy Resources Ltd (-11.15%)

SXG Southern Cross Gold Ltd (-5.41%)

OBM Ora Banda Mining Ltd (-5.25%)

RRL Regis Resources Ltd (-5.05%)

RMS Ramelius Resources Ltd (-5.00%)