Overnight – Stocks mixed in quiet session for Veterans Day

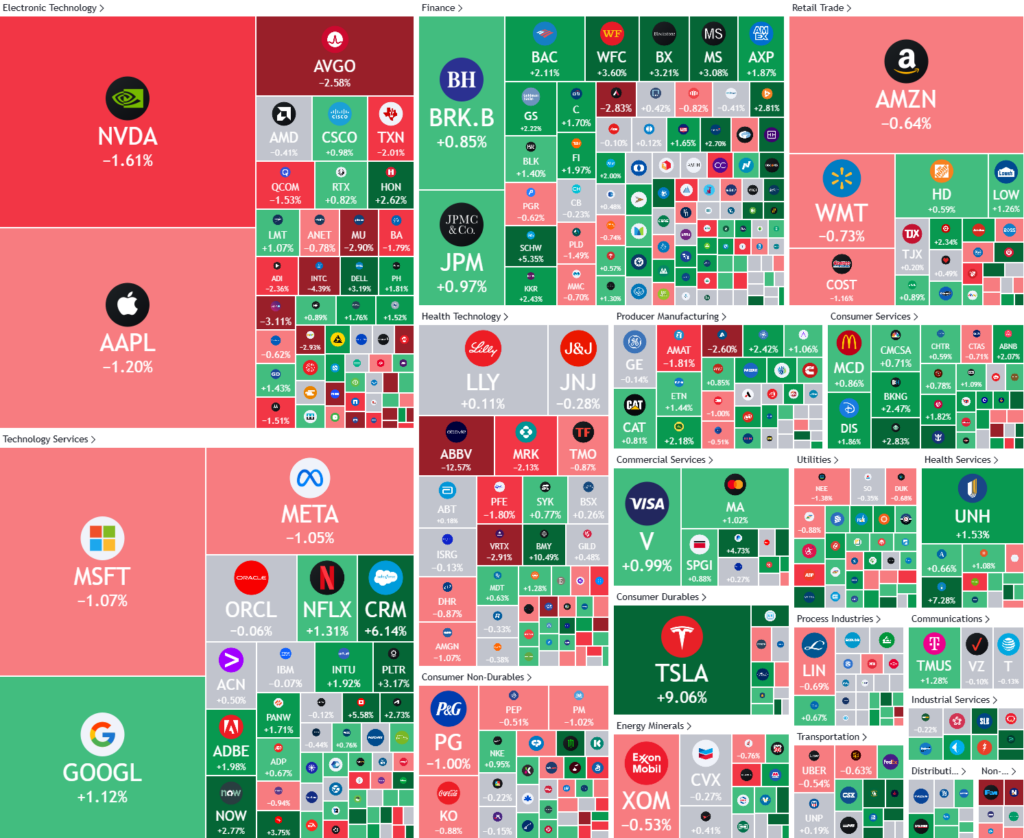

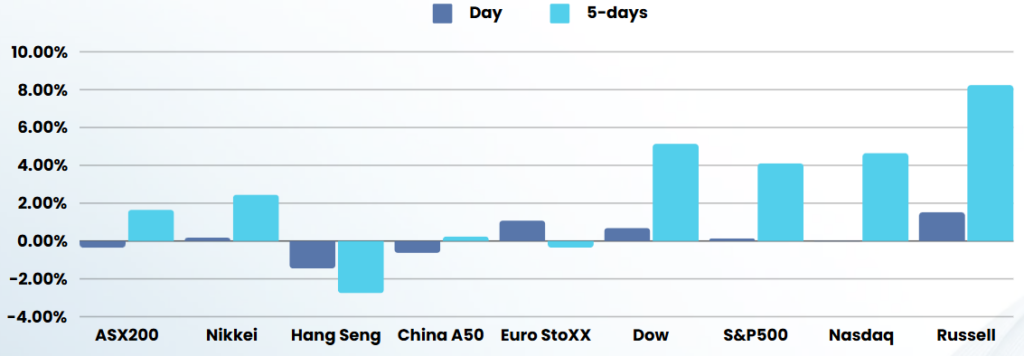

Stocks were mixed overnight with the Russell (small-caps) and the Dow reaching fresh records, with the focus turning to upcoming inflation data and a slew of Federal Reserve speakers.

