Overnight – Stocks lock in best month for 2024 as tech pulls market higher

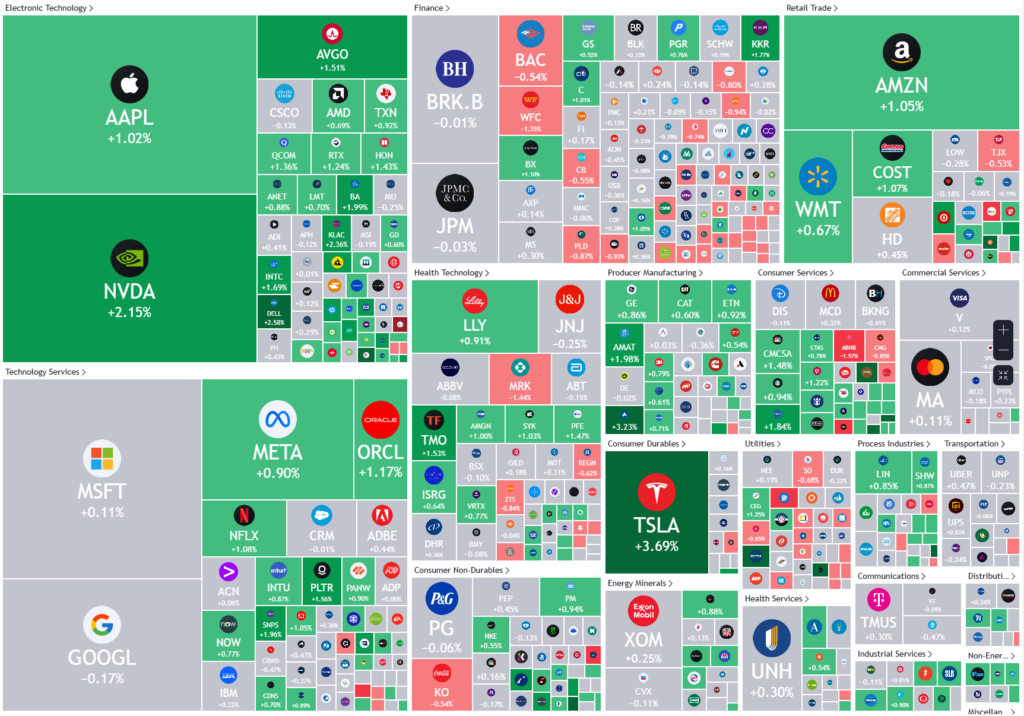

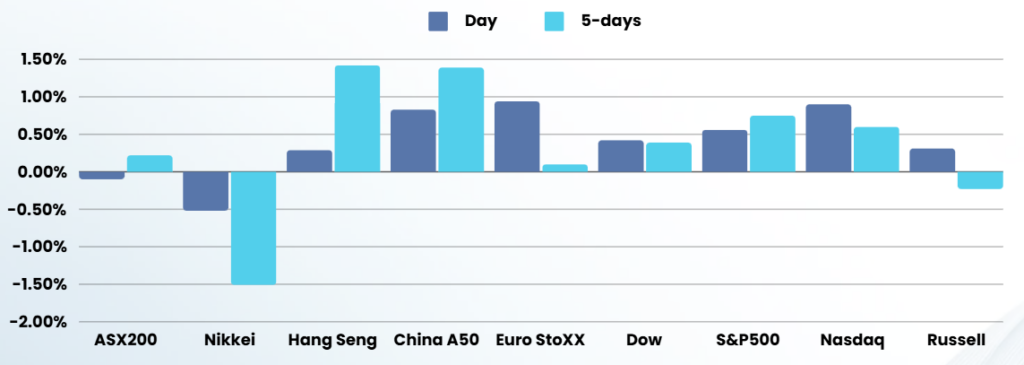

US Markets closed at a record high holiday-shortened trading session Friday, wrapping up its best month of 2024.

The S&P 500, NASDAQ and Dow were trading up between 5% and 7% for November, having rallied to a series of record highs in the wake of a Trump election victory.

Tech ended the month on a strong footing, underpinned by a rise in chip stocks. Chip stocks including NVIDIA, ASML and Applied Materials were more than 1% higher following a Bloomberg report that suggested President Joe Biden was considering additional bans on chip equipment sales to China that could be less restrictive than feared.

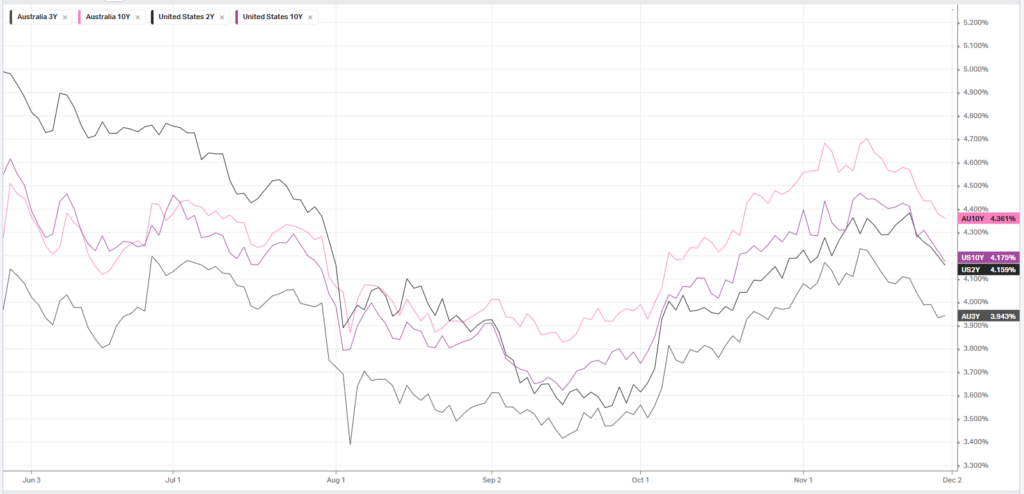

Focus in the coming week will be on comments from a slew of Fed officials, including Chair Jerome Powell on Wednesday, for more cues on interest rates.

Despite recent signs of sticky inflation and labor market strength, markets have largely maintained expectations for a 25 basis point cut in December. The cut will bring the Fed’s total rate cuts in 2024 to 100 bps.

But central bank officials have offered a more cautious outlook on rates in recent addresses, sparking some concerns that the Fed will slow its pace of rate cuts in 2025. Sticky inflation is also expected to elicit a higher terminal rate from the Fed during its current easing cycle.

The Fed is set to meet on December 17 and 18 in its final meeting for the year.

ASX SPI 8479 (+0.21%)

The ASX will drift higher as the US long weekend still has markets quiet. Many expecting the “Santa rally” are likely to be disappointed with many seasonal tends being bucked this year, expect the unexpected!