What's Affecting Markets Today

Asia-Pacific stock markets traded lower on Wednesday, mirroring Wall Street losses as the U.S. postelection rally lost momentum overnight. In Japan, the Nikkei 225 and Topix both declined 0.9%, as traders weighed corporate goods data revealing year-on-year producer price growth reached 3.4% in October, the highest since July last year. This exceeded economists’ expectations of 3% growth, up from 2.8% in September, signaling rising wholesale inflation.

In South Korea, the Kospi dropped 1.8%, while the Kosdaq Index saw a steeper fall, down 2.4%, as investors reacted to the global market’s broader risk-off sentiment.

China’s markets were also under pressure, with Hong Kong’s Hang Seng Index dipping 0.5% and the CSI 300 on the mainland down 0.25%. Overall, Asian traders remained cautious amid mixed economic data and a slowing U.S. rally, driving market sentiment into the red across the region as concerns over inflation and economic stability continued to weigh on investor confidence.

ASX Stocks

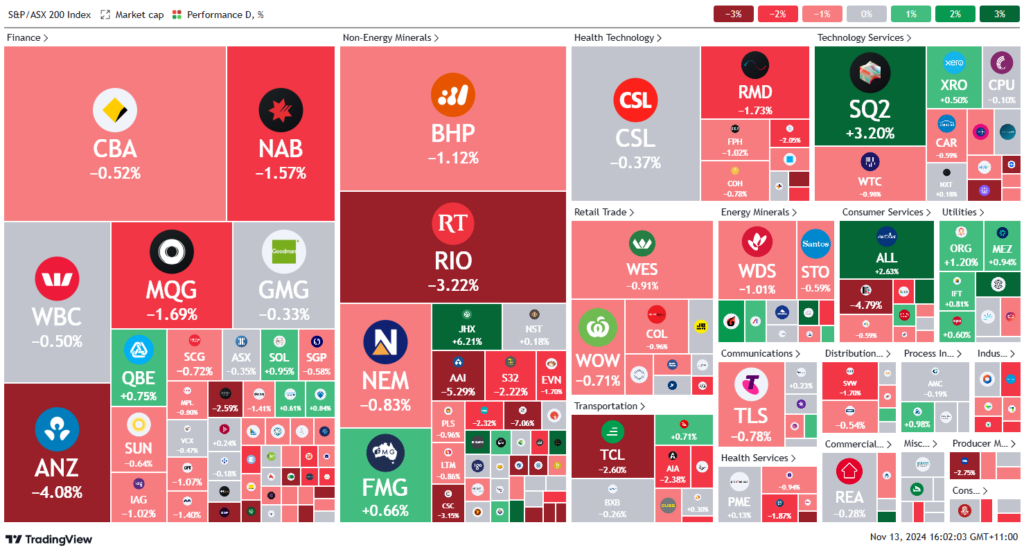

ASX 200 - 8,187.0 (-0.8%)

Key Highlights:

Australian shares pared early losses on Wednesday as the post-US election rally in global equities hit resistance. The S&P/ASX 200 was down 72 points, or 0.9%, at 8183, having fallen as much as 1.4% earlier. Financials led declines, sliding 1.9% amid market shifts pushing the RBA’s anticipated rate cut to September 2025. Commonwealth Bank dropped 1.6%, Westpac 1.8%, NAB 2.2%, and ANZ 4.6% as it traded ex-dividend.

Gold continued its descent to below $US2600 an ounce, while oil edged higher and iron ore remained steady. Mining stocks fell 1.1%, marking a five-day drop of 4.4%, following China’s softer-than-expected stimulus response.

Mineral Resources declined 5.6% as it paused Bald Hill operations. Aristocrat Leisure rose 1.9% on North American growth, and James Hardie gained 6.8% despite a profit dip. Selfwealth surged 73% on a buyout offer from Bell Financial, which rose 2%. Life360 fell 7.6% despite revenue growth, and Insignia Financial dropped 4.5% amid tepid investor response to its efficiency strategy.

Leaders

PDN Paladin Energy Ltd (+7.92%)

JHX James Hardie Industries Plc (+7.64%)

NXG Nexgen Energy (Canada) Ltd (+6.30%)

OBM Ora Banda Mining Ltd (+4.73%)

VUL Vulcan Energy Resources Ltd (+4.27%)

Laggards

NXL Nuix Ltd (-23.35%)

ZIM Zimplats Holdings Ltd (-9.03%)

360 Life360 Inc (-6.82%)

MAH Macmahon Holdings Ltd (-6.67%)

MIN Mineral Resources Ltd (-6.24%