Overnight – Trump rally fizzles as Powell says there is no need to rush cuts

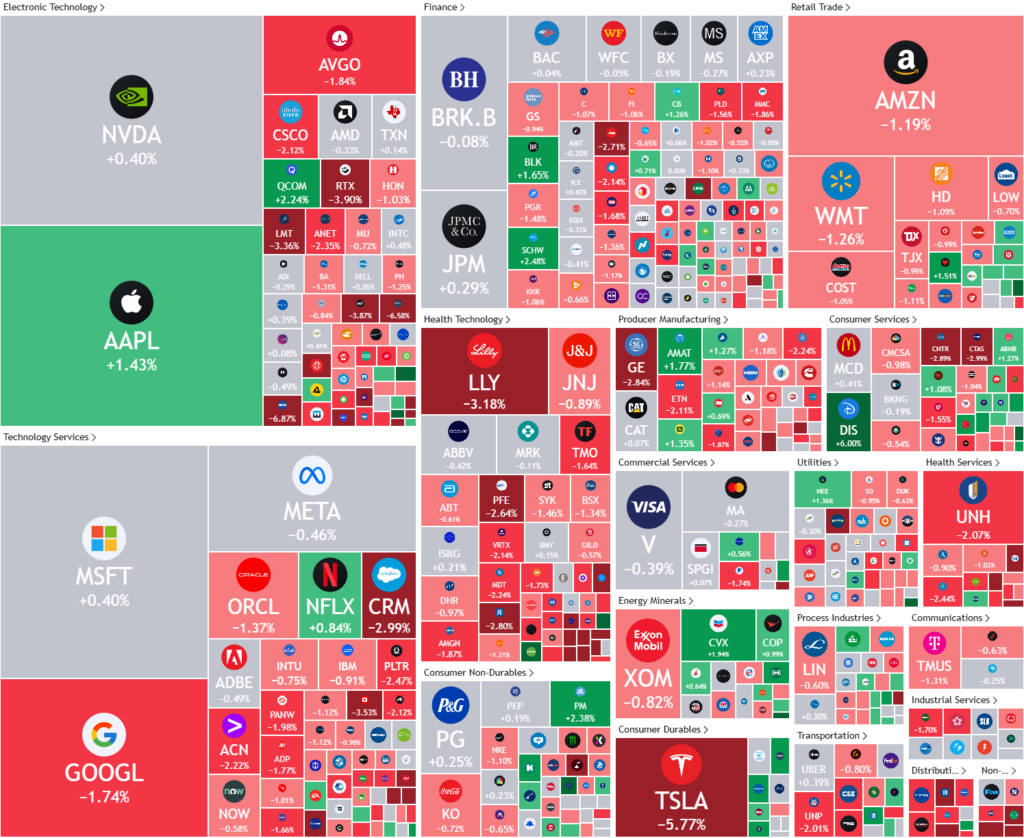

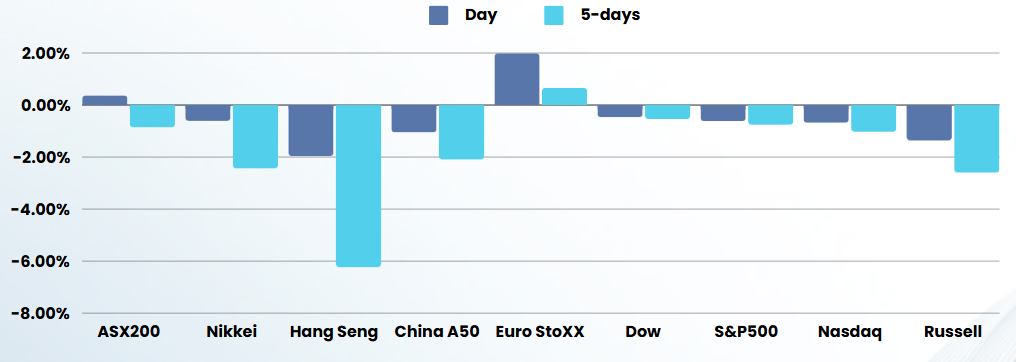

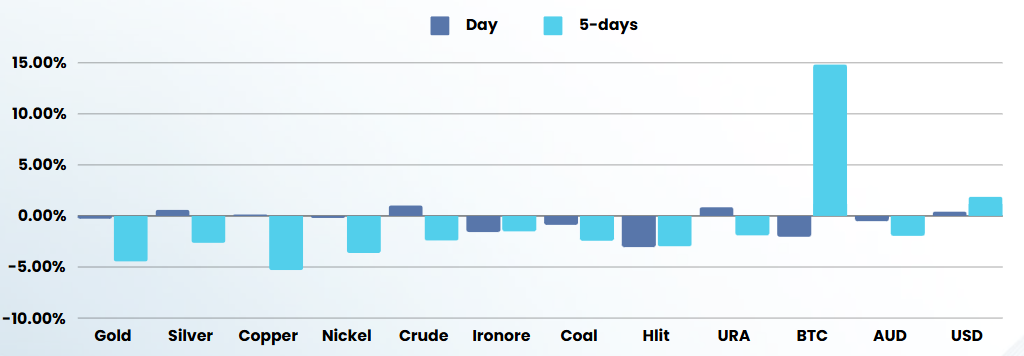

Stocks spent the session lower overnight as the Trump rally burnt out and persistent inflation gave the Fed room to slow the pace of cuts, a sentiment echoed by Chairman Powell in a speech in Dallas around the market close

The producer price index for final demand rose 0.2% on a monthly basis in October, in line with forecasts, though the annual rise of 2.4% was a touch higher than expectations. Jobless claims dropped 4,000 to a seasonally adjusted 217,000 for the week ended Nov. 9, lower than forecast.

Federal Reserve Chairman Jerome Powell said Thursday that economy isn’t signalling a need for speed on rate cuts as the recent strength allows the Fed to take a careful approach to monetary policy decisions. “The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully,” Powell said in a speech Thursday. The Fed chief also said the central bank remains “confident” that the strength in the economy and labour market can be maintained. “We are confident that with an appropriate recalibration of our policy stance, strength in the economy and the labour market can be maintained, with inflation moving sustainably down to 2 percent,” he added.

Earlier in the day, Fed Governor Adriana Kugler, a prelude to Powells remarks, said the central bank has made considerable progress in working to achieve its job and inflation goals. Richmond Fed President Tom Barkin said high union wage settlements and the possibility of coming tariff increases could make Fed officials more cautious about thinking they have won their battle against high inflation.

ASX SPI 8307 (+0.63%)

The ASX is likely to buck the trend and have a reasonable strong finish to the week as analysts are now starting to realise that the Trump rally, based on growth, could be good for Chinese exporter & Australia

US futures have made fresh lows on the day after the close on Fed Chair Powells comments on interest rates