What's Affecting Markets Today

Asian markets showed mixed performance Friday as Wall Street declined after U.S. Federal Reserve Chair Jerome Powell indicated a cautious approach to rate cuts. Speaking in Dallas, Powell highlighted that strong U.S. growth allows policymakers flexibility in timing rate reductions.

In Asia, investors evaluated new economic data from China, revealing October gains in retail sales above forecasts, though industrial production and investment missed expectations. China’s urban unemployment rate declined to 5% from 5.1% in September. Hong Kong’s Hang Seng Index advanced 0.62%, while mainland China’s CSI 300 slipped 0.2%.

Japan reported a 0.3% year-on-year GDP increase for Q3, ending two consecutive quarters of declines. Quarter-on-quarter growth matched forecasts at 0.2%. Following the GDP release, Japan’s Nikkei 225 climbed 0.76% and the Topix rose 0.8%. The yen weakened 0.2% against the U.S. dollar to 156.47.

In contrast, South Korea’s Kospi fell 0.45%, with the Kosdaq down 0.97%, reflecting divergent regional sentiment amid economic data reviews and Fed outlooks.

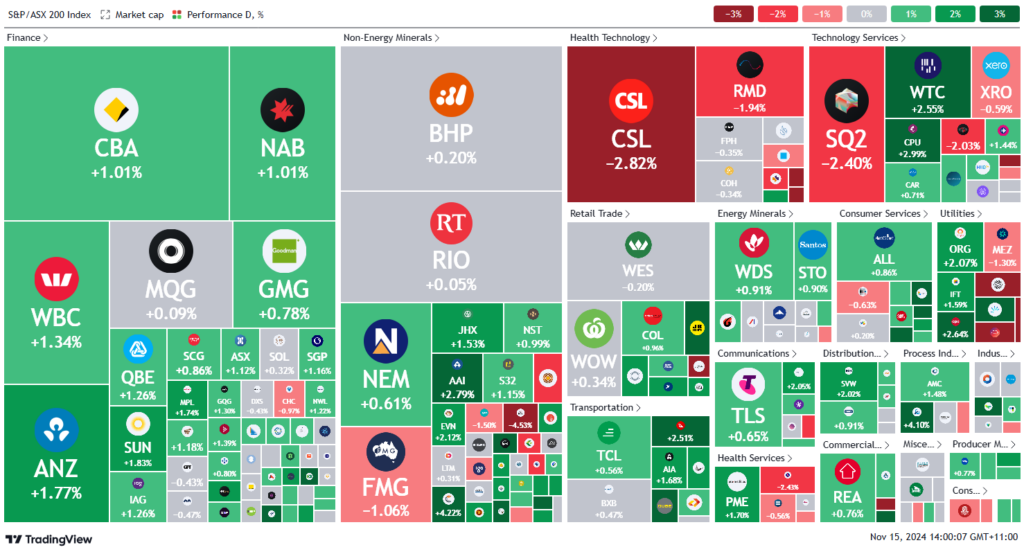

ASX Stocks

ASX 200 - 8,266.7 (+0.5%)

Key Highlights:

Australian shares edged higher at midday, with the S&P/ASX 200 Index rising 0.3% (24.7 points) to 8248.7, buoyed by gains across 10 of 11 sectors. Utilities led, with APA Group advancing 3.2% after reiterating its FY2025 EBITDA guidance, supported by a Q1 revenue increase to $256.4 million from $237.6 million.

The real estate sector also posted gains, with Lendlease up 4.8% on plans for a potential $500 million share buyback, contingent on asset sales. In other stocks, ASX Ltd rose 1.3%, refuting claims of misleading statements regarding its CHESS replacement project.

Investor sentiment remained resilient despite a cautious outlook from US Fed Chair Jerome Powell on interest rate cuts, with the chance of a December rate cut dropping to 55.5% from 82.5%. In Adelaide, the Sohn Australia conference sparked interest, with shares of Perpetual and Corporate Travel Management climbing over 3% following endorsement from fund managers at Ellerston Capital and IFM Investors.

Leaders

ADT Adriatic Metals Plc (+5.73%)

SLC Superloop Ltd (+5.24%)

DEG De Grey Mining Ltd (+4.48%)

CSC Capstone Copper Corp (+4.07%)

RRL Regis Resources Ltd (+3.96%)

Laggards

HLS Healius Ltd (-16.35%)

MSB Mesoblast Ltd (-9.55%)

OPT Opthea Ltd (-8.21%)

OBM Ora Banda Mining Ltd (-7.24%)

GNC Graincorp Ltd (-5.24%)