Overnight – Stocks lower as China accuses Nvidia of “Monopolistic behavior”

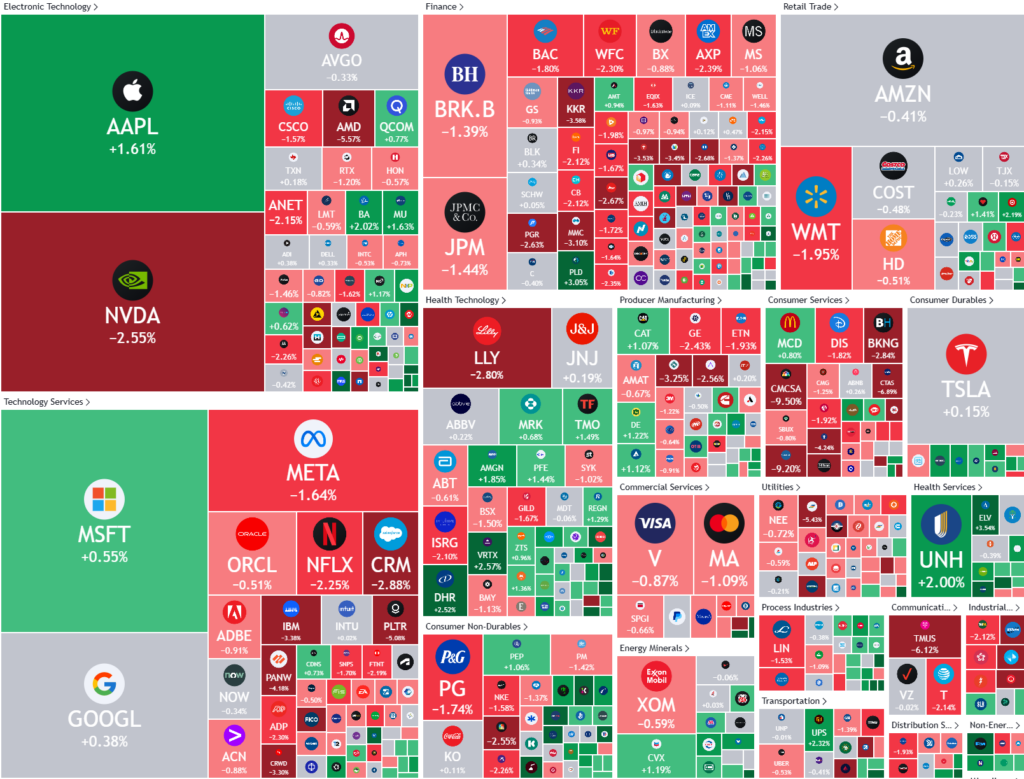

US Stocks turned lower on overnight as concerns over US inflation data and China’s regulators opening a “monopoly” investigation into Nvidia drove chip stocks lower.

Shares of chip maker Nvidia lost over 3% as China said on Monday it has launched an investigation into the company over suspected violations of the country’s anti-monopoly law, in a move widely seen as a retaliatory shot against Washington’s latest curbs on the Chinese chip sector.

The statement from the State Administration for Market Regulation (SAMR) announcing the probe did not elaborate on how the U.S. company, known for its artificial intelligence (AI) and gaming chips, might have violated China’s anti-monopoly laws. It said the U.S. chipmaker is, in addition, suspected of violating commitments it made during its acquisition of Israeli chip designer Mellanox Technologies under terms outlined in the regulator’s 2020 conditional approval of that deal.

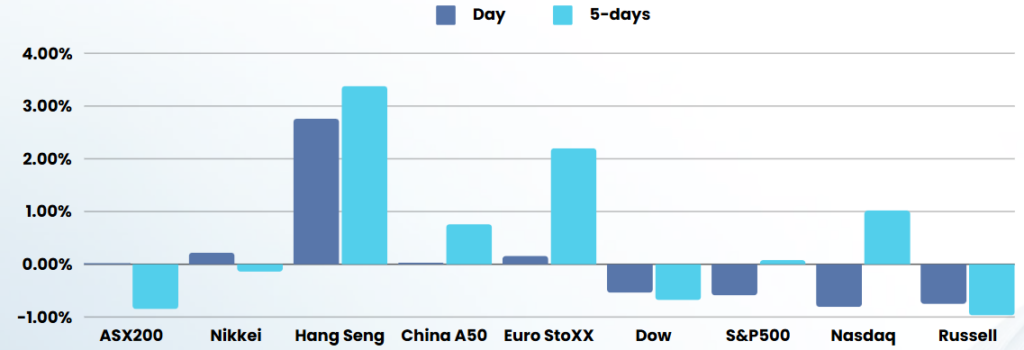

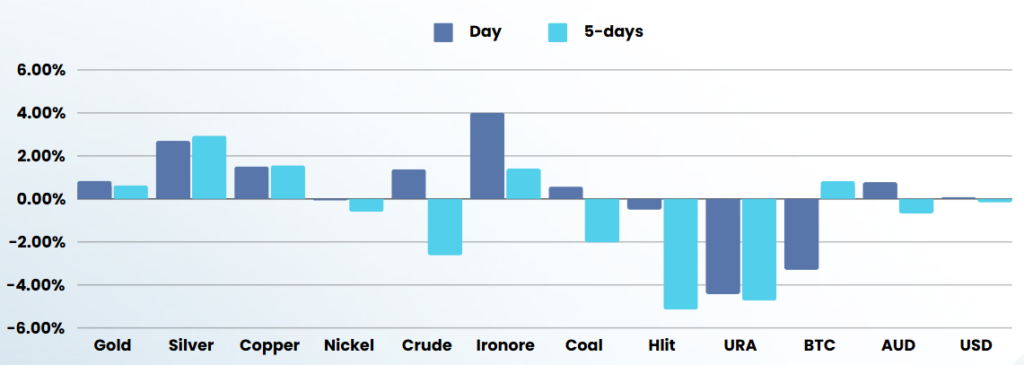

Conversely, commodities lifted while Beijing’s promise of stimulus and the sudden collapse of the Syrian government drove investors to oil and gold on geopolitical worries. China’s decision on Monday to alter the wording of its stance toward monetary policy for the first time since 2010 helped global sentiment. Beijing pledged to introduce stimulus to encourage economic growth next year.

