What's Affecting Markets Today

Asia-Pacific markets mostly declined on Friday, weighed down by losses in South Korean stocks following another month of declining industrial production. South Korea’s industrial output fell 0.3% month-on-month in October, mirroring September’s decline. Year-on-year, production rose 2.3%, reversing a 1.3% fall in September.

The Kospi dropped 1.29%, while the Kosdaq fell 1.87%. In contrast, Hong Kong’s Hang Seng Index rose 1.29%, and mainland China’s CSI 300 surged 2%, leading gains in the region. Optimism in Chinese markets followed a Reuters poll forecasting slower declines in home prices this year and next, with stabilization anticipated in 2026 as policy support takes effect.

In Japan, investors digested November inflation data from Tokyo, a bellwether for national trends. Headline inflation rebounded to 2.6% from 1.8% in October, while core inflation, excluding fresh food costs, increased to 2.2%, slightly above expectations.

Japan’s Nikkei 225 fell 0.42%, and the Topix slipped 0.2% following the inflation release, reflecting concerns over potential monetary policy implications.

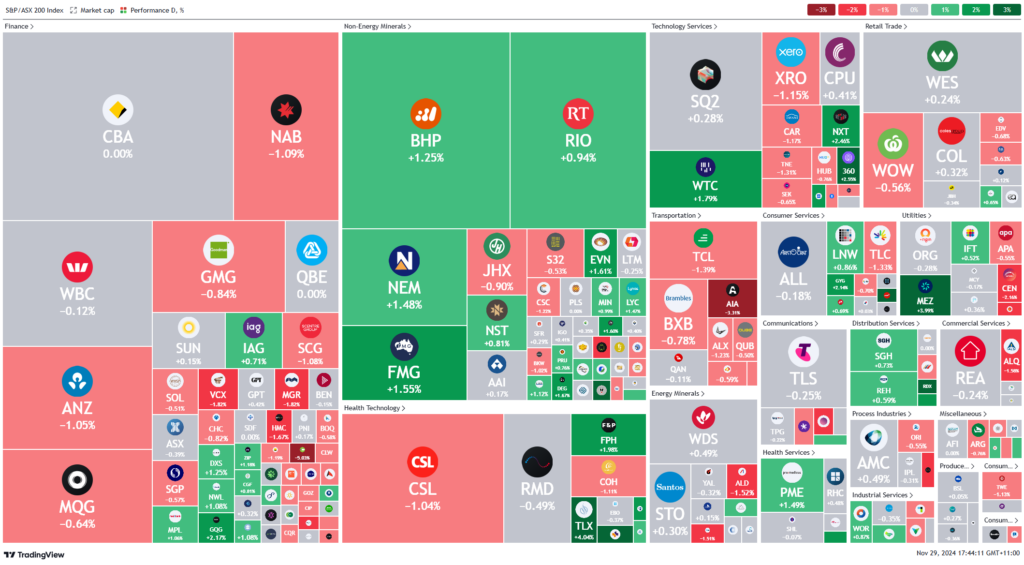

ASX Stocks

ASX 200 - 8,469.7 (+0.7%)

Key Highlights:

The Australian sharemarket edged lower on Friday, trimming gains from earlier in the week that saw the S&P/ASX 200 Index set two record highs. The benchmark slipped 0.1% or 8.1 points to close at 8436.2, while the All Ordinaries remained flat. Over the week, the S&P/ASX 200 advanced 0.5%.

The index had reached a record 8444.3 on Thursday, driven by strength in heavyweight CSL, which fell 1% to $282.22 on Friday, weighing on the market. Property stocks were the weakest sector, sliding 0.7%, with Goodman Group down 0.8% to $37.91 and Scentre Group falling 1.1% to $3.68.

The declines coincided with revised forecasts from ANZ, AMP, and Bank of Queensland, delaying expectations for the Reserve Bank of Australia’s first interest rate cut to May 2025.

Web Travel surged 4.9% to $5.15, capping a 20% rally since its strong earnings report earlier this week. Meanwhile, Star Entertainment hit a record low of 18¢ before recovering to close flat at 19.5¢, amid ongoing financial struggles and an analyst downgrade.

Leaders

MGH Maas Group Holdings Ltd (+7.61%)

OPT Opthea Ltd (+5.88%)

GTK Gentrack Group Ltd (+4.92%)

WEB WEB Travel Group Ltd (+4.89%)

RSG Resolute Mining Ltd (+4.82%)

Laggards

ERA Energy Resources of Aus (-33.33%)

BFL BSP Financial Group Ltd (-5.03%)

AIA Auckland Int Airport Ltd (-3.31%)

PGC Paragon Care Ltd (-2.94%)

TAH Tabcorp Holdings Ltd (-2.73%)