Overnight – Hawkish Fed & Trump cabinet appointments drive market lower

Investors started to abandon the Trump trade on Friday driven by concerns about slower interest-rate cuts and reactions to President-elect Donald Trump’s cabinet selections.

Federal Reserve Chair Jerome Powell’s comments on ongoing economic growth, a robust job market, and inflation above the 2% target suggested a more cautious approach to future rate cuts, leading traders to adjust their expectations accordingly.

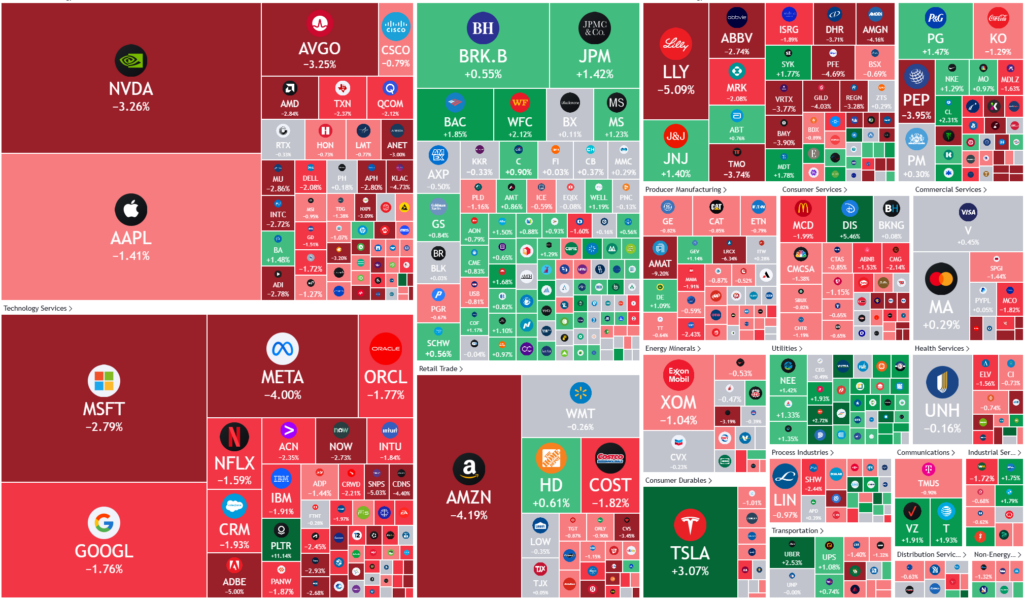

The market also reacted to Trump’s nomination of Robert F. Kennedy Jr. for the Department of Health and Human Services, causing declines in vaccine maker and packaged food company stocks.

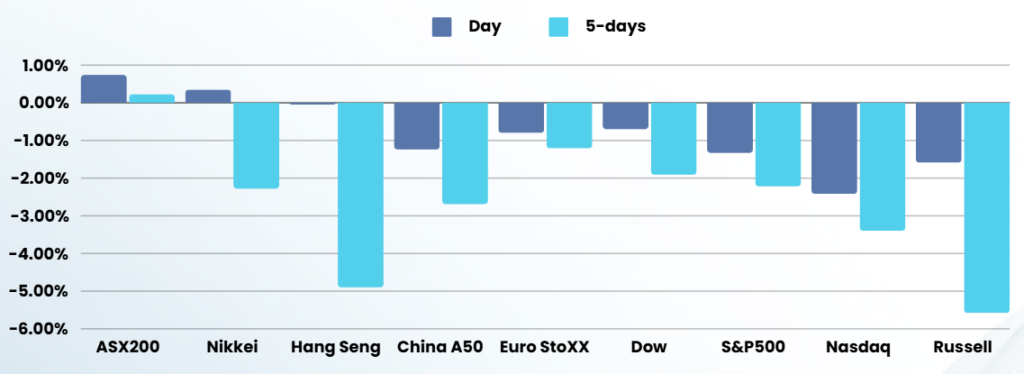

The week concluded with substantial losses across major indexes, marking their most significant weekly declines in over two months. The S&P 500 fell 2.08%, the Nasdaq dropped 3.15%, and the Dow Jones Industrial Average decreased by 1.24%. This sell-off reflected a shift in market focus from the initial optimism surrounding Trump’s election victory to concerns about the future path of interest rates and potential inflation risks under the new administration.

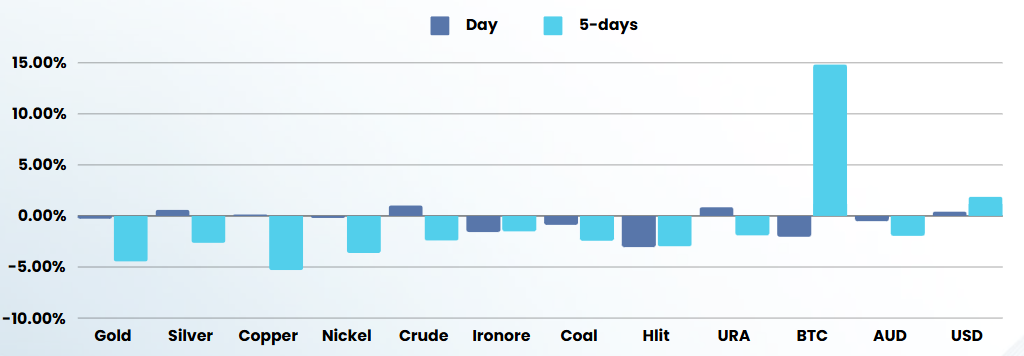

Economic data released during the week contributed to the market’s cautious sentiment. Retail sales in October exceeded expectations, increasing by 0.4% compared to the forecasted 0.3%. Additionally, import prices unexpectedly rose by 0.3% in October, indicating persistent inflationary pressures. These strong economic indicators, combined with Powell’s warnings about the Fed’s deliberate approach to rate cuts, led to a significant reduction in market expectations for interest rate reductions.

In corporate news, several companies experienced notable movements. Applied Materials saw a 9% drop after missing earnings expectations, while Domino’s Pizza and Pool Corporation had mixed results following Berkshire Hathaway’s stake acquisitions. Alibaba’s stock declined by 2% after reporting moderate revenue growth, and Palantir announced its move to the Nasdaq Global Select Market.

ASX SPI 8296 (-0.31%)

The local market is unlikely to see the same downside as the US as the Trump trade hit a wall of reality. Given that patriotism is not an investment thesis, it isn’t surprising that the US rally and enthusiasm for the USD is fading, although many media pundits and analysts (many who called a “close race”) regurgitate each others anecdotal soundbites, justifying the optimism.

We expect the AU market to outperform the US for the remainder of the week as further unwinding of last weeks rally continues as people do the maths on the downside of many of Trumps policies