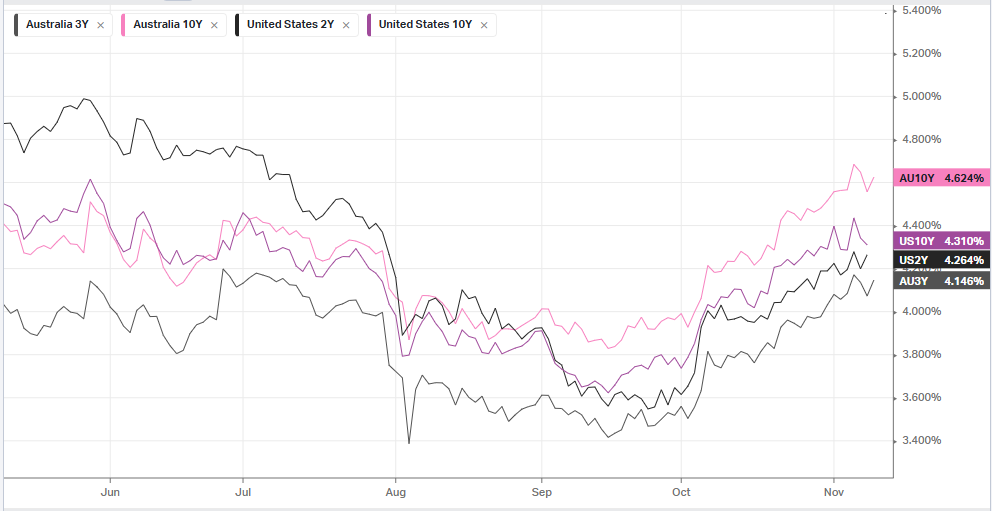

Focus this week was squarely on upcoming consumer price index inflation data for October, for more signs that inflation is easing. The reading comes just a week after the Fed cut interest rates by 25 basis points, and reiterated that future easing will be largely dependent on the path of inflation. This week’s CPI data is expected to factor into the outlook for rates. While U.S. inflation did fall earlier in the year, it turned sticky in recent months amid persistent strength in the economy and the labour market.

Beyond the CPI data, focus this week is also on addresses by a string of Fed officials, who are expected to offer more insight into the central bank’s plans for interest rates.

Wall Street banks including JP Morgan, Goldman Sachs, and Citi were rising amid hopes that a second Trump administration could result in an easier banking regulatory environment, while Tesla added to its 29% gain from last week on bets that a close Elon Musk and Donald Trump during the latter’s second presidential term may benefit the EV maker.

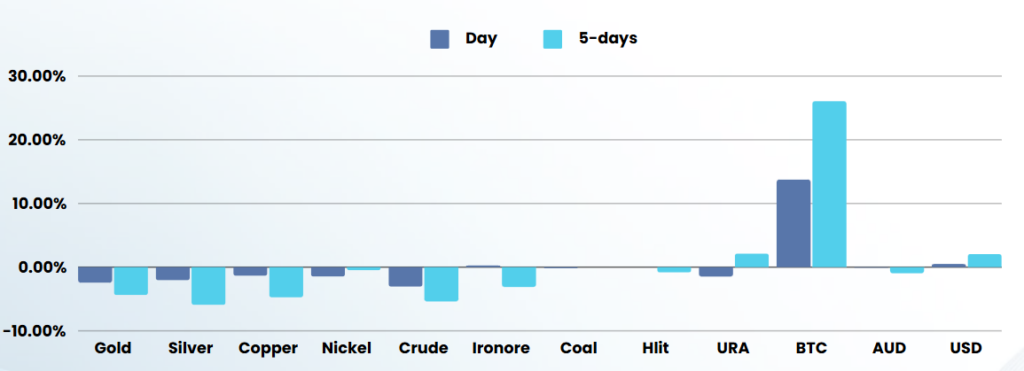

Bitcoin topped $84,00 for the first ever, adding to its post-election gains on optimism that President-elect Donald Trump could follow with a campaign pledge to make the US “crypto capital of the planet.

ASX SPI 8291 (+0.04%)

Todays session is likely to be quiet after the volatility of last week. We don’t expect any major moves during the day

NAB Business survey and Westpac consumer sentiment are due mid-morning

Shares in Liontown Resources will likely face pressure when trading kicks off this morning after the lithium developer was cut to a sell rating by analysts at Citi.

Piedmont Lithium releases earnings, while Coles, Lifestyle Communities, Nanosonics, Platinum and PointsBet host AGMs.

NAB shares trade ex-dividend. DigiCo Infrastructure REIT will launch with a $4 billion portfolio.