What's Affecting Markets Today

Asia-Pacific markets declined Monday, impacted by China’s latest stimulus, which left investors unimpressed, and lower-than-expected inflation data, raising concerns about recovery in the world’s second-largest economy.

On Friday, Beijing unveiled a five-year, 10 trillion yuan ($1.4 trillion) package aimed at easing local government debt. However, analysts question its effectiveness in driving meaningful growth. China’s inflation rate fell to 0.3% in October, below expectations of 0.4% and marking its lowest level in four months, according to LSEG data.

As China’s Singles’ Day shopping event kicks off, analysts at ING expect strong sales, emphasizing a shift towards value-for-money purchases and e-commerce. “We anticipate that Singles’ Day growth will outpace overall consumption trends,” ING noted.

In markets, Hong Kong’s Hang Seng index dropped 2.5%, while mainland China’s CSI 300 lost 1%. Japan’s Nikkei 225 and Topix fell 0.40% and 0.32%, respectively. South Korea’s Kospi was down 1%, with the smaller Kosdaq sliding 1.9%, reflecting broader regional apprehension over China’s economic measures.

ASX Stocks

ASX 200 - 8,309.4 (+1.0)

Key Highlights:

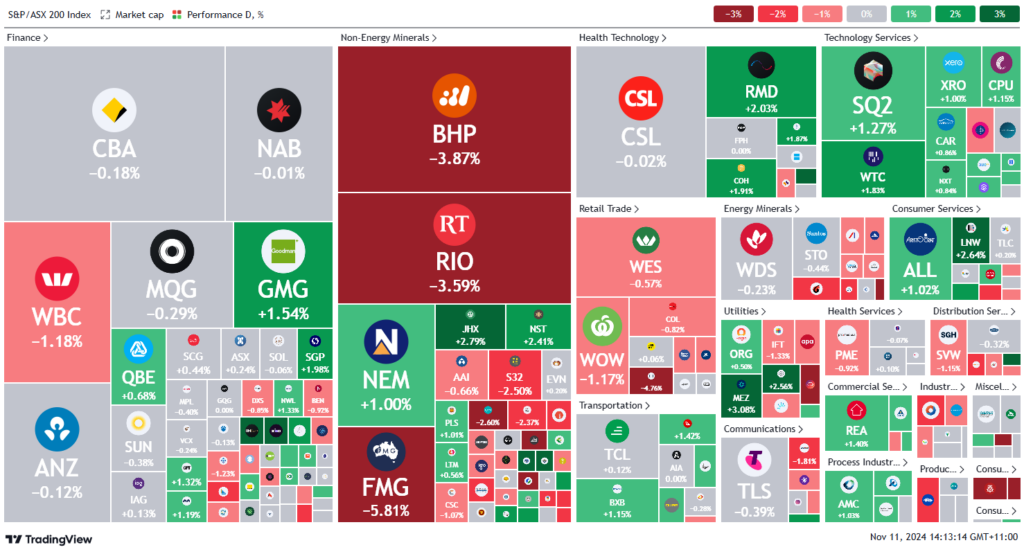

The S&P/ASX 200 fell 0.4% (36.3 points) to 8258.8 by midday, pressured by China’s underwhelming stimulus measures, which impacted already weakened mining and energy stocks. This dip followed last week’s 2.2% rally, spurred by a Wall Street surge after Donald Trump’s decisive election win.

Lower iron ore and oil prices hit mining giants, with BHP and Rio Tinto dropping nearly 4%, Fortescue down 4.7%, and South32 off 3.2%. Energy losses were less severe; Woodside slipped 0.5%, and Santos declined 1%.

Endeavour Group fell 4.6% to a record low of $4.45, warning of profit pressures. Novonix soared 14% after securing a supply deal with Stellantis, while Resolute Mining plunged 27% on news of its CEO’s detainment in Mali. Cleanspace fell 18% on weak revenue.

Meanwhile, Fonterra rose 2.5% after boosting its 2024/25 farmgate milk price forecast, and Stockland gained 1.8% after raising its FY25 earnings guidance. Technology and real estate sectors provided modest offsets to commodity-related losses.

Leaders

IPX Iperionx Ltd (+7.54%)

MSB Mesoblast Ltd (+6.09%)

VUL Vulcan Energy Resources Ltd (+4.06%)

GMD Genesis Minerals Ltd (+4.02%)

HMC HMC Capital Ltd (+3.76%)

Laggards

RSG Resolute Mining Ltd (-30.97%)

CIA Champion Iron Ltd (-10.08%)

ILU Iluka Resources Ltd (-6.18%)

FMG Fortescue Ltd (-5.86%)

A2M The a2 Milk Company Ltd (-5.68%)