The rapid collapse over the weekend of Syrian President Bashar al-Assad’s 24-year rule complicates an already fraught situation in the Middle East, pushing investors back to safe haven assets and Oil as yet another situation unfolds in the middle east.

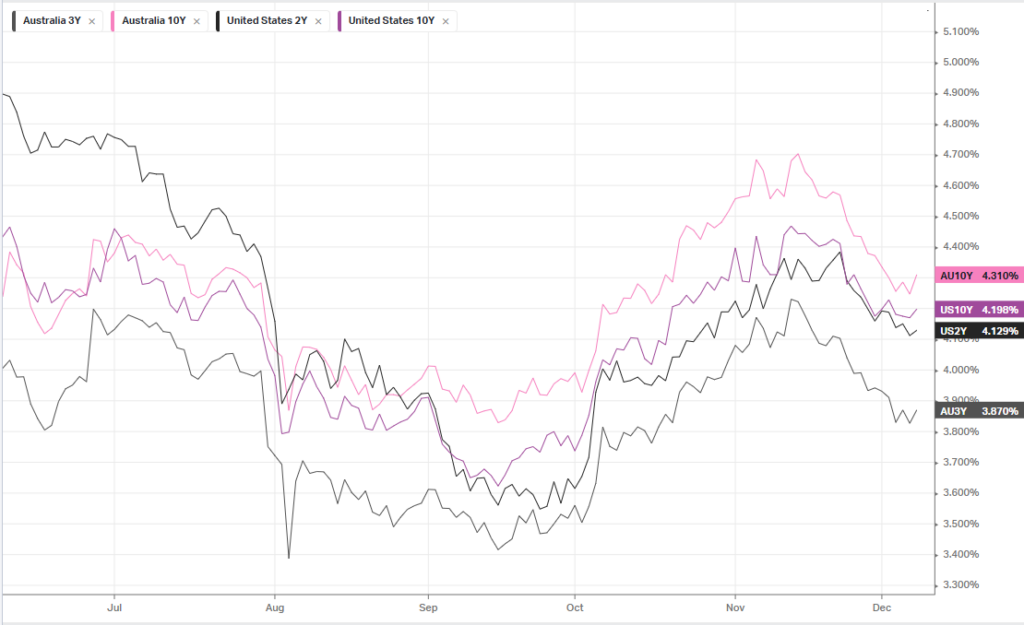

U.S. inflation data this week could cement or destroy December interest rate cut hopes ahead of the Federal Reserve meeting next week.

Friday’s U.S. monthly employment data was strong enough to soothe any concerns about the resilience of the economy, but not so robust as to rule out a rate cut from the Federal Reserve next week.

ASX SPI 8447 (+0.03%)

The ASX is in for a much better day than the US markets as commodities rallied after China’s Politburo was quoted as saying that the country will adopt an “appropriately loose” monetary policy next year, rather than a “prudent” one, marking the first time it has changed the wording of its stance in around 14 years

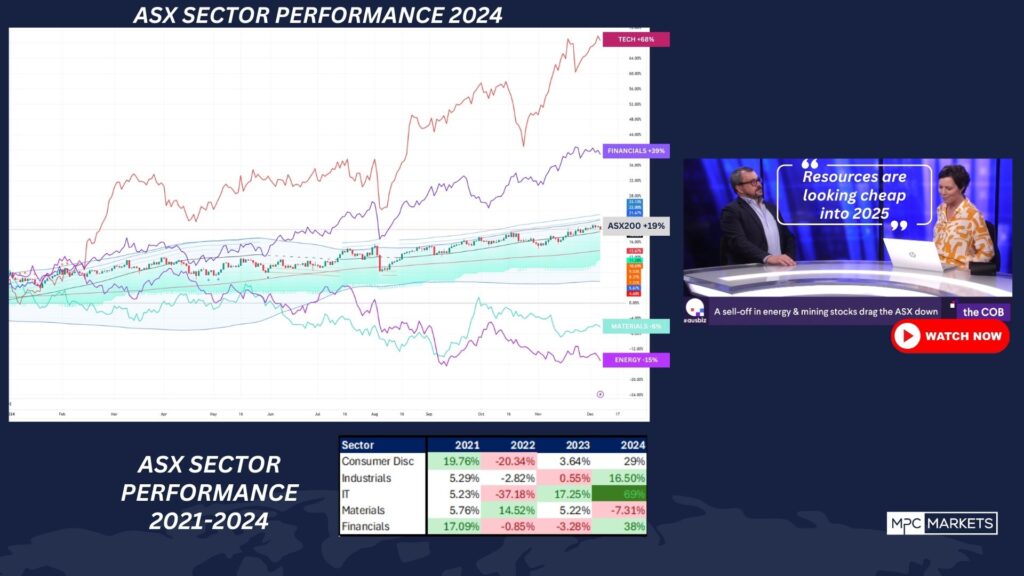

This saw BHP and RIO ADR’s rise 4.5% in the US session. Resources have weighed down the ASX200 this year and have considerable upside China turns the corner with renewed stimulus.

The RBA meets today with an announcement at 1130am AEDST and a press conference in the afternoon