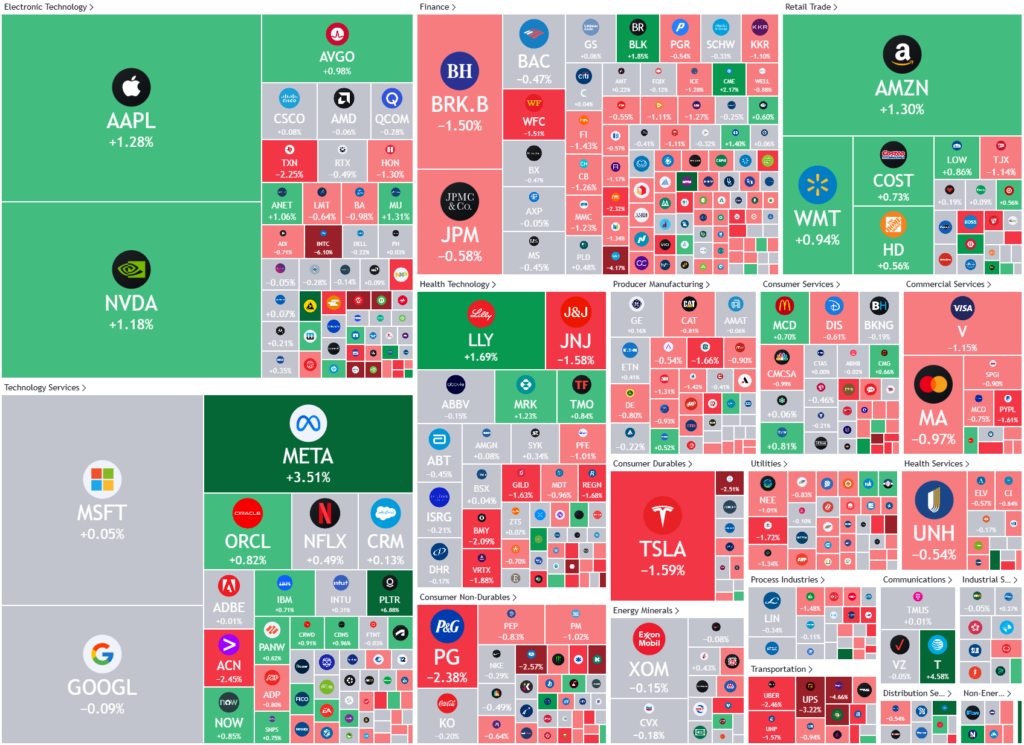

Overnight – Equities drift lower as market waits on Jobs data

The Nasdaq and S&P500 just scraped in record highs, ahead of a speech from Federal Reserve Chairman Jerome Powell and monthly jobs data due later this week.

Last night was the 55th record close for the year, just 22 short of the record 77 with around 20 sessions remaining in the year

Tesla fell more than 1% after a Delaware court upheld its decision to invalidate Elon Musk’s $56 billion compensation package. The decision came even as Tesla shareholders voted to reinstate the package, and was deemed excessive by the court, which had first struck down the package in January.

U.S. job openings, a gauge of labor demand, rose in October to 7.7 million, up from 7.4M in September, topping economists estimates of 7.5M. The better-than-expected jobs point to underlying health in the labor market just days ahead of November’s nonfarm payrolls report due Friday.

Several Fed members have continued to stress the importance of monitoring incoming economic data to gauge the pace of rate cuts. Fed governor Christopher Waller said Monday he was leaning toward backing a rate cut in December, but also cautioned that any upside surprise in the economic data would sway his decision.

Chair Jerome Powell is set to speak Wednesday. While markets have so far maintained expectations for a December rate cut, the longer-term outlook is more uncertain, especially on the prospect of inflationary policies under a Trump administration.

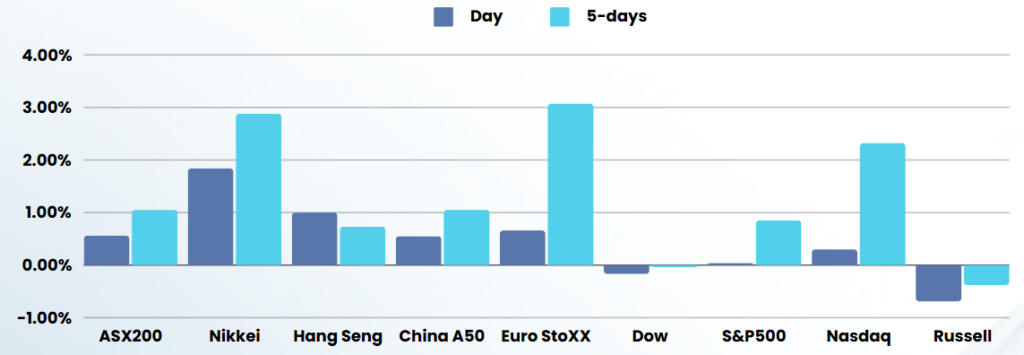

ASX SPI 8492 (-0.35%)

The ASX is likely to drift lower today following the broader market lead from global markets. GDP numbers for Australia will be watched closely for clues to the RBAs next move in interest rates.

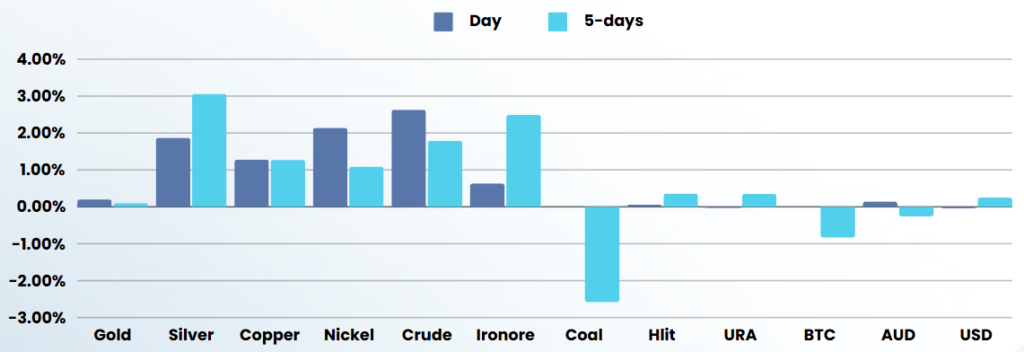

The Iron ore miners could start to see a solid rally as China ratcheted up trade tensions with the US by banning several materials with high-tech and military applications, including steel. Iron ore & steel are two commodities the US need but don’t have if they start a trade war, and Australia would be the only viable source of Iron ore as the next 5 biggest exporters are Brazil, Russia, India, China & South Africa….LITERALLY BRICS

Economic data is released at 1130AEDST – Australian GDP